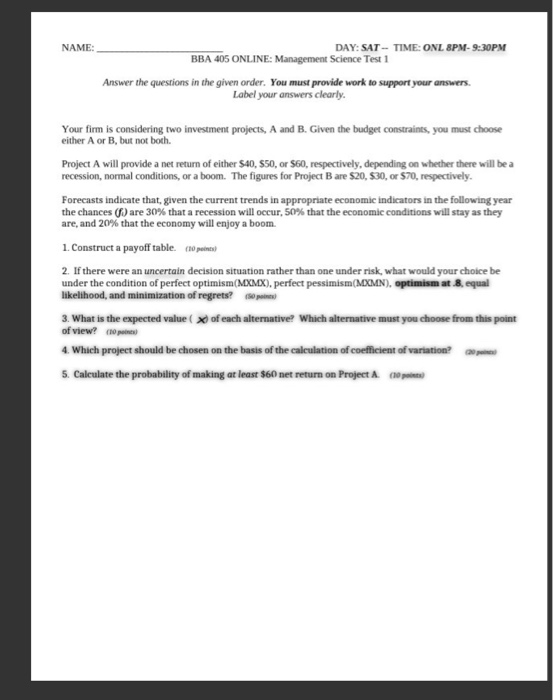

NAME: DAY: SAT - TIME: ONL 8PM - 9:30PM BBA 405 ONLINE: Management Science Test 1 Answer the questions in the given order. You must provide work to support your answers. Label your answers clearly. Your firm is considering two investment projects, A and B. Given the budget constraints, you must choose either A or B, but not both Project A will provide a net return of either 540, 550, or $60, respectively, depending on whether there will be a recession, normal conditions, or a boom. The figures for Project B are $20, 530, or $70, respectively. Forecasts indicate that, given the current trends in appropriate economic indicators in the following year the chances (f) are 30% that a recession will occur, 50% that the economic conditions will stay as they are, and 20% that the economy will enjoy a boom. 1. Construct a payoff table. 10 points) 2. If there were an uncertain decision situation rather than one under risk, what would your choice be under the condition of perfect optimism(MXMX), perfect pessimism(MXMN), optimism at 8, equal likelihood, and minimization of regrets? Opines 3. What is the expected value ( xof each alternative? Which alternative must you choose from this point of view? 10 4. Which project should be chosen on the basis of the calculation of coefficient of variation? 5. Calculate the probability of making at least $60 net return on Project A. NAME: DAY: SAT - TIME: ONL 8PM - 9:30PM BBA 405 ONLINE: Management Science Test 1 Answer the questions in the given order. You must provide work to support your answers. Label your answers clearly. Your firm is considering two investment projects, A and B. Given the budget constraints, you must choose either A or B, but not both Project A will provide a net return of either 540, 550, or $60, respectively, depending on whether there will be a recession, normal conditions, or a boom. The figures for Project B are $20, 530, or $70, respectively. Forecasts indicate that, given the current trends in appropriate economic indicators in the following year the chances (f) are 30% that a recession will occur, 50% that the economic conditions will stay as they are, and 20% that the economy will enjoy a boom. 1. Construct a payoff table. 10 points) 2. If there were an uncertain decision situation rather than one under risk, what would your choice be under the condition of perfect optimism(MXMX), perfect pessimism(MXMN), optimism at 8, equal likelihood, and minimization of regrets? Opines 3. What is the expected value ( xof each alternative? Which alternative must you choose from this point of view? 10 4. Which project should be chosen on the basis of the calculation of coefficient of variation? 5. Calculate the probability of making at least $60 net return on Project A