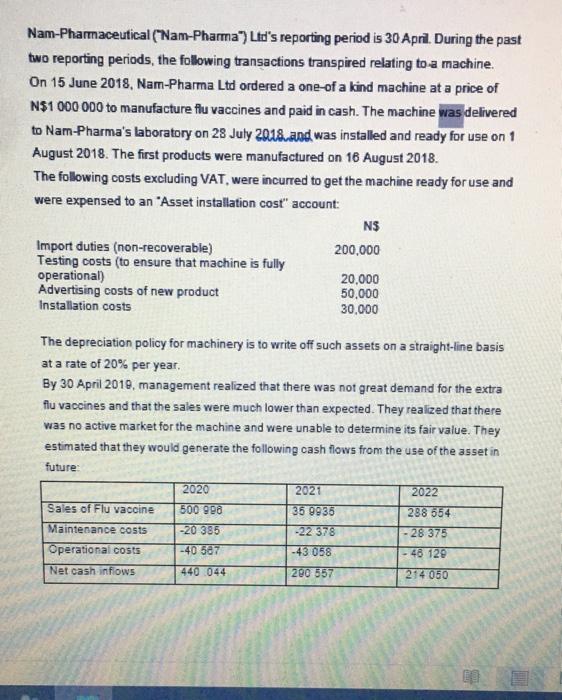

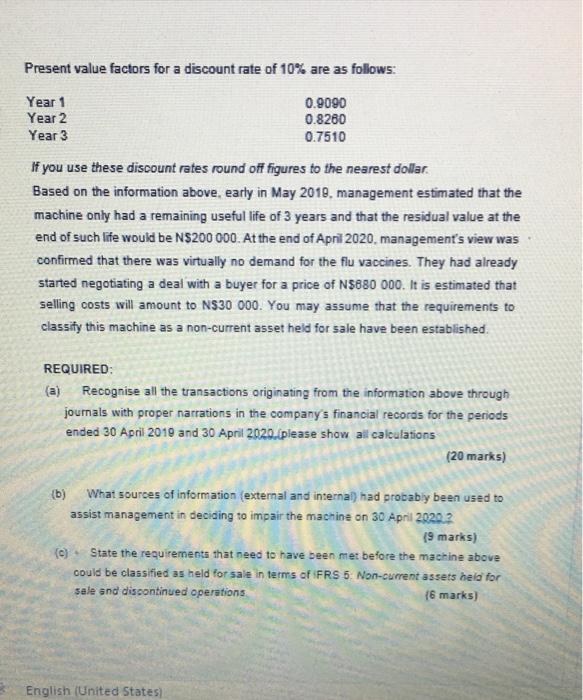

Nam-Pharmaceutical ("Nam-Pharma") Lid's reporting period is 30 April. During the past two reporting periods, the following transactions transpired relating to a machine. On 15 June 2018, Nam-Pharma Ltd ordered a one of a kind machine at a price of N$1 000 000 to manufacture flu vaccines and paid in cash. The machine was delivered to Nam-Pharma's laboratory on 28 July 2018, and was installed and ready for use on 1 August 2018. The first products were manufactured on 18 August 2018. The following costs excluding VAT, were incurred to get the machine ready for use and were expensed to an "Asset installation cost" account: N$ 200,000 Import duties (non-recoverable) Testing costs (to ensure that machine is fully operational) Advertising costs of new product Installation costs 20,000 50,000 30,000 The depreciation policy for machinery is to write off such assets on a straight-line basis at a rate of 20% per year. By 30 April 2019, management realized that there was not great demand for the extra flu vaccines and that the sales were much lower than expected. They realized that there was no active market for the machine and were unable to determine its fair value. They estimated that they would generate the following cash flows from the use of the asset in future 2020 2021 2022 Sales of Flu vaccine 500 990 35 9936 288 654 Maintenance costs -20 385 -22 378 - 28 375 Operational costs -40 587 -43 058 - 46 120 Net cash infows 440 044 200 557 214050 Present value factors for a discount rate of 10% are as follows: Year 1 Year 2 Year 3 0.9090 0.8260 0.7510 If you use these discount rates round off figures to the nearest dollar. Based on the information above, early in May 2010. management estimated that the machine only had a remaining useful life of 3 years and that the residual value at the end of such life would be N$200 000. At the end of Apni 2020, management's view was confirmed that there was virtually no demand for the flu vaccines. They had already started negotiating a deal with a buyer for a price of N$880 000. It is estimated that selling costs will amount to N$30 000. You may assume that the requirements to classify this machine as a non-current asset held for sale have been established. REQUIRED: (a) Recognise all the transactions originating from the information above through journals with proper narrations in the company's financial records for the periods ended 30 April 2010 and 30 April 2020. please show all calculations (20 marks) {b) What sources of information (external and internal) had probably been used to assist management in deciding to impair the machine on 30 April 2020.2 19 marks) (0) State the requirements that need to have been mer before the machine above could be classified as held for sale in terms of IFRS 5. Non-current assets held for sale and discontinued operations {6 marks) English (United States) Nam-Pharmaceutical ("Nam-Pharma") Lid's reporting period is 30 April. During the past two reporting periods, the following transactions transpired relating to a machine. On 15 June 2018, Nam-Pharma Ltd ordered a one of a kind machine at a price of N$1 000 000 to manufacture flu vaccines and paid in cash. The machine was delivered to Nam-Pharma's laboratory on 28 July 2018, and was installed and ready for use on 1 August 2018. The first products were manufactured on 18 August 2018. The following costs excluding VAT, were incurred to get the machine ready for use and were expensed to an "Asset installation cost" account: N$ 200,000 Import duties (non-recoverable) Testing costs (to ensure that machine is fully operational) Advertising costs of new product Installation costs 20,000 50,000 30,000 The depreciation policy for machinery is to write off such assets on a straight-line basis at a rate of 20% per year. By 30 April 2019, management realized that there was not great demand for the extra flu vaccines and that the sales were much lower than expected. They realized that there was no active market for the machine and were unable to determine its fair value. They estimated that they would generate the following cash flows from the use of the asset in future 2020 2021 2022 Sales of Flu vaccine 500 990 35 9936 288 654 Maintenance costs -20 385 -22 378 - 28 375 Operational costs -40 587 -43 058 - 46 120 Net cash infows 440 044 200 557 214050 Present value factors for a discount rate of 10% are as follows: Year 1 Year 2 Year 3 0.9090 0.8260 0.7510 If you use these discount rates round off figures to the nearest dollar. Based on the information above, early in May 2010. management estimated that the machine only had a remaining useful life of 3 years and that the residual value at the end of such life would be N$200 000. At the end of Apni 2020, management's view was confirmed that there was virtually no demand for the flu vaccines. They had already started negotiating a deal with a buyer for a price of N$880 000. It is estimated that selling costs will amount to N$30 000. You may assume that the requirements to classify this machine as a non-current asset held for sale have been established. REQUIRED: (a) Recognise all the transactions originating from the information above through journals with proper narrations in the company's financial records for the periods ended 30 April 2010 and 30 April 2020. please show all calculations (20 marks) {b) What sources of information (external and internal) had probably been used to assist management in deciding to impair the machine on 30 April 2020.2 19 marks) (0) State the requirements that need to have been mer before the machine above could be classified as held for sale in terms of IFRS 5. Non-current assets held for sale and discontinued operations {6 marks) English (United States)