my last name begins with an E. also here is the link for the intel 10k

https://www.sec.gov/Archives/edgar/data/50863/000005086314000020/a10kdocument12282013.htm

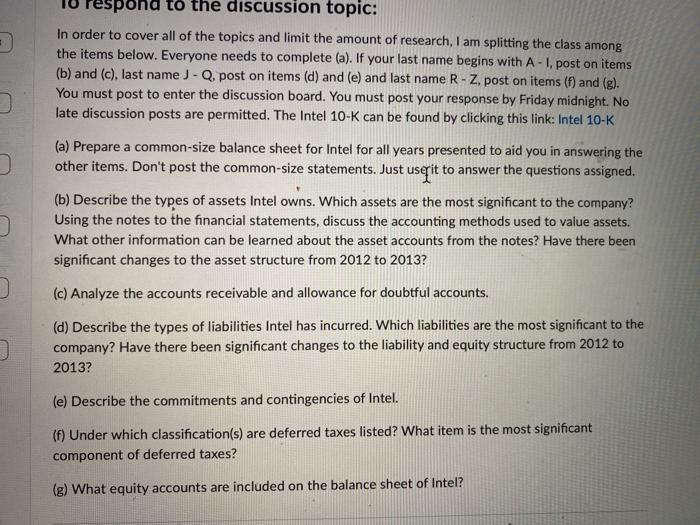

espond to the discussion topic: In order to cover all of the topics and limit the amount of research, I am splitting the class among the items below. Everyone needs to complete (a). If your last name begins with A-1, post on items (b) and (c), last name ) - Q. post on items (d) and (e) and last name R-Z, post on items (f) and (g). You must post to enter the discussion board. You must post your response by Friday midnight. No late discussion posts are permitted. The Intel 10-K can be found by clicking this link: Intel 10-K (a) Prepare a common-size balance sheet for Intel for all years presented to aid you in answering the other items. Don't post the common-size statements. Just userit to answer the questions assigned. (b) Describe the types of assets Intel owns. Which assets are the most significant to the company? Using the notes to the financial statements, discuss the accounting methods used to value assets. What other information can be learned about the asset accounts from the notes? Have there been significant changes to the asset structure from 2012 to 2013? (c) Analyze the accounts receivable and allowance for doubtful accounts. (d) Describe the types of liabilities Intel has incurred. Which liabilities are the most significant to the company? Have there been significant changes to the liability and equity structure from 2012 to 2013? (e) Describe the commitments and contingencies of Intel. (f) Under which classification(s) are deferred taxes listed? What item is the most significant component of deferred taxes? (g) What equity accounts are included on the balance sheet of Intel? espond to the discussion topic: In order to cover all of the topics and limit the amount of research, I am splitting the class among the items below. Everyone needs to complete (a). If your last name begins with A-1, post on items (b) and (c), last name ) - Q. post on items (d) and (e) and last name R-Z, post on items (f) and (g). You must post to enter the discussion board. You must post your response by Friday midnight. No late discussion posts are permitted. The Intel 10-K can be found by clicking this link: Intel 10-K (a) Prepare a common-size balance sheet for Intel for all years presented to aid you in answering the other items. Don't post the common-size statements. Just userit to answer the questions assigned. (b) Describe the types of assets Intel owns. Which assets are the most significant to the company? Using the notes to the financial statements, discuss the accounting methods used to value assets. What other information can be learned about the asset accounts from the notes? Have there been significant changes to the asset structure from 2012 to 2013? (c) Analyze the accounts receivable and allowance for doubtful accounts. (d) Describe the types of liabilities Intel has incurred. Which liabilities are the most significant to the company? Have there been significant changes to the liability and equity structure from 2012 to 2013? (e) Describe the commitments and contingencies of Intel. (f) Under which classification(s) are deferred taxes listed? What item is the most significant component of deferred taxes? (g) What equity accounts are included on the balance sheet of Intel