Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My question is requirement 2, this is just all the information on it Reference Reference More info Mighty Delivery Service has completed closing entries and

My question is requirement 2, this is just all the information on it

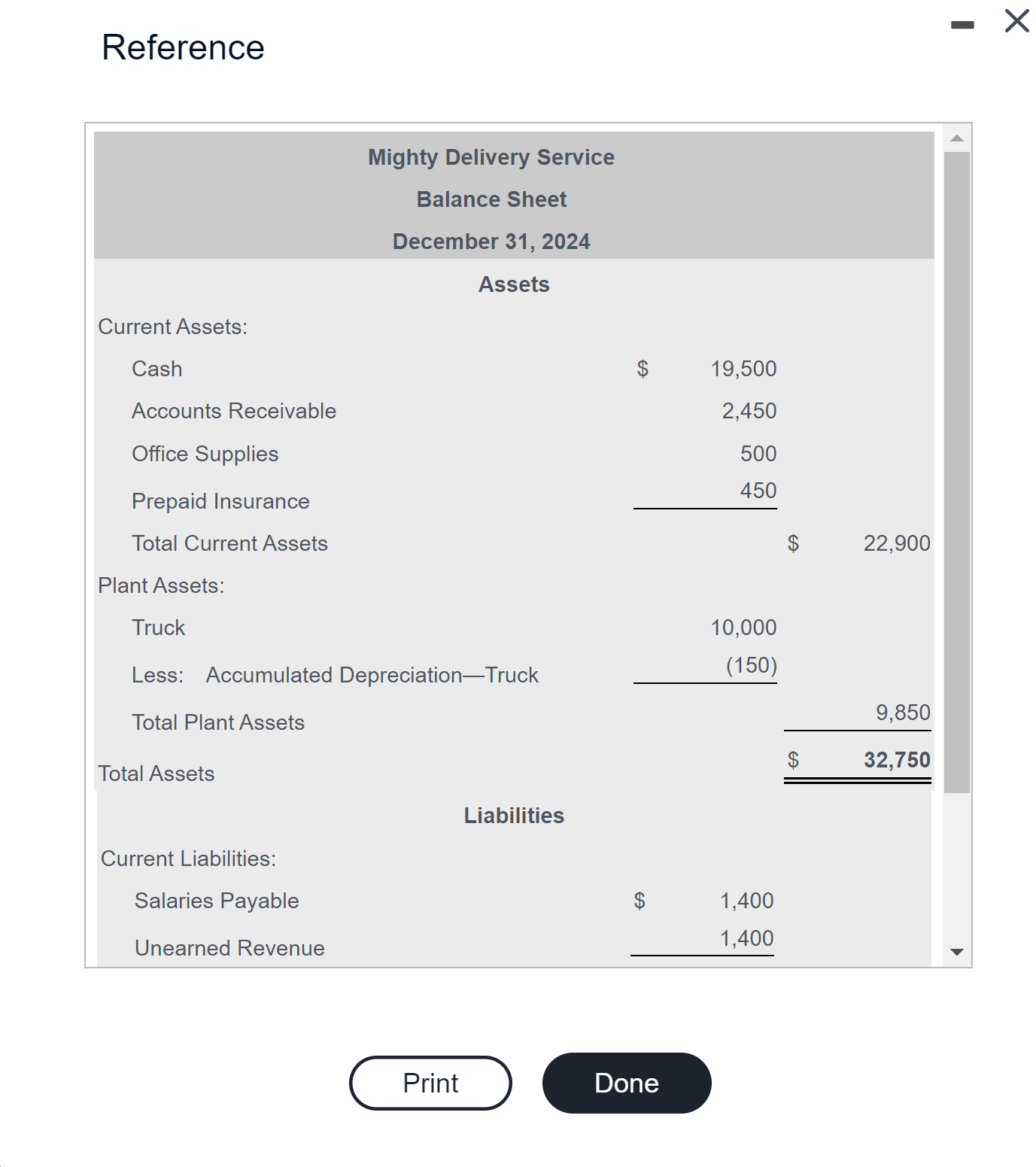

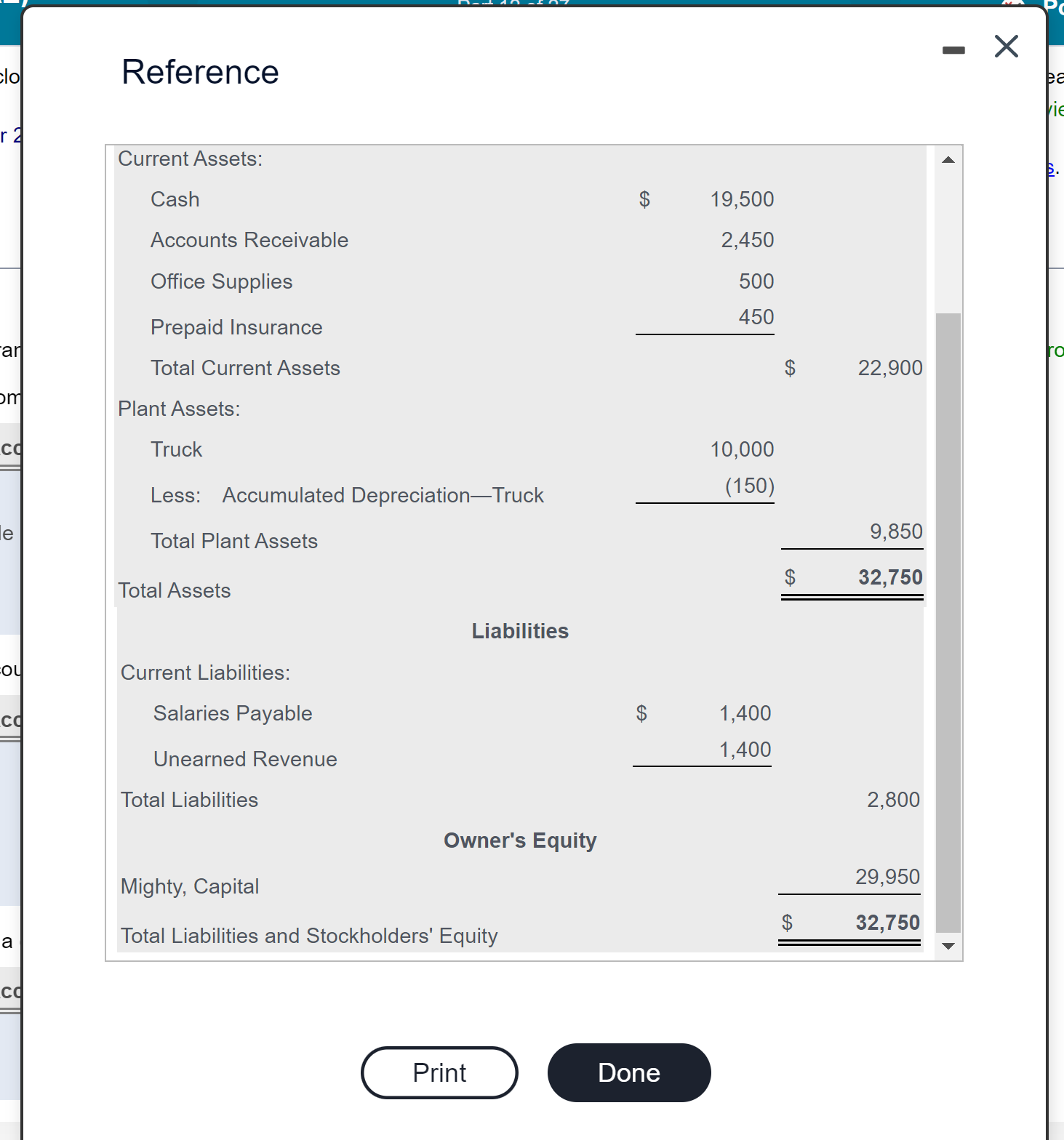

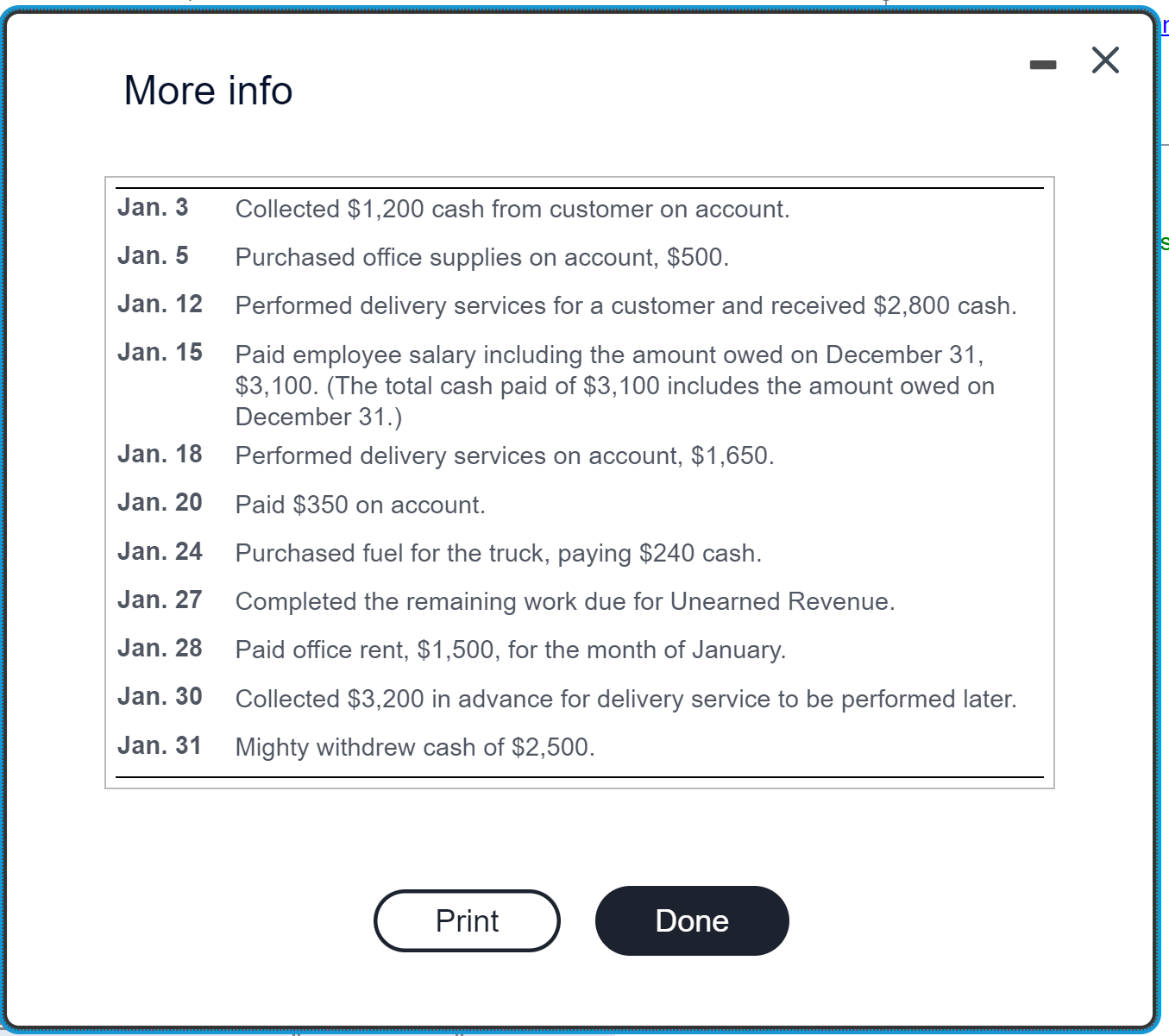

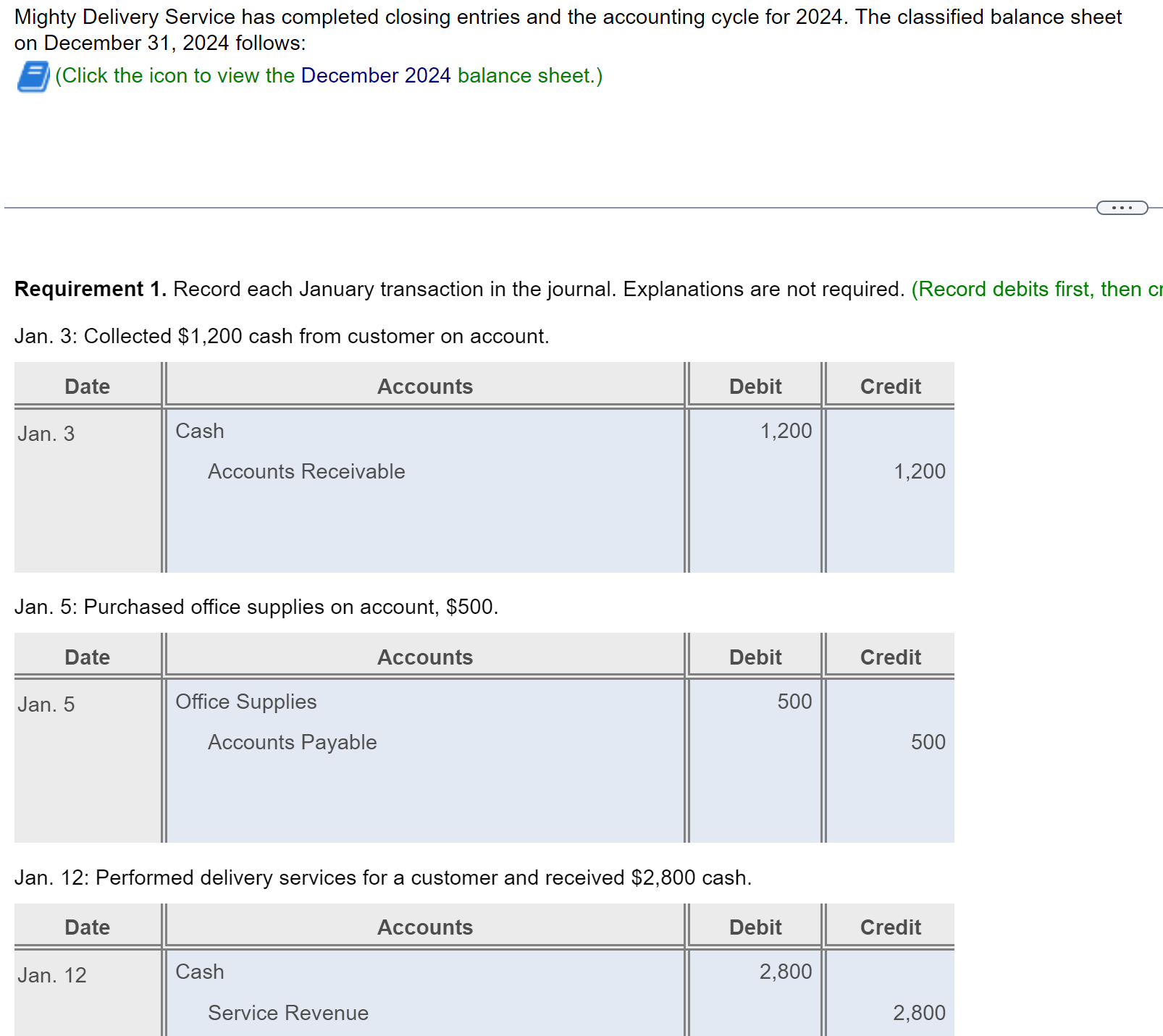

