Answered step by step

Verified Expert Solution

Question

1 Approved Answer

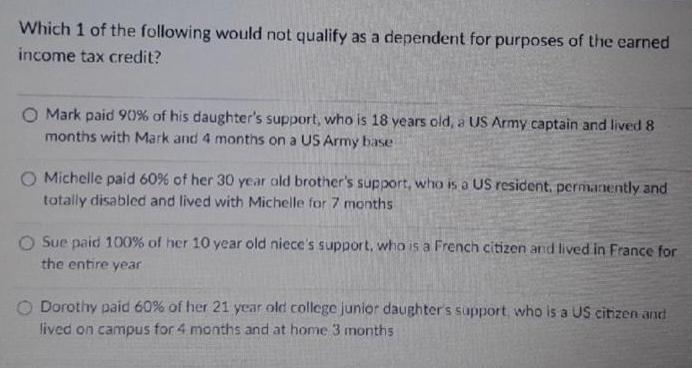

Which 1 of the following would not qualify as a dependent for purposes of the earned income tax credit? O Mark paid 90% of

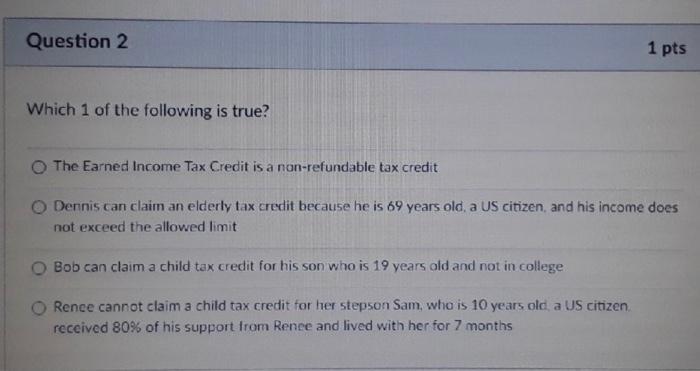

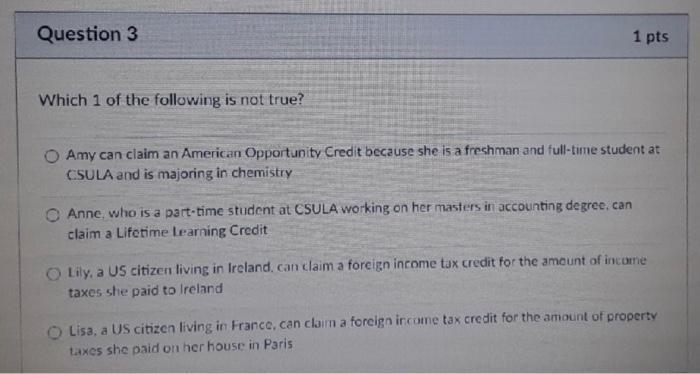

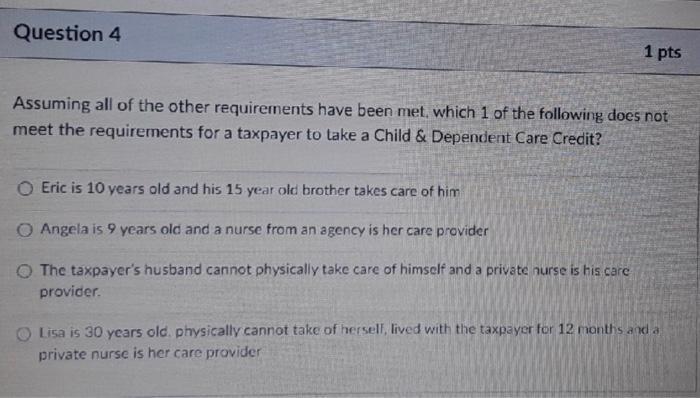

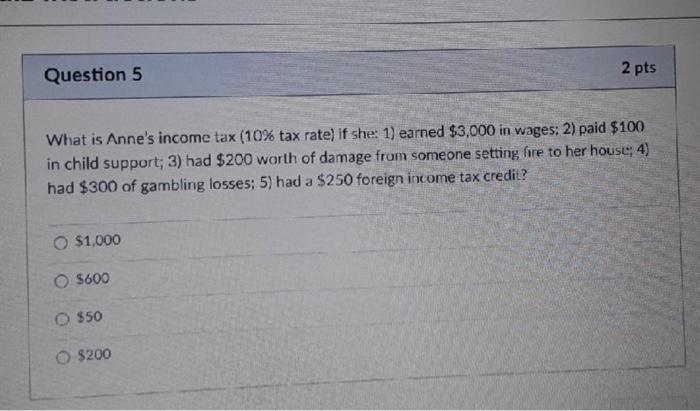

Which 1 of the following would not qualify as a dependent for purposes of the earned income tax credit? O Mark paid 90% of his daughter's support, who is 18 years old, a US Army captain and lived 8 months with Mark and 4 months on a US Army base O Michelle paid 60% of her 30 year old brother's support, who is a US resident, permanently and totally disabled and lived with Michelle for 7 months O Sue paid 100% of her 10 year old niece's support, who is a French citizen and lived in France for the entire year Dorothy paid 60% of her 21 year old college junior daughter's support, who is a US citizen and lived on campus for 4 months and at home 3 months Question 2 Which 1 of the following is true? 1 pts O The Earned Income Tax Credit is a non-refundable tax credit Dennis can claim an elderly tax credit because he is 69 years old, a US citizen, and his income does not exceed the allowed limit Bob can claim a child tax credit for his son who is 19 years old and not in college Rence cannot claim a child tax credit for her stepson Sam, who is 10 years old, a US citizen. received 80% of his support from Renee and lived with her for 7 months Question 3 Which 1 of the following is not true? 1 pts O Amy can claim an American Opportunity Credit because she is a freshman and full-time student at CSULA and is majoring in chemistry O Anne, who is a part-time student at CSULA working on her masters in accounting degree, can claim a Lifetime Learning Credit O Lily, a US citizen living in Ireland, can claim a foreign income tax credit for the amount of income taxes she paid to Ireland O Lisa, a US citizen living in France, can claim a foreign income tax credit for the amount of property taxes she paid on her house in Paris Question 4 1 pts Assuming all of the other requirements have been met, which 1 of the following does not meet the requirements for a taxpayer to take a Child & Dependent Care Credit? O Eric is 10 years old and his 15 year old brother takes care of him O Angela is 9 years old and a nurse from an agency is her care provider QThe taxpayer's husband cannot physically take care of himself and a private nurse is his care provider. Lisa is 30 years old. physically cannot take of hersell, lived with the taxpayer for 12 months and a private nurse is her care provider Question 5 What is Anne's income tax (10% tax rate) if she: 1) earned $3,000 in wages; 2) paid $100 in child support; 3) had $200 worth of damage from someone setting fire to her house; 4) had $300 of gambling losses; 5) had a $250 foreign income tax credit? O $1,000 O $600 O $50 2 pts O $200

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Answer Sue paid 100 of her 10 years old nieces support who is a French citizen and lived in France ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started