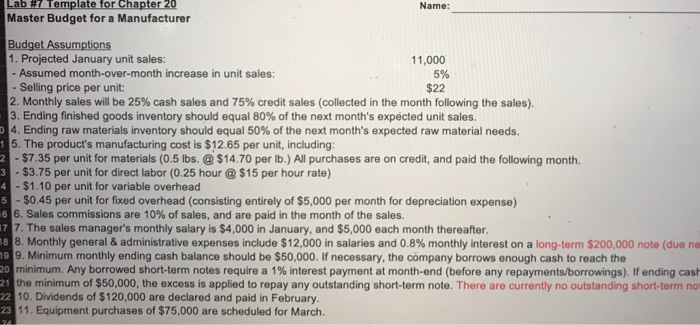

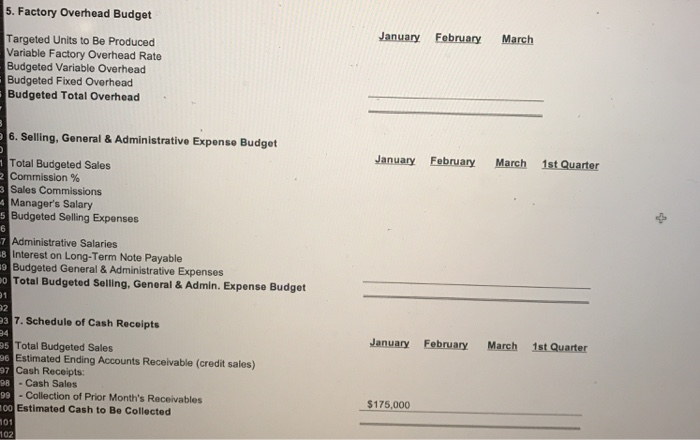

Name: Lab #7 Template for Chapter 20 Master Budget for a Manufacturer 5% Budget Assumptions 1. Projected January unit sales: 11,000 - Assumed month-over-month increase in unit sales: - Selling price per unit: $22 2. Monthly sales will be 25% cash sales and 75% credit sales (collected in the month following the sales). 3. Ending finished goods inventory should equal 80% of the next month's expected unit sales. 4. Ending raw materials inventory should equal 50% of the next month's expected raw material needs. 15. The product's manufacturing cost is $12.65 per unit, including: 2 - $7.35 per unit for materials (0.5 lbs. @ $14.70 per lb.) All purchases are on credit, and paid the following month. 3 - $3.75 per unit for direct labor (0.25 hour @ $15 per hour rate) 1 - $1.10 per unit for variable overhead 5 - $0.45 per unit for fixed overhead (consisting entirely of $5,000 per month for depreciation expense) 6. Sales commissions are 10% of sales, and are paid in the month of the sales. 7 7. The sales manager's monthly salary is $4,000 in January, and $5,000 each month thereafter 8. Monthly general & administrative expenses include $12,000 in salaries and 0.8% monthly interest on a long-term $200.000 note (due ne 9. Minimum monthly ending cash balance should be $50,000. If necessary, the company borrows enough cash to reach the minimum. Any borrowed short-term notes require a 1% interest payment at month-end (before any repayments/borrowings). If ending cast 21 the minimum of $50,000, the excess is applied to repay any outstanding short-term note. There are currently no outstanding short-term no 22 10. Dividends of $120,000 are declared and paid in February 11. Equipment purchases of $75,000 are scheduled for March. 5. Factory Overhead Budget January February March Targeted Units to Be Produced Variable Factory Overhead Rate Budgeted Variable Overhead Budgeted Fixed Overhead Budgeted Total Overhead 6. Selling, General & Administrative Expense Budget January February March 1st Quarter Total Budgeted Sales 2 Commission % 3 Sales Commissions 4 Manager's Salary 5 Budgeted Selling Expenses Administrative Salaries Interest on Long-Term Note Payable Budgeted General & Administrative Expenses Total Budgeted Selling, General & Admin Expense Budget 7. Schedule of Cash Receipts January February March 1st Quarter 5 Total Budgeted Sales 16 Estimated Ending Accounts Receivable (credit sales) Cash Receipts: 28 - Cash Sales 29 - Collection of Prior Month's Receivables 00 Estimated Cash to Be Collected $175,000