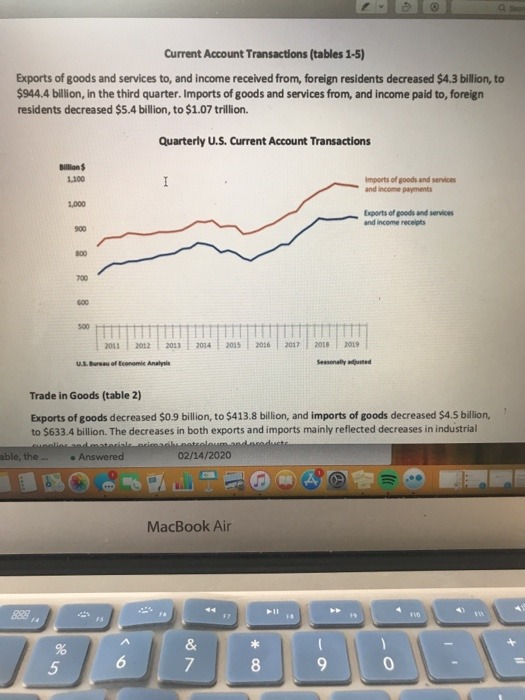

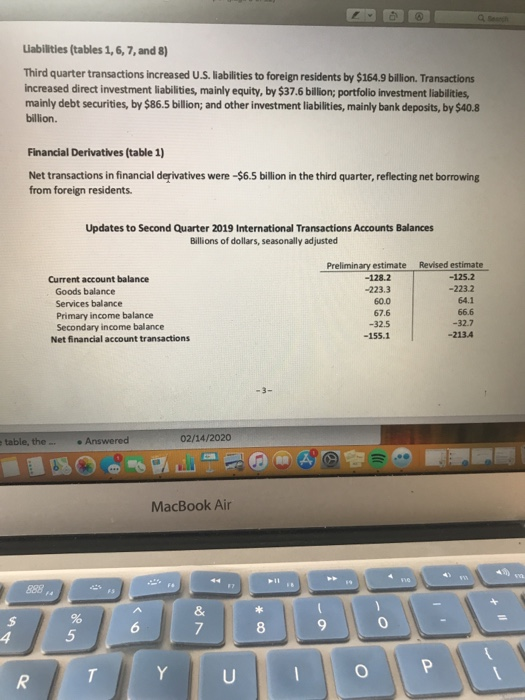

NAME 1. Using Table 1 of file trans319.pfd posted on the Canvas, for the year 2018: a. Calculate the current account balance. b. Calculate the sum of the capital and financial accounts. c. State the amount of the statistical discrepancy, d. For imports of goods and services and income payments: 1. State which is the largest component (goods, services, primary income payments or secondary income payments), and 2. The amount of that component. e. For Net U.S. acquisition of financial assets excluding financial derivatives: 1. State which is the largest component (direct investment assets, portfolio investment assets, other investment assets or reserve assets), and 2. The amount of that component Current Account Transactions (tables 1-5) Exports of goods and services to, and income received from, foreign residents decreased $4.3 billion, to $944.4 billion, in the third quarter. Imports of goods and services from, and income paid to foreign residents decreased $5.4 billion, to $1.07 trillion. Quarterly U.S. Current Account Transactions Billion $ Imports of goods and services and income payments Exports of goods and services and income receipts 500 2011 2012 2013 2014 2015 2016 2017 2018 U.S. Bureau of Economie Analysis Trade in Goods (table 2) Exports of goods decreased $0.9 billion, to $413.8 billion, and imports of goods decreased $4.5 billion to $633.4 billion. The decreases in both exports and imports mainly reflected decreases in industrial waandmateriale vaataloud able, the ... Answered 02/14/2020 MacBook Air J OOBLE trans310-1.pdf (page 2 of 22) Trade in Goods (table 2) Exports of goods decreased $0.9 billion, to $413.8 billion, and imports of goods decreased $4.5 billion, to $633.4 billion. The decreases in both exports and imports mainly reflected decreases in industrial supplies and materials, primarily petroleum and products. Trade in Services (table 3) Exports of services decreased $0.3 billion, to $212.0 billion, reflecting partly offsetting changes across major categories. Decreases were led by travel, mainly other personal travel, and increases were led by other business services, mainly professional and management consulting services. Imports of services Increased $1.6 billion, to $149.8 billion, reflecting increases in nearly all major categories. Increases were led by insurance services, mainly reinsurance. Primary Income (table 4) Receipts of primary income decreased $4.1 billion, to $282.0 billion, and payments of primary income decreased $6.2 billion, to $213.3 billion. The decreases in both receipts and payments mainly reflected decreases in direct investment income and in other investment income. Within direct investment income receipts, dividends increased $24.9 billion, to $95.3 billion, in the third quarter and remain elevated since the passage of the 2017 Tax Cuts and Jobs Act, which generally eliminated taxes on table, the Answered 02/14/2020 MacBook Air trans.319-1 dl (page 3 of 22) repatriated earnings beginning in 2018. For more information, see "How do the effects of the 2017 Trax Cuts and Jobs Act appear in BEA's direct investment statistics?" The decreases in other investment income receipts and payments mainly reflected decreases in interest on loans and deposits Secondary Income (table 5) Receipts of secondary Income increased $1.0 billion, to $36.6 billion, mainly reflecting an increase in private sector fines and penalties, a component of private transfer receipts. Payments of secondary Income increased $3.7 billion, to $72.0 billion, mainly reflecting increases in U.S. government grants and in insurance-related transfers, a component of private transfer payments. Financial Account Transactions (tables 1, 6, 7, and 8) Net financial account transactions were -$47.9 billion in the third quarter, reflecting net U.S. borrowing from foreign residents. Financial Assets (tables 1,6,7, and 8) Third quarter transactions increased U.S. residents' foreign financial assets by $1235 billion. Transactions increased direct investment assets, primarily equity, by $33.3 billion; portfolio investment assets, mainly debt securities, by $18.5 billion; other investment assets, primarily loans, by $69.9 billion and reserve assets by $1.9 billion Liabilities (tables 1, 6, 7, and 8) Third quarter transactions increased U.S. liabilities to foreign residents by $164.9 billion. Transactions increased direct investment liabilities, mainly equity, by $37.6 billion portfolio investment liabilities mainly debt securities, by $86.5 billion; and other investment liabilities, mainly bank deposits, by $40.8 me table, the Answered 02/14/2020 MacBook Air Liabilities (tables 1, 6, 7, and 8) Third quarter transactions increased U.S. llabilities to foreign residents by $164.9 billion. Transactions Increased direct investment liabilities, mainly equity, by $37.6 billion: portfolio investment liabilities mainly debt securities, by $86.5 billion; and other investment liabilities, mainly bank deposits, by $40.8 billion. Financial Derivatives (table 1) Net transactions in financial derivatives were - $6.5 billion in the third quarter, reflecting net borrowing from foreign residents. Updates to Second Quarter 2019 International Transactions Accounts Balances Billions of dollars, seasonally adjusted Current account balance Goods balance Services balance Primary income balance Secondary income balance Net financial account transactions Preliminary estimate -128.2 -223.3 60.0 67.6 -32.5 -155.1 Revised estimate -125.2 -223.2 64.1 66.6 -32.7 - 213.4 table, the Answered 02/14/2020 MacBook Air $ RTY U 10 NAME 1. Using Table 1 of file trans319.pfd posted on the Canvas, for the year 2018: a. Calculate the current account balance. b. Calculate the sum of the capital and financial accounts. c. State the amount of the statistical discrepancy, d. For imports of goods and services and income payments: 1. State which is the largest component (goods, services, primary income payments or secondary income payments), and 2. The amount of that component. e. For Net U.S. acquisition of financial assets excluding financial derivatives: 1. State which is the largest component (direct investment assets, portfolio investment assets, other investment assets or reserve assets), and 2. The amount of that component Current Account Transactions (tables 1-5) Exports of goods and services to, and income received from, foreign residents decreased $4.3 billion, to $944.4 billion, in the third quarter. Imports of goods and services from, and income paid to foreign residents decreased $5.4 billion, to $1.07 trillion. Quarterly U.S. Current Account Transactions Billion $ Imports of goods and services and income payments Exports of goods and services and income receipts 500 2011 2012 2013 2014 2015 2016 2017 2018 U.S. Bureau of Economie Analysis Trade in Goods (table 2) Exports of goods decreased $0.9 billion, to $413.8 billion, and imports of goods decreased $4.5 billion to $633.4 billion. The decreases in both exports and imports mainly reflected decreases in industrial waandmateriale vaataloud able, the ... Answered 02/14/2020 MacBook Air J OOBLE trans310-1.pdf (page 2 of 22) Trade in Goods (table 2) Exports of goods decreased $0.9 billion, to $413.8 billion, and imports of goods decreased $4.5 billion, to $633.4 billion. The decreases in both exports and imports mainly reflected decreases in industrial supplies and materials, primarily petroleum and products. Trade in Services (table 3) Exports of services decreased $0.3 billion, to $212.0 billion, reflecting partly offsetting changes across major categories. Decreases were led by travel, mainly other personal travel, and increases were led by other business services, mainly professional and management consulting services. Imports of services Increased $1.6 billion, to $149.8 billion, reflecting increases in nearly all major categories. Increases were led by insurance services, mainly reinsurance. Primary Income (table 4) Receipts of primary income decreased $4.1 billion, to $282.0 billion, and payments of primary income decreased $6.2 billion, to $213.3 billion. The decreases in both receipts and payments mainly reflected decreases in direct investment income and in other investment income. Within direct investment income receipts, dividends increased $24.9 billion, to $95.3 billion, in the third quarter and remain elevated since the passage of the 2017 Tax Cuts and Jobs Act, which generally eliminated taxes on table, the Answered 02/14/2020 MacBook Air trans.319-1 dl (page 3 of 22) repatriated earnings beginning in 2018. For more information, see "How do the effects of the 2017 Trax Cuts and Jobs Act appear in BEA's direct investment statistics?" The decreases in other investment income receipts and payments mainly reflected decreases in interest on loans and deposits Secondary Income (table 5) Receipts of secondary Income increased $1.0 billion, to $36.6 billion, mainly reflecting an increase in private sector fines and penalties, a component of private transfer receipts. Payments of secondary Income increased $3.7 billion, to $72.0 billion, mainly reflecting increases in U.S. government grants and in insurance-related transfers, a component of private transfer payments. Financial Account Transactions (tables 1, 6, 7, and 8) Net financial account transactions were -$47.9 billion in the third quarter, reflecting net U.S. borrowing from foreign residents. Financial Assets (tables 1,6,7, and 8) Third quarter transactions increased U.S. residents' foreign financial assets by $1235 billion. Transactions increased direct investment assets, primarily equity, by $33.3 billion; portfolio investment assets, mainly debt securities, by $18.5 billion; other investment assets, primarily loans, by $69.9 billion and reserve assets by $1.9 billion Liabilities (tables 1, 6, 7, and 8) Third quarter transactions increased U.S. liabilities to foreign residents by $164.9 billion. Transactions increased direct investment liabilities, mainly equity, by $37.6 billion portfolio investment liabilities mainly debt securities, by $86.5 billion; and other investment liabilities, mainly bank deposits, by $40.8 me table, the Answered 02/14/2020 MacBook Air Liabilities (tables 1, 6, 7, and 8) Third quarter transactions increased U.S. llabilities to foreign residents by $164.9 billion. Transactions Increased direct investment liabilities, mainly equity, by $37.6 billion: portfolio investment liabilities mainly debt securities, by $86.5 billion; and other investment liabilities, mainly bank deposits, by $40.8 billion. Financial Derivatives (table 1) Net transactions in financial derivatives were - $6.5 billion in the third quarter, reflecting net borrowing from foreign residents. Updates to Second Quarter 2019 International Transactions Accounts Balances Billions of dollars, seasonally adjusted Current account balance Goods balance Services balance Primary income balance Secondary income balance Net financial account transactions Preliminary estimate -128.2 -223.3 60.0 67.6 -32.5 -155.1 Revised estimate -125.2 -223.2 64.1 66.6 -32.7 - 213.4 table, the Answered 02/14/2020 MacBook Air $ RTY U 10