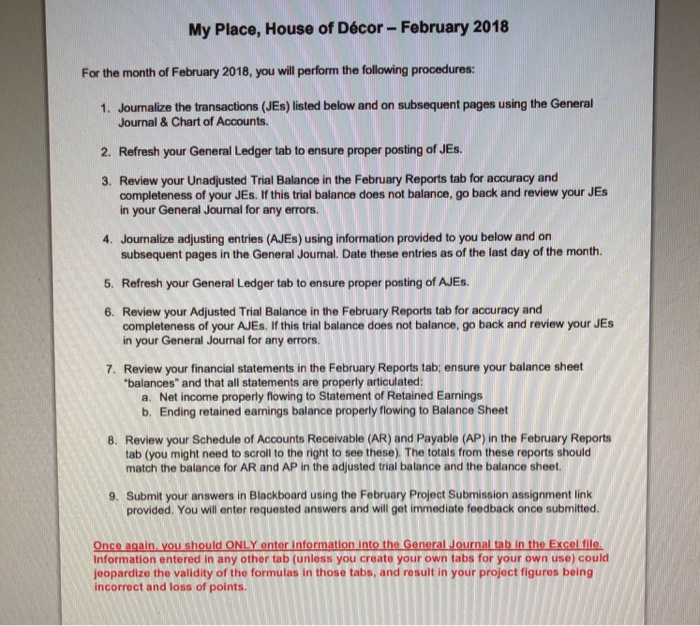

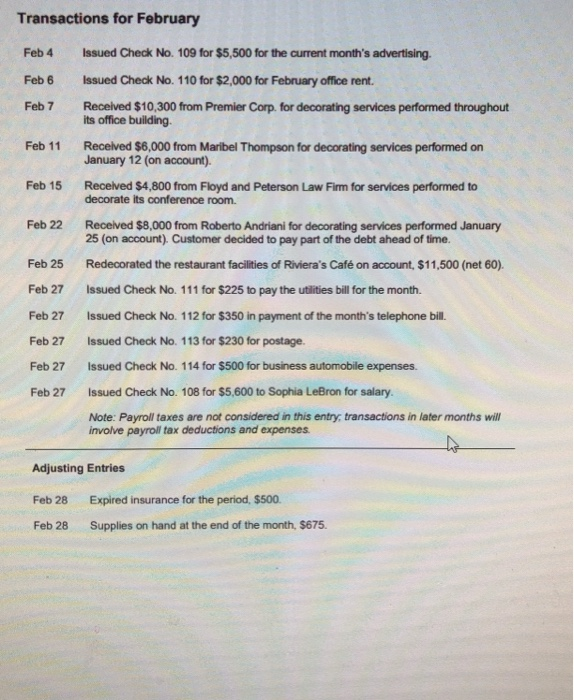

My Place, House of Dcor - February 2018 For the month of February 2018, you will perform the following procedures: 1. Journalize the transactions (JES) listed below and on subsequent pages using the General Journal & Chart of Accounts. 2. Refresh your General Ledger tab to ensure proper posting of JES. 3. Review your Unadjusted Trial Balance in the February Reports tab for accuracy and completeness of your JEs. If this trial balance does not balance, go back and review your JES in your General Journal for any errors. 4. Journalize adjusting entries (AJES) using information provided to you below and on subsequent pages in the General Journal. Date these entries as of the last day of the month. 5. Refresh your General Ledger tab to ensure proper posting of AJES. 6. Review your Adjusted Trial Balance in the February Reports tab for accuracy and completeness of your AJEs. If this trial balance does not balance, go back and review your JES in your General Journal for any errors. 7. Review your financial statements in the February Reports tab; ensure your balance sheet "balances" and that all statements are properly articulated: a. Net income properly flowing to Statement of Retained Earnings b. Ending retained earnings balance properly flowing to Balance Sheet 8. Review your Schedule of Accounts Receivable (AR) and Payable (AP) in the February Reports tab (you might need to scroll to the right to see these). The totals from these reports should match the balance for AR and AP in the adjusted trial balance and the balance sheet. 9. Submit your answers in Blackboard using the February Project Submission assignment link provided. You will enter requested answers and will get immediate feedback once submitted. Once again, you should ONLY enter information into the General Journal tab in the Excel file. Information entered in any other tab (unless you create your own tabs for your own use) could jeopardize the validity of the formulas in those tabs, and result in your project figures being incorrect and loss of points. Transactions for February Feb 4 Feb 6 Feb 7 Feb 11 Feb 15 Feb 22 Issued Check No. 109 for $5,500 for the current month's advertising. Issued Check No. 110 for $2,000 for February office rent. Received $10,300 from Premier Corp. for decorating services performed throughout its office building Received $6,000 from Maribel Thompson for decorating services performed on January 12 (on account). Received 84,800 from Floyd and Peterson Law Firm for services performed to decorate its conference room. Received $8,000 from Roberto Andriani for decorating services performed January 25 (on account). Customer decided to pay part of the debt ahead of time. Redecorated the restaurant facilities of Riviera's Caf on account, $11,500 (net 60). Issued Check No. 111 for $225 to pay the utilities bill for the month. Issued Check No. 112 for $350 in payment of the month's telephone bill. Issued Check No. 113 for $230 for postage. Issued Check No. 114 for $500 for business automobile expenses. Issued Check No. 108 for $5,600 to Sophia LeBron for salary. Note: Payroll taxes are not considered in this entry, transactions in later months will involve payroll tax deductions and expenses. Feb 25 Feb 27 Feb 27 Feb 27 Feb 27 Feb 27 Adjusting Entries Feb 28 Expired insurance for the period, $500. Supplies on hand at the end of the month, $675. Feb 28