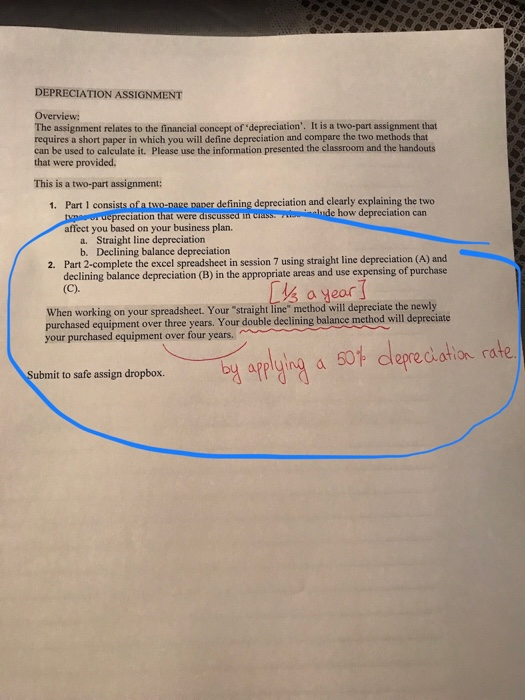

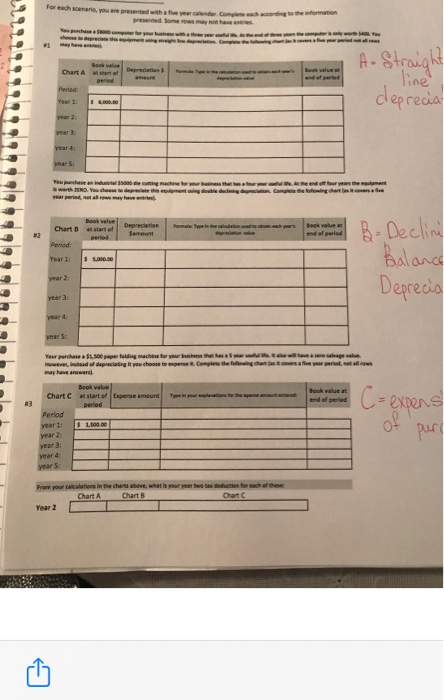

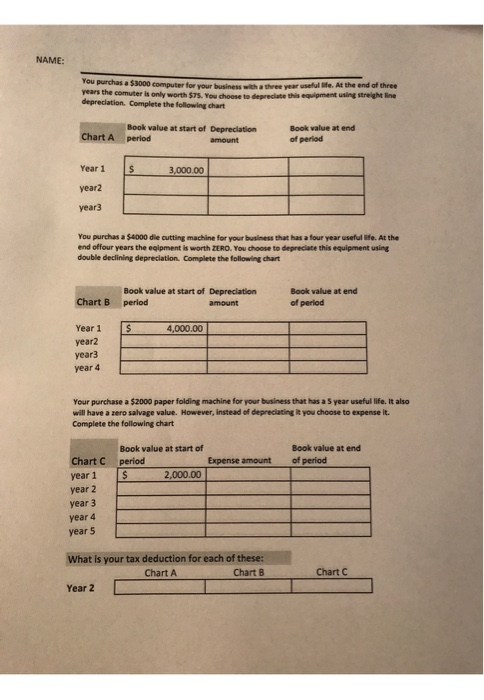

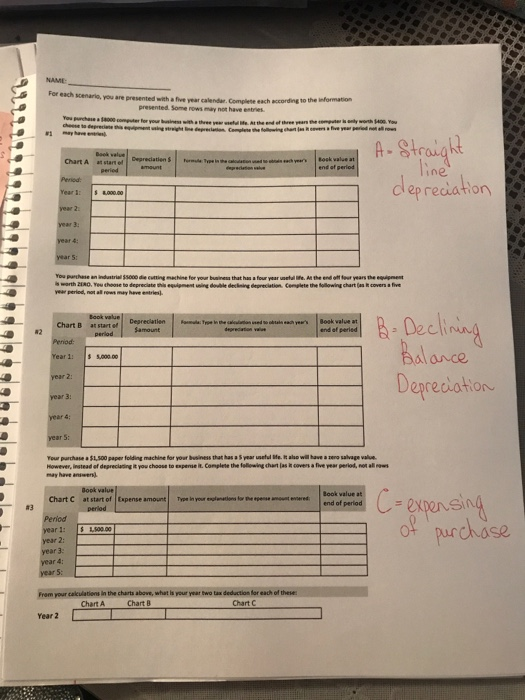

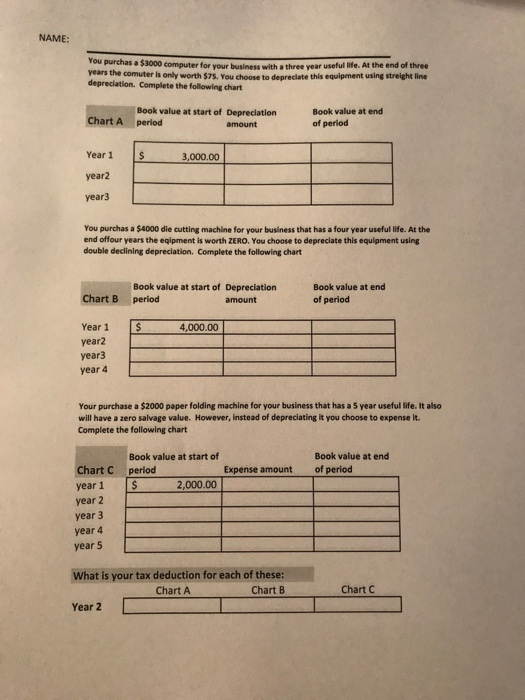

NAME: Tou purchas a $3000 computer for your business with a three year useful ife. At the end af three years the comuter is only worth $75, You choose to depreciate this equipment using streight ine depreciation. Complete the following chart Book value at start of Depreciation period Book value at end Chart A of period amount Year 1 3,000.00 year2 year3 You purchas a $4000 die cutting machine for your business that has a four year useful ife. At the end offour years the egipment is worth 2ERO. You choose to depreciate this equipment using double declining depreciation. Complete the following chart Book value at start of Depreciation period Book value at end Chart B of period amount Year 1 4,000.00 year2 year3 year 4 Your purchase a $2000 paper folding machine for your business that has a 5 year useful life. It also will have a zero salvage value. However, instead of depreciating it you choose to expense it. Complete the following chart Book value at end Book value at start of Chart C Expense amount of period period 2,000.00 year 1 year 2 year 3 year 4 year 5 What is your tax deduction for each of these: Chart B Chart C Chart A Year 2 NAME For each scenario, you are presented with a five year calendar. Complete each according to the information presented. Some rows may not have entries You punchase a 000 omputer fer your business wmthree ear td ts Athe end f tee years the omputer ny wonth 400 You cheese to depreciane ha equipmet ing srighte deprecianion Cemplete he foing chan es a five year peried not all rows may have n A-Straight Book value at start ef Depreiatien ine Book value at Formule Type in the caloation ed se ebn ach year depecdaton e Chart A end of period amount peried deprediation Period Year 1 s 000.00 year 2 year 3 year 4 year 5 You purchase an lndustrial $5000 die cuting machine for your buainess that has a four year uneful lfe. At the end oft feur years the equipment is worth 2RO. Yeu choose to depreciate