Answered step by step

Verified Expert Solution

Question

1 Approved Answer

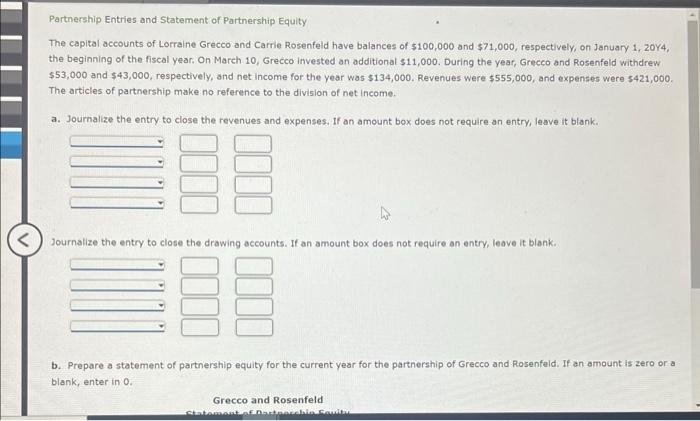

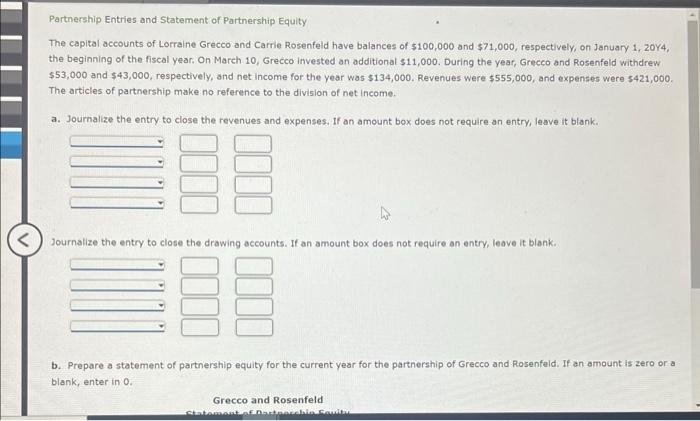

n Partnership Entries and Statement of Partnership Equity The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of 5100,000 and $71,000, respectively, on

n

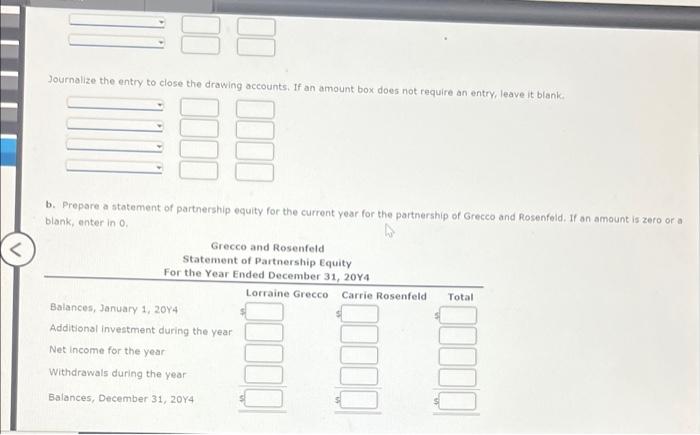

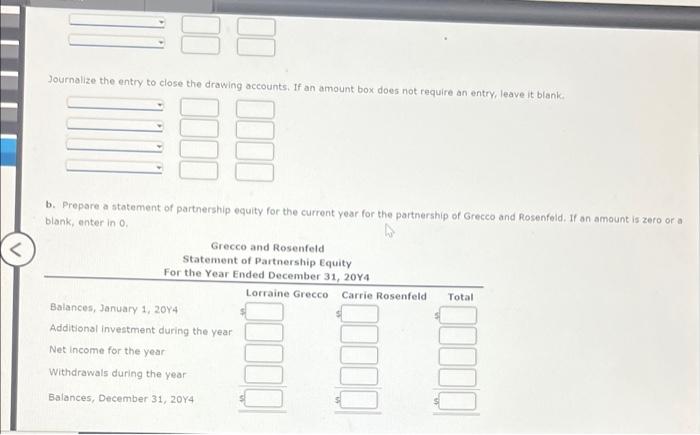

Partnership Entries and Statement of Partnership Equity The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of 5100,000 and $71,000, respectively, on January 1 , 20Y4, the beginning of the fiscal year. On. March 10, Grecco invested an additional $11,000. During the year, Grecco and Rosenfeld withdrew $53,000 and $43,000, respectively, and net income for the year was $134,000. Revenues were $555,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. a. Journalize the entry to close the revenues and expenses. If an amount box does not require an entry, leave it blank. Journalize the entry to close the drawing accounts. If an amount box does not require an entry, leave it blank. b. Prepare a statement of partnership equity for the current year for the partnership of Grecco and Rosenfeld. If an amount is zero or a blank, enter in 0 . Grecco and Rosenfeld Journalize the entry to close the drawing accounts. If an amount box does not require an entry, leave it blank. b. Prepare a statement of partnership equity for the current year for the partnership of Grecco and Rosenfeld. If an amount is zero or a blank, enter in 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started