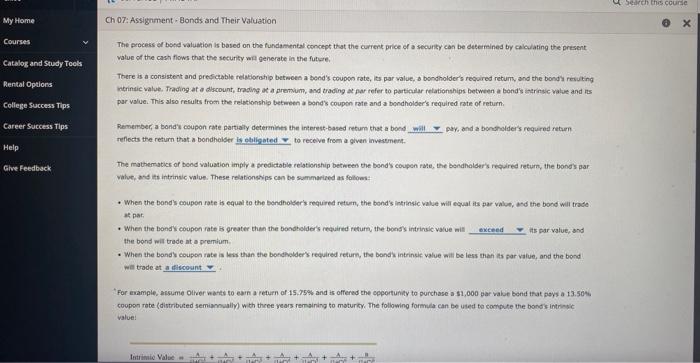

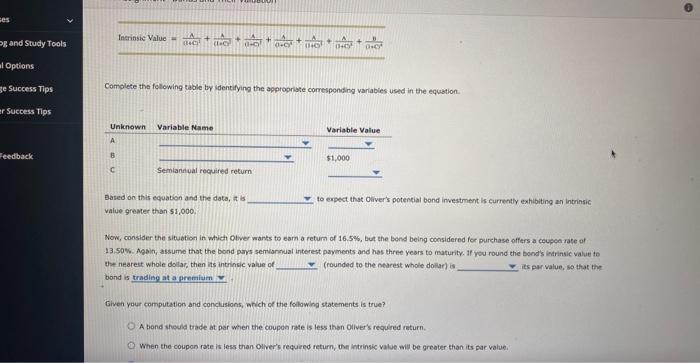

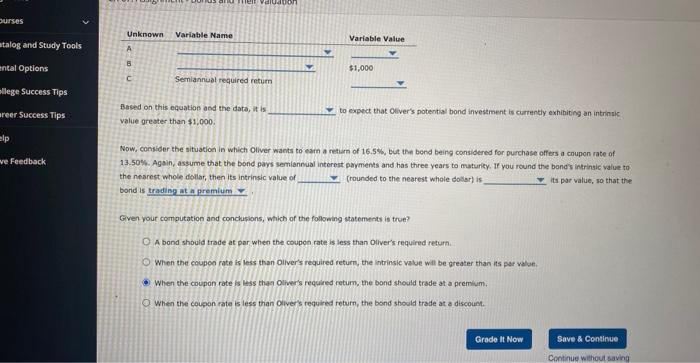

My Home Ch 07 : Assignment - Bonds and Their Valuation The mathematics of bend valuation imply a sredictable relationship between the bonds coupen rate, the bendhalder's required return, the bones par value, and it intrinsic value. These relationakips can be summariaed as fottows: - When the bond's coupon rate is equal to the bendholder's required return, the bond's intitisic value will equal its par valus, and the bond will trade as pati, - When the bond y coupen rate is greater then the bondholders recuired return, the bonsy intrinsic value ais its sar value, and the bons wit trade at o premium. - When the bands coupen rate is less than the bondholder's required return, the bonds intrinuc value will be less than ts far value, and the bond will trade at "For example, atsime oltief wayts to eain a return of 15,75% and is offered the coportunity to purchase a s1,000 par value bond that poys a 13.50% coupon rate (distributed semiacnually) with theee years remaining to moturity. The following formiar can be used to carpute the bonds intrinst value: Comolete the folowing table by identifying the appropriste comespending variables used in the equation. ge success Tips. or Success Tips reedback Based on this equation and the data, it is to expect that Oiliver's potential bond investment is curnently exhibiting an intrinsic value 9 reater than 51,000 . Now, consider the situation in with olver wants to earn a return of 16.5%, but the bend being considered for purchase offers a coupon rate of 13.50\%. Agsin, assume that the bond pays semiarnual interest payments and has three years to maturity. If you round the bond's intrinuic value to the nearest whole dotar, then its interinsic value of (rounded to the nearest whole dollar) is its par value, so that the bond is Given yaur computation and conclusions, arich of the following statements is true? talog and Study Toots Besed on this equation and the data, it is to expect that Oliver's potential bond investment is currently exhibiong an intrinsic: value grester than $1,000. Now, consider the situation in which Oliver waets to eam a retism of 16.5\%, but the bond being considered for purchase offers a crupon rate of 13.504. Agsin, assume that the bond pays semianmial interest paymients and has three years to maturify. If you round the bands intrinsle value to the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dostar) is its por value, so that the bond is Given your computation and conchisions, which of the following statements is true? A bond should trade at par when the coupen rate is less than oiver's required return. When the coupoe rate is less than oilver's required return, the intrinsic value will be greater than its par value. When the coupon rate is less than oliver's required retum, the bond should trade at a premium, When the coupon rate is less than olver's required return, the bond should trade at a discount