Question: Myra Breck must choose between two bonds: Bond A pays $120 annual interest with semiannual payment and has a market value of $820. It has

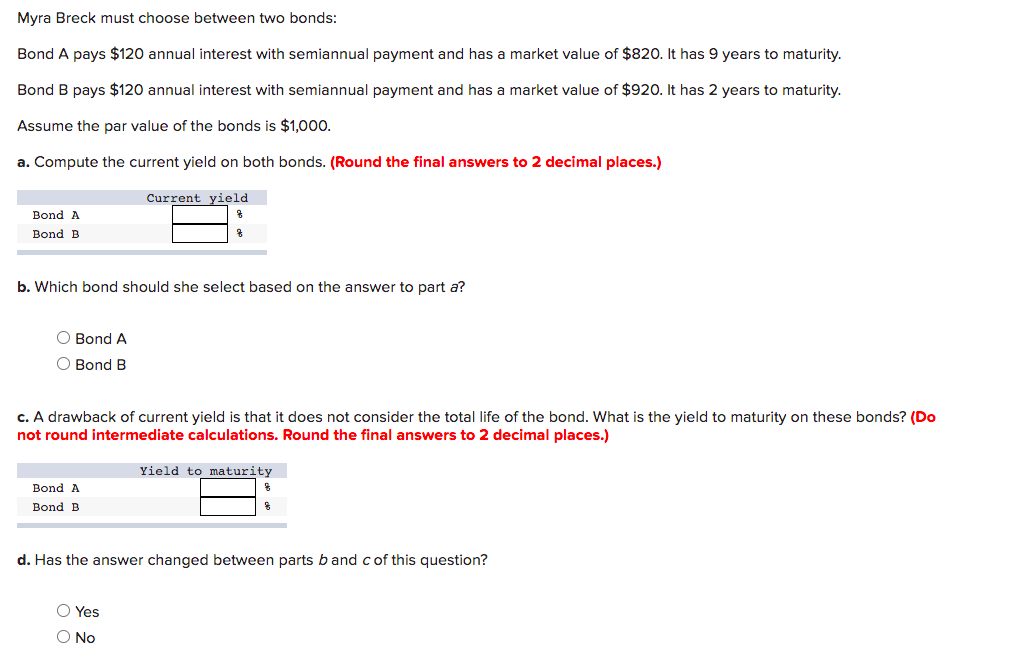

Myra Breck must choose between two bonds: Bond A pays $120 annual interest with semiannual payment and has a market value of $820. It has 9 years to maturity. Bond B pays $120 annual interest with semiannual payment and has a market value of $920. It has 2 years to maturity. Assume the par value of the bonds is $1,000. a. Compute the current yield on both bonds. (Round the final answers to 2 decimal places.) Current yield Bond A Bond B b. Which bond should she select based on the answer to part a? O Bond A O Bond B c. A drawback of current yield is that it does not consider the total life of the bond. What is the yield to maturity on these bonds? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Yield to maturity 3 Bond A Bond B d. Has the answer changed between parts band cof this question? O Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts