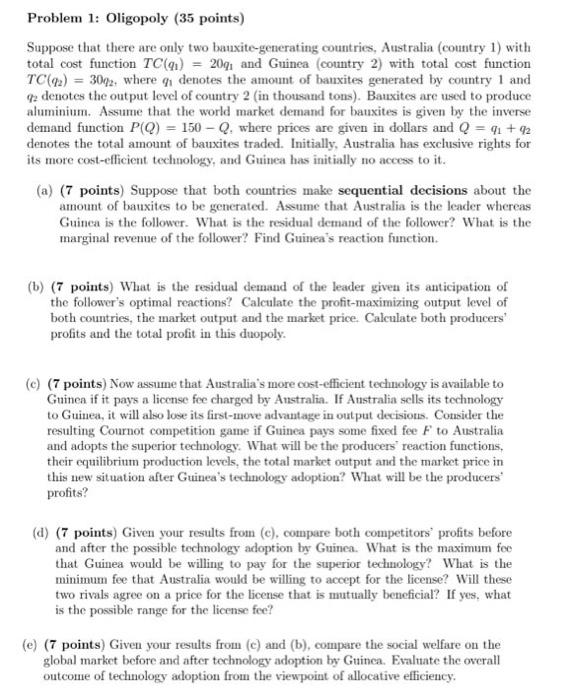

Problem 1: Oligopoly (35 points) Suppose that there are only two bauxite-generating countries, Australia (country 1) with total cost function TC(q1)=20q1 and Guinea (country 2) with total cost function TC(q2)=30q2, where q1 denotes the amount of bauxites generated by country 1 and q2 denotes the output level of country 2 (in thousand tons). Bauxites are used to produce aluminium. Assume that the world market demand for bauxites is given by the inverse demand function P(Q)=150Q, where prices are given in dollars and Q=q1+q2 denotes the total amount of bauxites traded. Initially, Australia has exchusive rights for its more cost-efficient technology, and Guinea has initially no access to it. (a) (7 points) Suppose that both countries make sequential decisions about the amount of bauxites to be generated. Assume that Australia is the leader whereas Guinea is the follower. What is the residual demand of the follower? What is the marginal revenue of the follower? Find Guinea's reaction function. (b) (7 points) What is the residual demand of the leader given its anticipation of the follower's optimal reactions? Calculate the profit-maximizing output level of both countries, the market output and the market price. Calculate both producers' profits and the total profit in this duopoly. (c) (7 points) Now assume that Australia's more cost-efficient technology is available to Guinea if it pays a license fee charged by Anstralia. If Anstralia sells its technology to Guinea, it will also lose its first-move advantage in output decisions. Consider the resulting Cournot competition game if Guinea pays some fixed fee F to Australia and adopts the superior technology. What will be the producers' reaction functions, their equilibrium production levels, the total market output and the market price in this new situation after Guinea's technology adoption? What will be the producers' profits? (d) ( 7 points) Given your results from (c), compare both competitors' profits before and after the possible technology adoption by Guinea. What is the maximum foe that Guinea would be willing to pay for the superior technology? What is the minimum fee that Australia would be willing to accept for the license? Will these two rivals agree on a price for the license that is mutually beneficial? If yes, what is the possible range for the license fee? (e) (7 points) Given your results from (c) and (b), compare the social welfare on the global market before and after technology adoption by Guinea. Evaluate the overall outcome of technology adoption from the viewpoint of allocative efficiency