Answered step by step

Verified Expert Solution

Question

1 Approved Answer

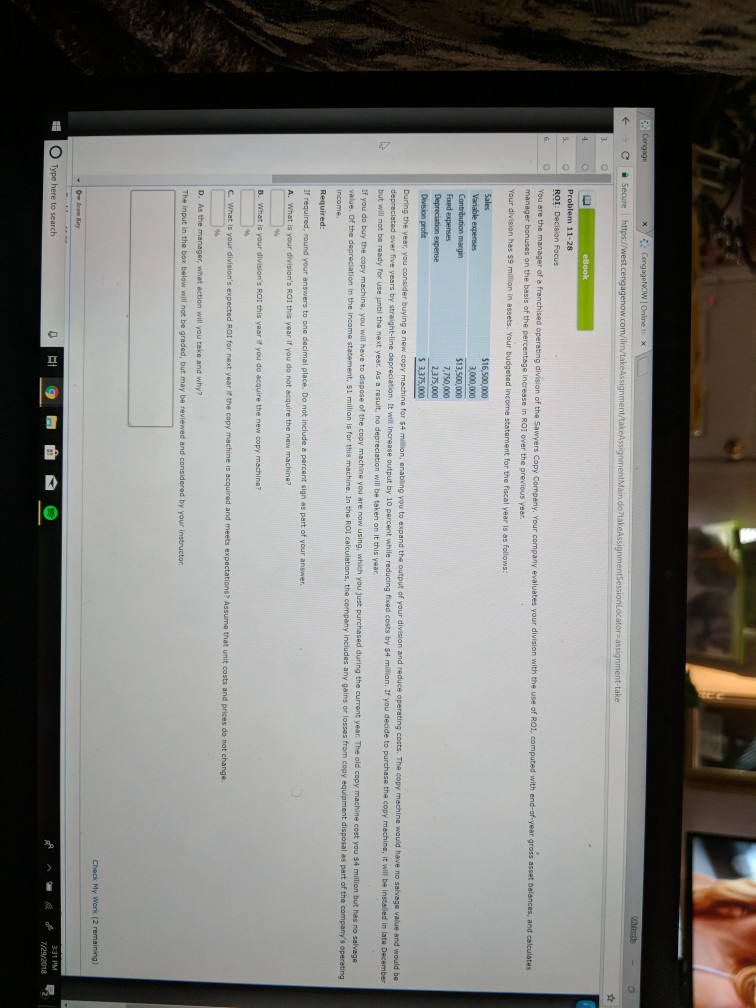

n do takeAssi ROI: Decision Focus Sawyers Copy Company. Your company evaluates your division with th use of ROI, computed with end-of-year gross asset You

n do takeAssi ROI: Decision Focus Sawyers Copy Company. Your company evaluates your division with th use of ROI, computed with end-of-year gross asset You are the manager of a franchised operating division of the manager bonuses on the basis of the percentage increase in $16,500,000 3,000,000 Fixed expenses 7,750,000 2,375,000 S 3,375,000 year, you consider buying a new copy machine for $4 million, anabling you to expand the output of your division and reduce operating coats. The c over five years by straight-line dapreciation, tt vwill Increase output by 10 parcent while reducing fixed costs by $4 million. If you decide to purchase the copy mechine, it will be installed in late December copy machine would have no salvage value and would be but will not ba roady for use until the next year. As a rasult, no depreciation will be taken on it this year ed during the current year. The old copy machine cost you s4 million but has no salvage If you da buy the copy machine, you will have to dispose of the copy machin value. Of the depreciation in the income statement, S1 million is for this machine. In the ROI calculations, the e you are now using, which you just purchas company includes any gains or losses from copy equipment disposal as part of the company's operating If required, round your answers to one dacimal place. Do not include a parcent sign as part of your answer A. What is your division's RO1 this year if you do not acquire the new machine? 29/2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started