Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my question? give your comments for each ratio (use of ratio,and the performance of the company on that particular ratio ). ANALYSIS OF FINANCIAL STATEMENTS

my question? give your comments for each ratio (use of ratio,and the performance of the company on that particular ratio ).

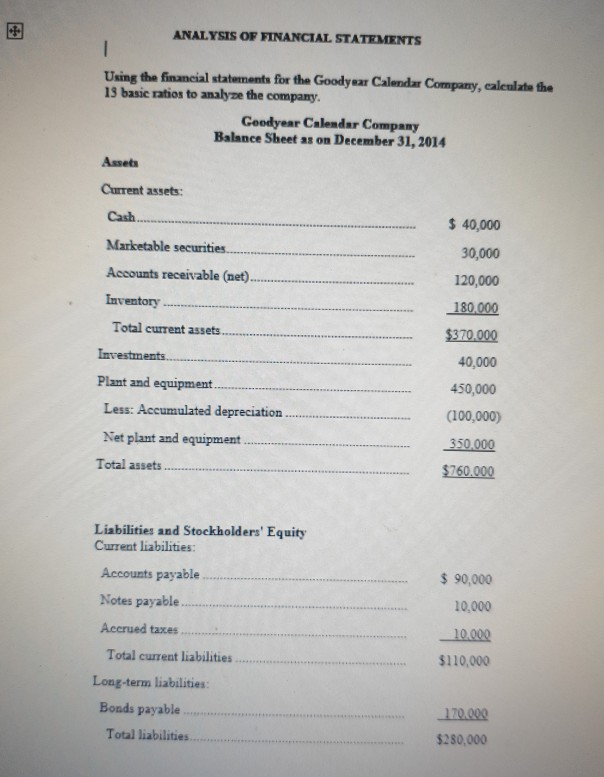

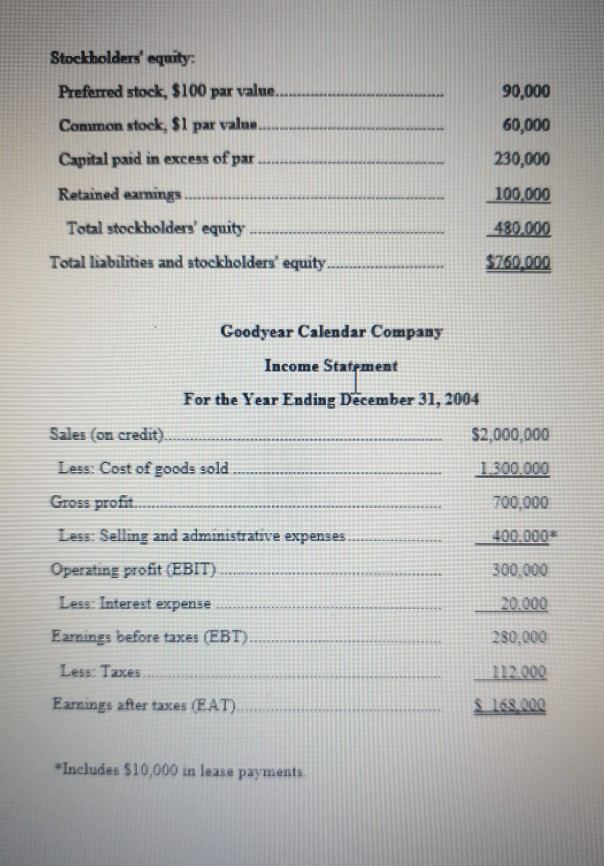

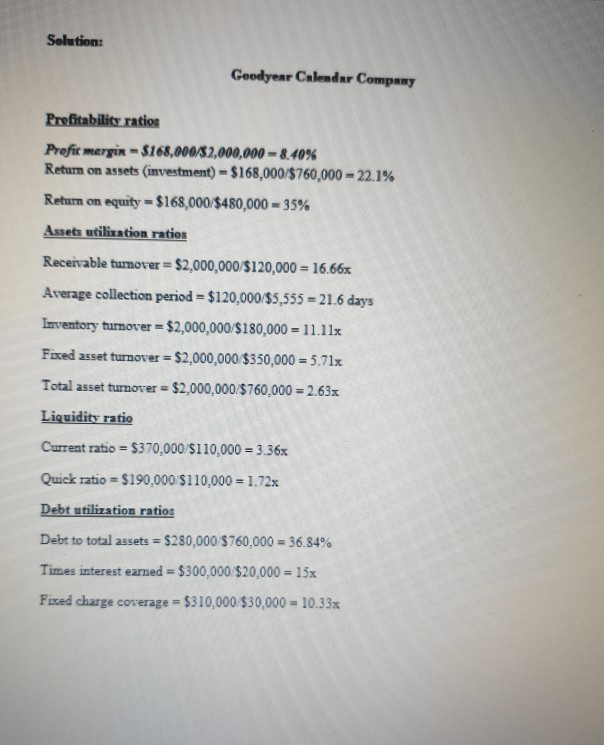

ANALYSIS OF FINANCIAL STATEMENTS Using the fimancial statements for the Goodyear Calendar Compamy, caleulate the 13 basic ratios to analyze the company. Goodyear Calendar Company Balance Sheet as on December 31, 2014 Assets Current assets: Cash. Marketable securities Accounts receivable (net). Inventory 40,000 30,000 120,000 180,000 $370,000 40,000 450,000 (100,000) 350,000 $760.000 Total current assets Plant and equipment Less: Accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Notes payable Accrued taxes. $90,000 10,000 10.00 $110,000 Total current liabilities Long-term liabilities Bonds payable Total liabilities. 170.000 $280,000 Stockholders' equity Common stock, $1 par valns Capital paid in excess of par . Retained earnings Total stockholders' equity 90,000 60,000 230,000 100,000 480,000 $760,000 Total liabilities and stockholders' equity Goodyear Calendar Company Income Statement For the Year Ending December 31, 2004 Sales (on credit). $2,000,000 300,000 700,000 Less: Cost of goods sold Gross profft. Less: Selling and administrative expenses Operating profit (EBIT) 300,000 Less: Interest expense. Earnings before taxes (EBT) 280,000 112000 $ 168,000 Less: laxes Earnings after taxes (EAT Includes $10,000 in lease payments Solution: Geodyear Calendar Company Profitability ratios Prefir mergi" $168,000$2,000,000-8.40% Rehm on assets (investment)-$168,00060,000-22.1% Return on equity-31 68,000$480,000-35% Assets utilization ratios Receivable turnover $2,000,000/$120,000 16.66x Average collection period - $120,000 $5,555 -21.6 days Imventory turnover $2,000,000/$180,000-11.11x Fixed asset turnover $2,000,000 $350,000 5.71x Total asset turnover $2,000,000$760,000-2.63x uidity Current ratio $370,000/$110,000 3.36x Quick ratio $190,000 $110,000 1.72x Debt utilization ratios Debt to total assets -$280,000 S 760,000 = 36.84% Times interest earned $300,000 $20,000 15x Fixed charge coverage $310,000 $30,000-10.33x 1oStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started