this equipment uing double decining depreciation Comglete the following chart (an t covers a five year peried, not all rows may heve entries) 8-Oucliring Balance Book value Book value at end of peried Depreclatien Samount Famula: Type in the callaton sed o obtals eah year's depredation val Chart B at start of perlod #2 Period S 5,000.00 Year 1: Degreciation year 2 year 3 year 4 year 5: Your purchase a $1,500 paper folding machine for your business that has a 5 year useful Me. t also will have a zeng salvage value However, instead of depreciating it you choose to expense it. Complete the following chart (as it covers a five year period, not all rows may have answer Book value at start of Expense amount perlod C-eueneing purchase Book value at end of period Chart C Type in your explanations for the epese amount evered #3 Period $L500.00 year 1s year 2: year 3 year 4 year 5 From your calculations in the charts above, what is your year two taa deduction for each of these Chart A Chart B Chart C Year 2 NAME: You purchas a $3000 computer for your business with a three year useful life. At the end of three years the comuter is only worth $75. You choose to depreciate this equipment using streight line depreciation. Complete the following chart Book value at start of Depreciation period Book value at end Chart A of period amount Year 1 3,000.00 year2 year3 You purchas a $4000 die cutting machine for your business that has a four year useful life. At the end offour years the eqipment is worth ZERO. You choose to depreciate this equipment using double declining depreciation. Complete the following chart Book value at start of Depreciation Book value at end Chart B period amount of period Year 1 4,000.00 year2 year3 year 4 Your purchase a $2000 paper folding machine for your business that has a 5 year useful life. It also will have a zero salvage value. However, instead of depreciating it you choose to expense it. Complete the following chart Book value at start of Book value at end Expense amount of period Chart C period $ 2,000.00 year 1 year 2 year 3 year 4 year 5 What is your tax deduction for each of these: Chart C Chart A Chart B Year 2