Question: please explain not only give the answer thanku 6. You are faced with the probability distribution of the HPR on the stock market index fund

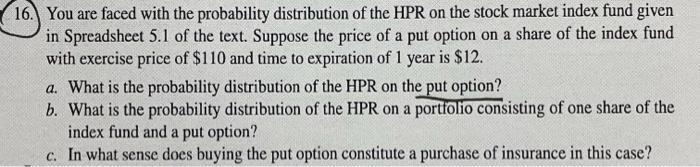

6. You are faced with the probability distribution of the HPR on the stock market index fund given in Spreadsheet 5.1 of the text. Suppose the price of a put option on a share of the index fund with exercise price of $110 and time to expiration of 1 year is $12. a. What is the probability distribution of the HPR on the put option? b. What is the probability distribution of the HPR on a portfolio consisting of one share of the index fund and a put option? c. In what sense does buying the put option constitute a purchase of insurance in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts