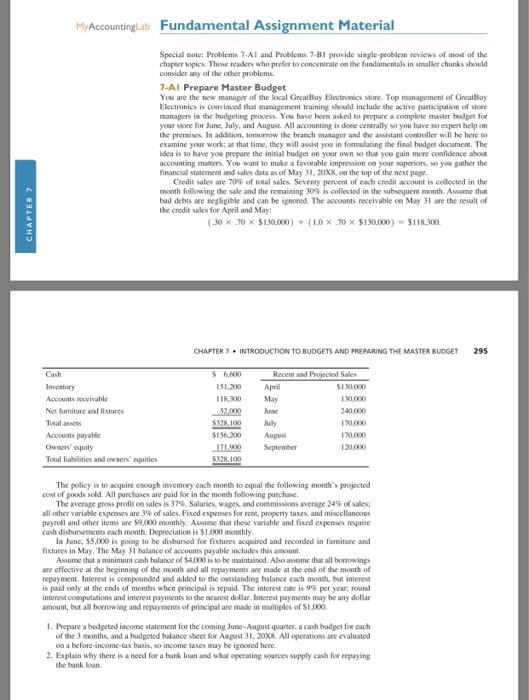

MyAccountingLab Fundamental Assignment Material Special nole: Problems 7-A1 and Problems 7-81 provide siagle-problem reviews of mont of the chapeer lopics. Those readers who prefer to concentrale on the fundamentals in smaller chunks should consider any of the other problems 7-Al Prepare Master Budget You are the new manaper of the local GreatBuy Electronics store. Top management of GreatBay Electronics is convinced that management training should include the active participation of stoee managers in the budgeting peocess. You have been asked to prepare a complete master badpet for your store for June, July, and August. All accounting is done centrally so you have no expert help on the premises. In addition, tomormow the branch manager and the assistant controller will be here to examine your work: at that time, they will assist you in formulating the final budget document. The idea is to have you prepare the initial budget on your own so that you gain more confidence abour accounting matters You want to make a favorable impression on your superions, so you gather the financial statement and sales data as of May 31, 20x8, on the top of the next page. Credit sales are 70% of total sales. Seventy percent of each credit account is collected in the month following the sale and the remaining 30% is collected in the subsequent month. Assume that bad debts are negligible and can be ignored. The accounts receivable on May 31 are the resalt of the credit salkes for April and May: (30 x 70 X $130,000)(10x .70 x $130,000)$118,300 OAPTER 7 * INTRODUCTION TO BUDGETS AND PREPARING THE MASTER BUDGET 295 Recent and Projected Sales 51,300April 18,300 May 130,000 Accounts receivable Net furmiture and fistures Total assets Accounts payatle Ouners equity Total liabillities and owsers equities 240,000 120,000 1720000 120000 156,200 Augs September The policy is to acquine enough inventory cach month to equal the following month's projected cost of goods sold. All purchases are paid for in the month following purchase. The average gross profit on sales is 37%. Salaries, wages, and commissions average 24% of sales; all other variable expenses are 3% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $9,000 monthly. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $1.000 monthly la June, $5,000 is going to be disbursed for fistures acquired and recorded in fumiture and fixtures in May, The May 31 halance of accounts payable includes this amount Assume that a minimum cash balance of S4.000 is to be maintainod. Also assume that all bonowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is compounded and added to the outstanding balance each moath, but interest is paid only at the ends of months when principal is repaid. The interest rate is 9% per year. round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repaymenis of principal are made in multiples of SI,000 1. Prepare a budgeted inacome statement for the coming June-August quarter, a cash budget for each of the 3 months, and a budgcted balance sheet for Aupust 31. 20XS. All opcrations are evaluatod on a before-income-tax basis, so income taxes may be ignored here. 2. Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan MyAccountingLab Fundamental Assignment Material Special nole: Problems 7-A1 and Problems 7-81 provide siagle-problem reviews of mont of the chapeer lopics. Those readers who prefer to concentrale on the fundamentals in smaller chunks should consider any of the other problems 7-Al Prepare Master Budget You are the new manaper of the local GreatBuy Electronics store. Top management of GreatBay Electronics is convinced that management training should include the active participation of stoee managers in the budgeting peocess. You have been asked to prepare a complete master badpet for your store for June, July, and August. All accounting is done centrally so you have no expert help on the premises. In addition, tomormow the branch manager and the assistant controller will be here to examine your work: at that time, they will assist you in formulating the final budget document. The idea is to have you prepare the initial budget on your own so that you gain more confidence abour accounting matters You want to make a favorable impression on your superions, so you gather the financial statement and sales data as of May 31, 20x8, on the top of the next page. Credit sales are 70% of total sales. Seventy percent of each credit account is collected in the month following the sale and the remaining 30% is collected in the subsequent month. Assume that bad debts are negligible and can be ignored. The accounts receivable on May 31 are the resalt of the credit salkes for April and May: (30 x 70 X $130,000)(10x .70 x $130,000)$118,300 OAPTER 7 * INTRODUCTION TO BUDGETS AND PREPARING THE MASTER BUDGET 295 Recent and Projected Sales 51,300April 18,300 May 130,000 Accounts receivable Net furmiture and fistures Total assets Accounts payatle Ouners equity Total liabillities and owsers equities 240,000 120,000 1720000 120000 156,200 Augs September The policy is to acquine enough inventory cach month to equal the following month's projected cost of goods sold. All purchases are paid for in the month following purchase. The average gross profit on sales is 37%. Salaries, wages, and commissions average 24% of sales; all other variable expenses are 3% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $9,000 monthly. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $1.000 monthly la June, $5,000 is going to be disbursed for fistures acquired and recorded in fumiture and fixtures in May, The May 31 halance of accounts payable includes this amount Assume that a minimum cash balance of S4.000 is to be maintainod. Also assume that all bonowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is compounded and added to the outstanding balance each moath, but interest is paid only at the ends of months when principal is repaid. The interest rate is 9% per year. round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repaymenis of principal are made in multiples of SI,000 1. Prepare a budgeted inacome statement for the coming June-August quarter, a cash budget for each of the 3 months, and a budgcted balance sheet for Aupust 31. 20XS. All opcrations are evaluatod on a before-income-tax basis, so income taxes may be ignored here. 2. Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan