Answered step by step

Verified Expert Solution

Question

1 Approved Answer

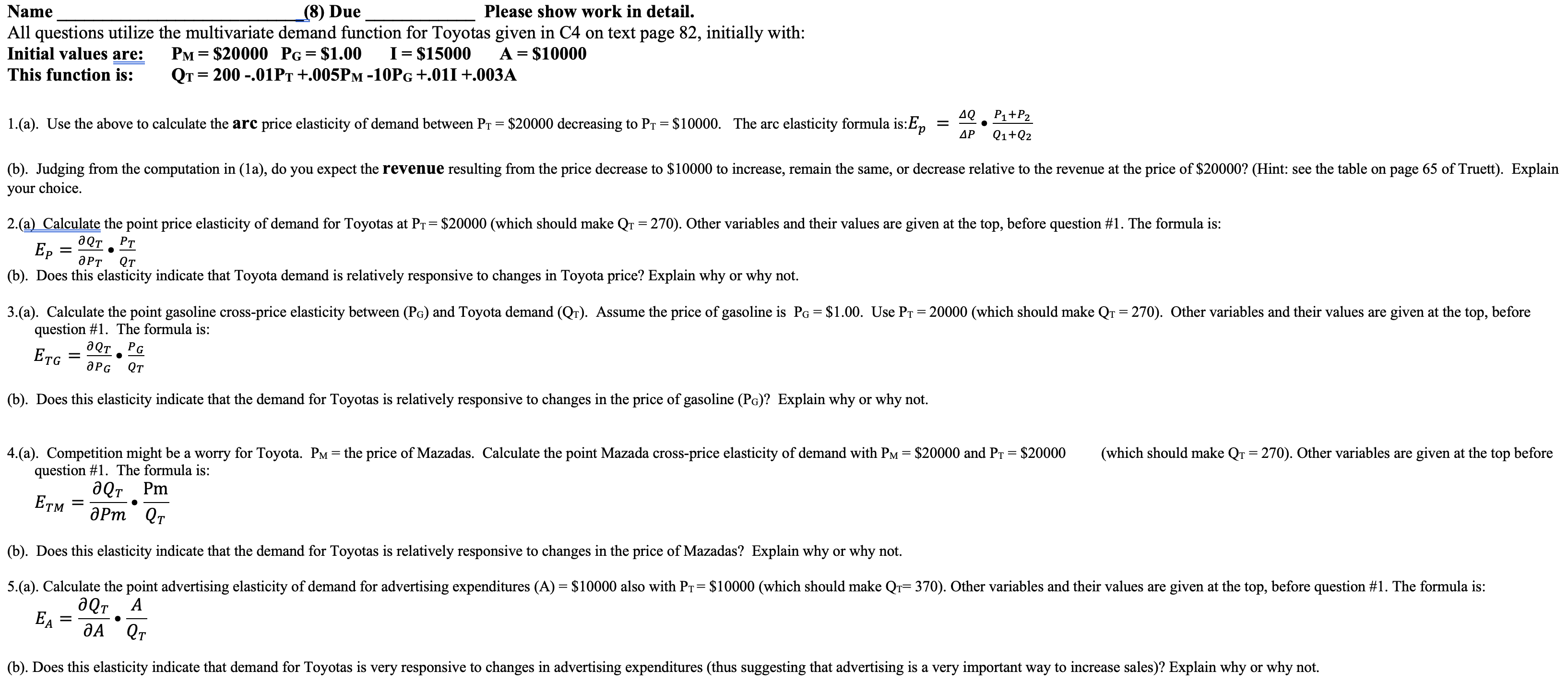

Name ( 8 ) Due Please show work in detail. All questions utilize the multivariate demand function for Toyotas given in C 4 on text

Name

Due

Please show work in detail.

All questions utilize the multivariate demand function for Toyotas given in C on text page initially with:

Initial values are: $$$$

This function is:

a Use the above to calculate the arc price elasticity of demand between $ decreasing to $ The arc elasticity formula is:

b Judging from the computation in a do you expect the revenue resulting from the price decrease to $ to increase, remain the same, or decrease relative to the revenue at the price of $Hint: see the table on page of Truett Explain

your choice.

a Calculate the point price elasticity of demand for Toyotas at $which should make Other variables and their values are given at the top, before question # The formula is:

b Does this elasticity indicate that Toyota demand is relatively responsive to changes in Toyota price? Explain why or why not.

a Calculate the point gasoline crossprice elasticity between and Toyota demand Assume the price of gasoline is $ Use which should make Other variables and their values are given at the top, before

question # The formula is:

b Does this elasticity indicate that the demand for Toyotas is relatively responsive to changes in the price of gasoline Explain why or why not.

a Competition might be a worry for Toyota. the price of Mazadas. Calculate the point Mazada crossprice elasticity of demand with $ and $

which should make Other variables are given at the top before

question # The formula is:

b Does this elasticity indicate that the demand for Toyotas is relatively responsive to changes in the price of Mazadas? Explain why or why not.

a Calculate the point advertising elasticity of demand for advertising expenditures $ also with $which should make Other variables and their values are given at the top, before question # The formula is:

b Does this elasticity indicate that demand for Toyotas is very responsive to changes in advertising expenditures thus suggesting that advertising is a very important way to increase sales Explain why or why not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started