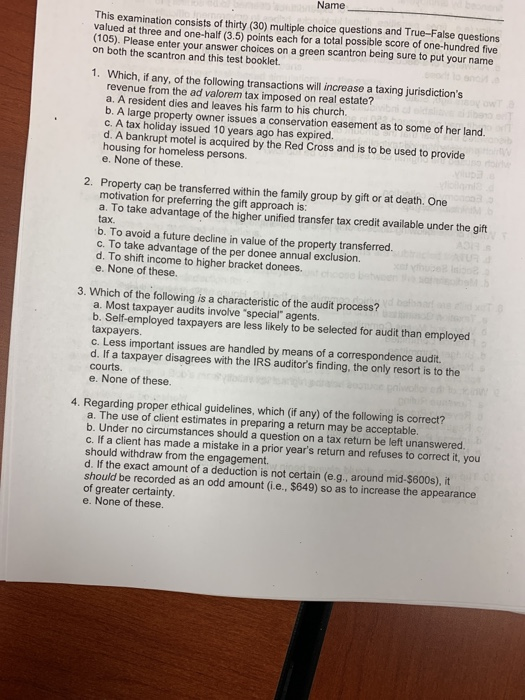

Name This examination consists of thirty (30) multiple choice questions and True-False questions valued at three and one-half (3.5) points each for a total possible score of one-hundred five (105). Please enter your answer choices on a green scantron being sure to put your name on both the scantron and this test booklet 1. Which, if any, of the following transactions will increase a taxing jurisdiction's revenue from the ad valorem tax imposed on real estate? a. A resident dies and leaves his farm to his church b. A large property owner issues a conservation easement as to some of her land c. A tax holiday issued 10 years ago has expired. d. A bankrupt motel is acquired by the Red Cross and is to be used to provide housing for homeless persons. e. None of these. 2. Property can be transferred within the family group by gift or at death. One motivation for preferring the gift approach is: a. To take advantage of the higher unified transfer tax credit available under the gift tax b. To avoid a future decline in value of the property transferred. c. To take advantage of the per donee annual exclusion. d. To shift income to higher bracket donees. e. None of these. 3. Which of the following is a characteristic of the audit process? a. Most taxpayer audits involve "special" agents. b. Self-employed taxpayers are less likely to be selected for audit than employed taxpayers c. Less important issues are handled by means of a correspondence audit. d. If a taxpayer disagrees with the IRS auditor's finding, the only resort is to the courts e. None of these. 4. Regarding proper ethical guidelines, which (if any) of the following is correct? a. The use of client estimates in preparing a return may be acceptable b. Under no circumstances should a question on a tax return be left unanswered. c. If a client has made a mistake in a prior year's return and refuses to correct it, you should withdraw from the engagement. d. If the exact amount of a deduction is not certain (e.g., around mid-$600s), it should be recorded as an odd amount (i.e., $649) so as to increase the appearance of greater certainty e. None of these