Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My answers for part C are incorrect. Maybe I am rounding incorrectly? I don't know. Please help. Suppose you have a student loan of $35,000

My answers for part C are incorrect. Maybe I am rounding incorrectly? I don't know. Please help.

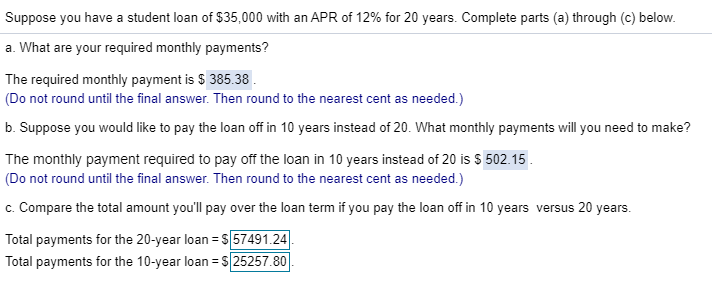

Suppose you have a student loan of $35,000 with an APR of 12% for 20 years. Complete parts (a) through (c) below. a. What are your required monthly payments? The required monthly payment is $ 385.38. (Do not round until the final answer. Then round to the nearest cent as needed.) b. Suppose you would like to pay the loan off in 10 years instead of 20. What monthly payments will you need to make? The monthly payment required to pay off the loan in 10 years instead of 20 is $ 502.15 (Do not round until the final answer. Then round to the nearest cent as needed.) c. Compare the total amount you'll pay over the loan term if you pay the loan off in 10 years versus 20 years. Total payments for the 20-year loan = $ 57491.24 Total payments for the 10-year loan = $ 25257.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started