Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the details of the answers 2. Tricia and Ulrich each own 50% of the TU partnership. On 1/1/2023, the TU partnership had the

Please show the details of the answers

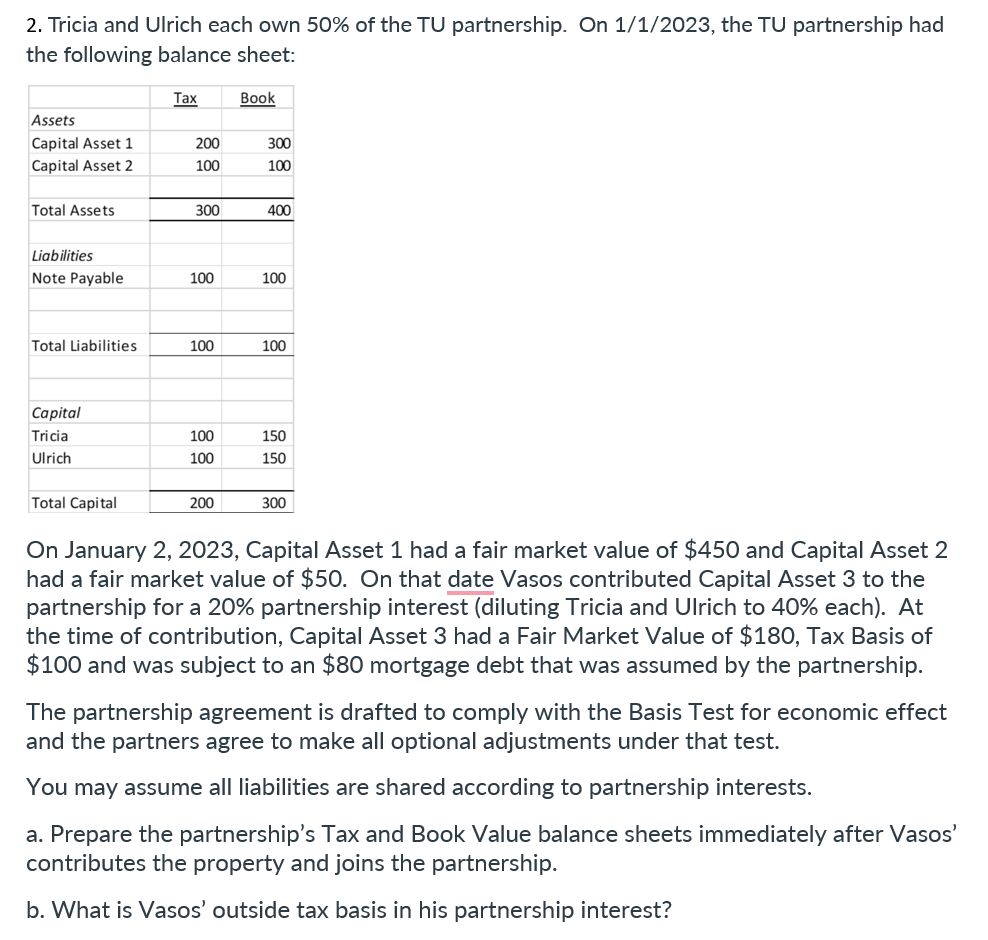

2. Tricia and Ulrich each own 50% of the TU partnership. On 1/1/2023, the TU partnership had the following balance sheet: On January 2, 2023, Capital Asset 1 had a fair market value of $450 and Capital Asset 2 had a fair market value of $50. On that date Vasos contributed Capital Asset 3 to the partnership for a 20% partnership interest (diluting Tricia and Ulrich to 40% each). At the time of contribution, Capital Asset 3 had a Fair Market Value of $180, Tax Basis of $100 and was subject to an $80 mortgage debt that was assumed by the partnership. The partnership agreement is drafted to comply with the Basis Test for economic effect and the partners agree to make all optional adjustments under that test. You may assume all liabilities are shared according to partnership interests. a. Prepare the partnership's Tax and Book Value balance sheets immediately after Vasos' contributes the property and joins the partnership. b. What is Vasos' outside tax basis in his partnership interestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started