8. Sales price computation. In June, Steinhardt, Inc., sold 50 air conditioners for $200 each. Costs included materials costs of $50 per unit, direct

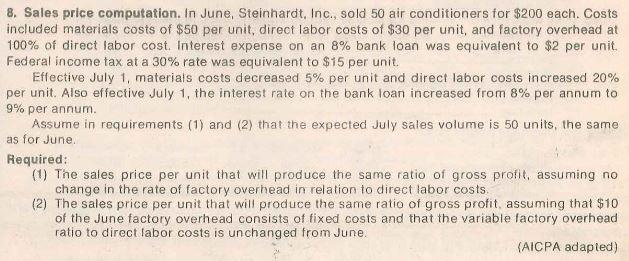

8. Sales price computation. In June, Steinhardt, Inc., sold 50 air conditioners for $200 each. Costs included materials costs of $50 per unit, direct labor costs of $30 per unit, and factory overhead at 100% of direct labor cost. Interest expense on an 8% bank loan was equivalent to $2 per unit. Federal income tax at a 30% rate was equivalent to $15 per unit. Effective July 1, materials costs decreased 5% per unit and direct labor costs increased 20% per unit. Also effective July 1, the interest rate on the bank loan increased from 8% per annum to 9% per annum. Assume in requirements (1) and (2) that the expected July sales volume is 50 units, the same as for June. Required: (1) The sales price per unit that will produce the same ratio of gross profit, assuming no change in the rate of factory overhead in relation to direct labor costs. (2) The sales price per unit that will produce the same ratio of gross profit, assuming that $10 of the June factory overhead consists of fixed costs and that the variable factory overhead ratio to direct labor costs is unchanged from June. (AICPA adapted)

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 2 Given Selling price Less Product costs Mat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started