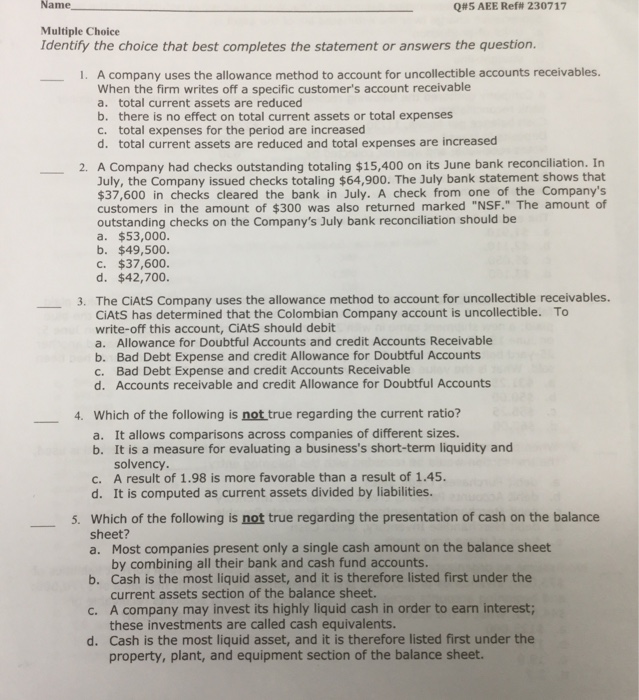

Name Q#5 AEE Ref# 230717 Multiple Choice Identify the choice that best completes the statement or answers the question A company uses the allowance method to account for uncollectible accounts receivables. When the firm writes off a specific customer's account receivab a. total current assets are reduced b. there is no effect on total current assets or total expenses c. total expenses for the period are increased d. total current assets are reduced and total expenses are increased I. 2. A Company had checks outstanding totaling $15,400 on its June bank reconciliation. In July, the Company issued checks totaling $64,900. The July bank statement shows that $37,600 in checks cleared the bank in July. A check from one of the Company's customers in the amount of $300 was also returned marked "NSF." The amount of outstanding checks on the Company's July bank reconciliation should be a. $53,000 b. $49,500 C. $37,600 d. $42,700. 3. The CiAtS Company uses the allowance method to account for uncollectible receivables. CiAtS has determined that the Colombian Company account is uncollectible. To write-off this account, CiAtS should debit a. Allowance for Doubtful Accounts and credit Accounts Receivable b. Bad Debt Expense and credit Allowance for Doubtful Accounts c. Bad Debt Expense and credit Accounts Receivable d. Accounts receivable and credit Allowance for Doubtful Accounts 4. Which of the following is not true regarding the current ratio? a. It allows comparisons across companies of different sizes. b. It is a measure for evaluating a business's short-term liquidity and solvency c. A result of 1.98 is more favorable than a result of 1.45. d. It is computed as current assets divided by liabilities. Which of the following is not true regarding the presentation of cash on the balance sheet? a. Most companies present only a single cash amount on the balance sheet by combining all their bank and cash fund accounts Cash is the most liquid asset, and it is therefore listed first under the current assets section of the balance sheet. A company may invest its highly liquid cash in order to earn interest these investments are called cash equivalents. Cash is the most liquid asset, and it is therefore listed first under the property, plant, and equipment section of the balance sheet. b. d