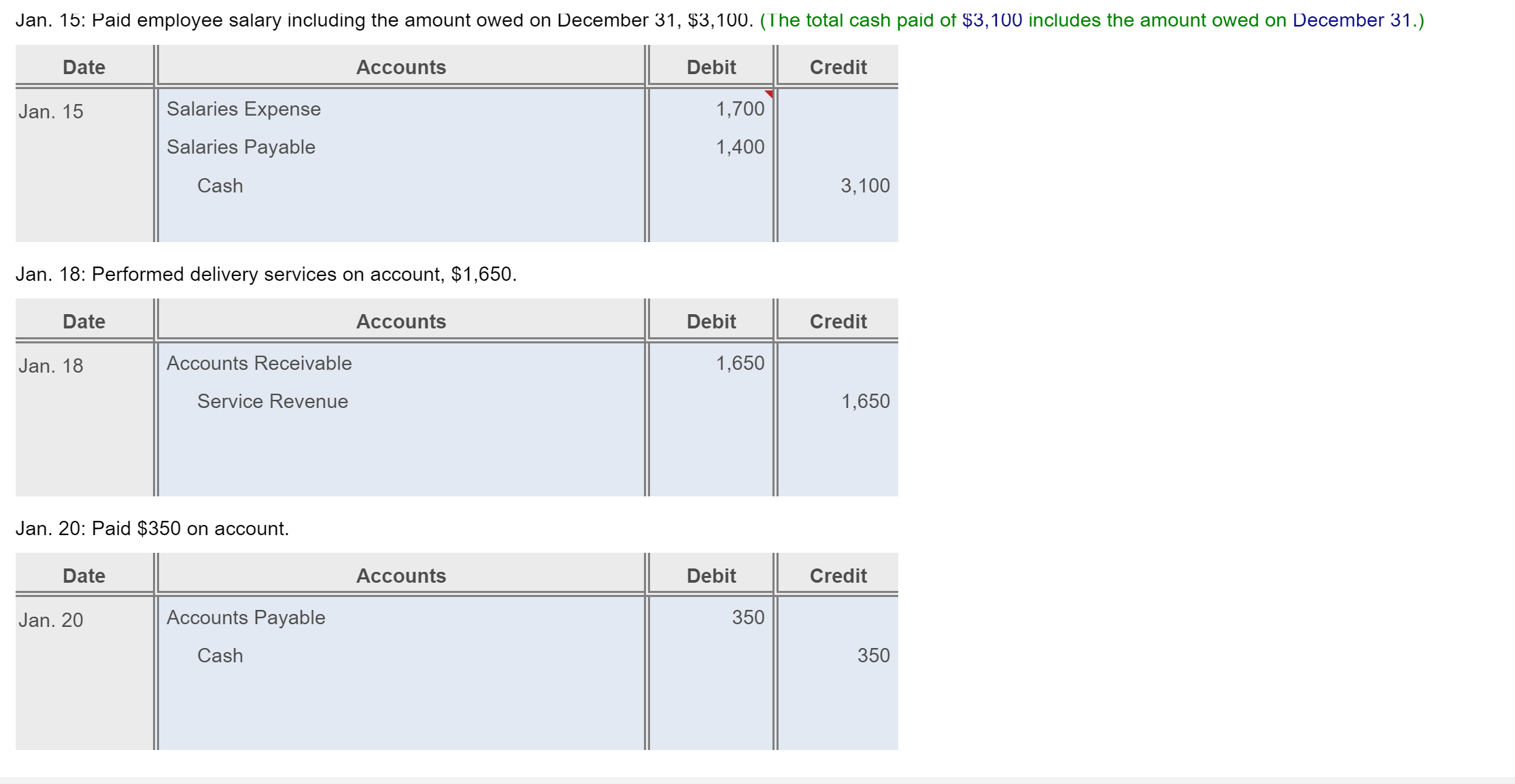

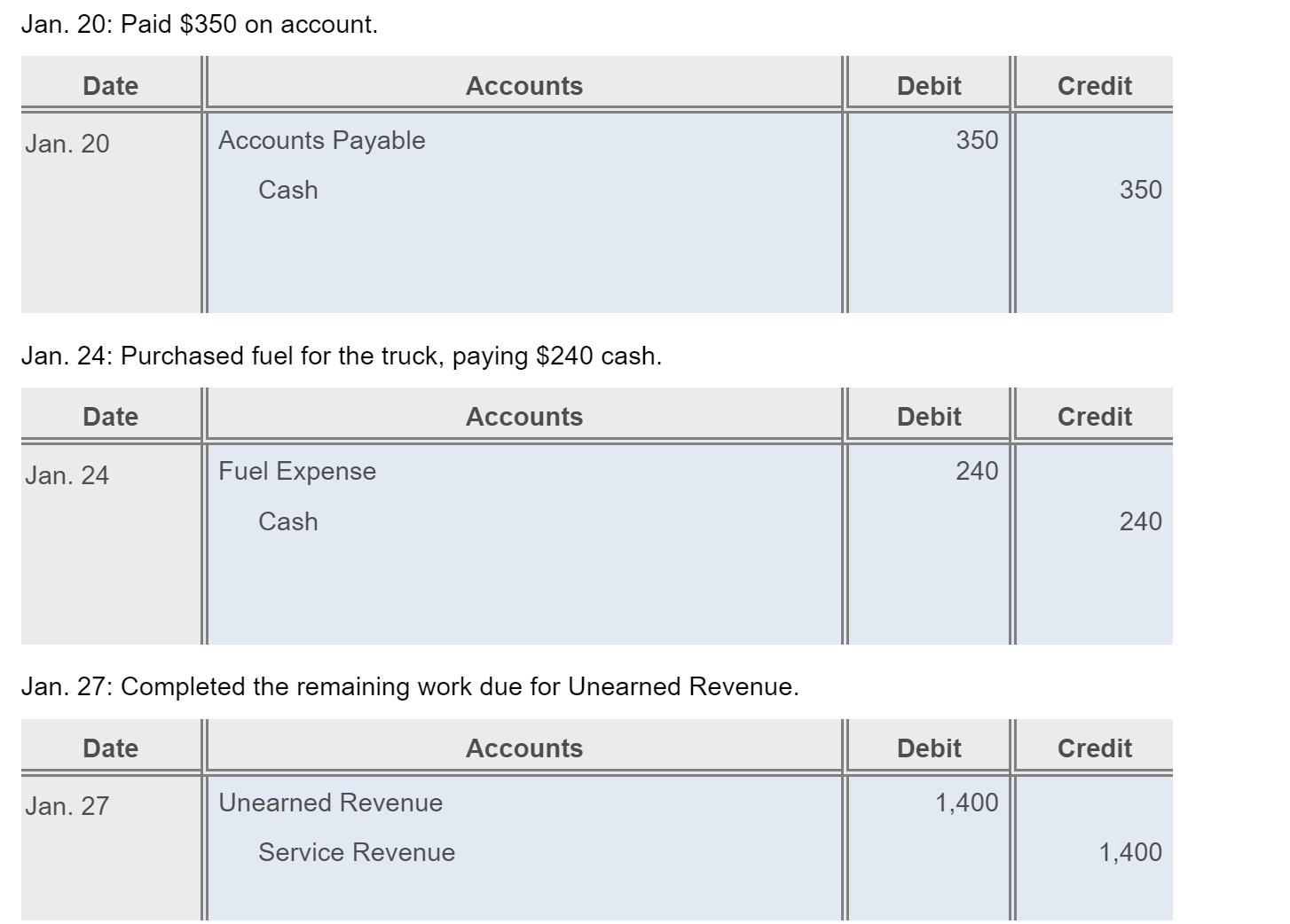

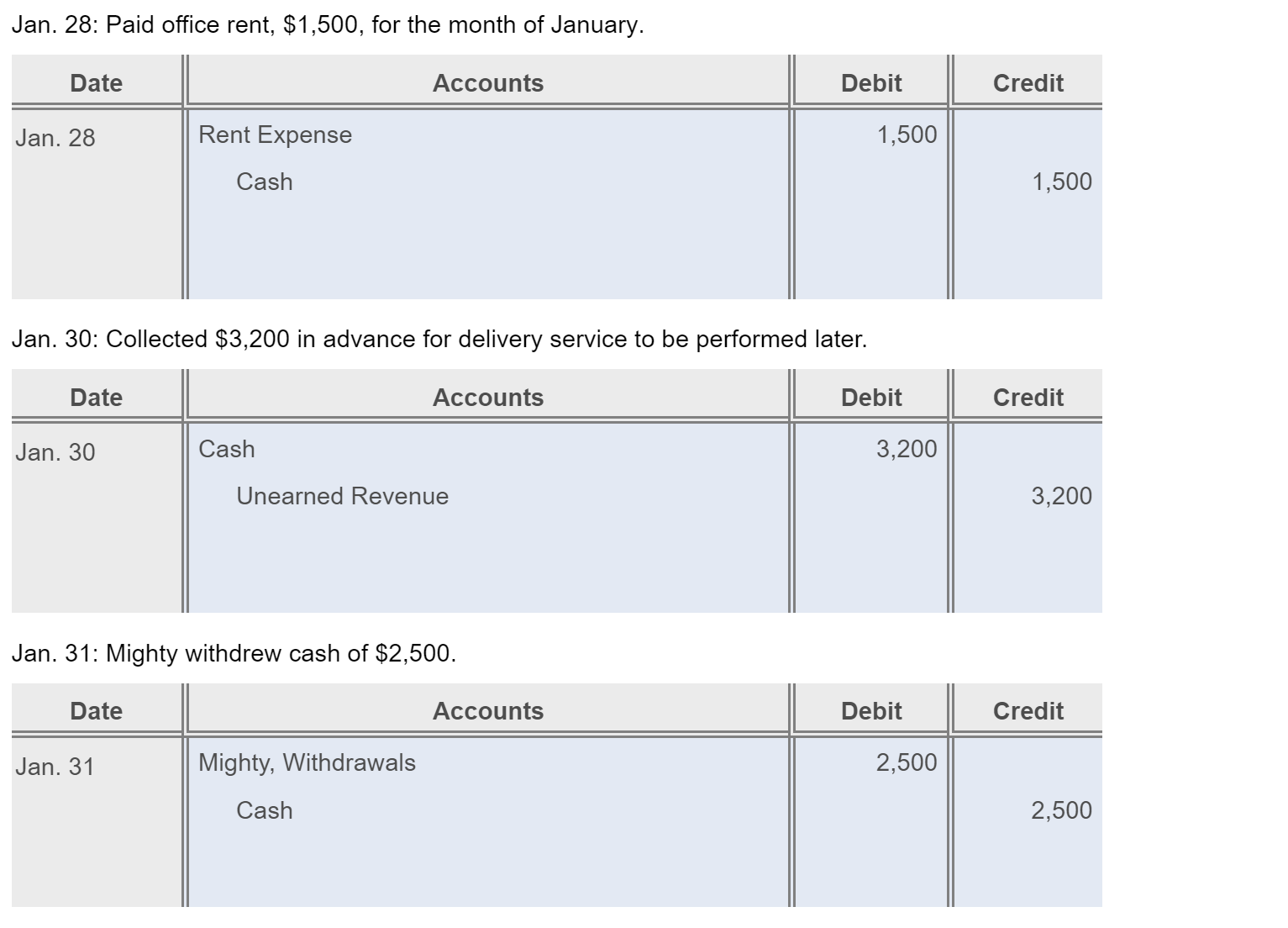

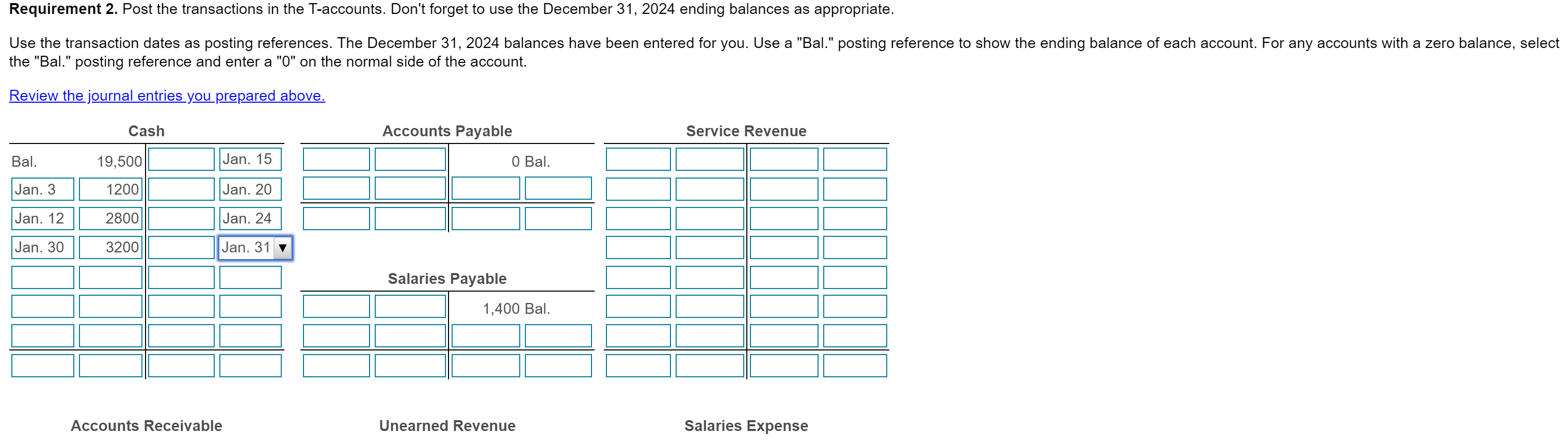

Reference Reference More info Mighty Delivery Service has completed closing entries and the accounting cycle for 2024 . The classified balance sheet on December 31, 2024 follows: (Click the icon to view the December 2024 balance sheet.) Requirement 1. Record each January transaction in the journal. Explanations are not required. (Record debits first, then Jan. 3: Collected $1,200 cash from customer on account. Jan. 5: Purchased office supplies on account, $500. Jan. 12: Performed delivery services for a customer and received $2,800 cash. Jan. 18: Performed delivery services on account, $1,650. Jan. 20: Paid $350 on account. Jan. 20: Paid $350 on account. Jan. 24: Purchased fuel for the truck, paying $240 cash. Jan. 27: Completed the remaining work due for Unearned Revenue. Jan. 28: Paid office rent, $1,500, for the month of January. Jan. 30: Collected $3,200 in advance for delivery service to be performed later. Jan. 31: Mighty withdrew cash of $2,500. Requirement 2. Post the transactions in the T-accounts. Don't forget to use the December 31,2024 ending balances as appropriate. the "Bal." posting reference and enter a "0" on the normal side of the accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started