Question

Nancy Corporation Income Statement For the Year Ended December 31, 1988 Sales (20,000) P300,000 Less Cost of Goods Sold 180,000 Gross Income P120,000 Less Selling

Nancy Corporation Income Statement For the Year Ended December 31, 1988

Sales (20,000) P300,000 Less Cost of Goods Sold 180,000 Gross Income P120,000 Less Selling Administrative Exp. 80,000 Operating Income 40,000

Other Data: - 1/3 of the cost of goods sold is fixed. -75% of the selling and administrative expenses is variable.

Required: Based on the above income statement and other data, determine the following: a. Total fixed cost b. Variable cost per unit and variable cost radio. c. Contribution margin per unit and contribution margin ration d. Break-even point in units and pesos e. Margin of safety in units and pesos f. Margin of safety ration ration and break-even sales ration g. Required sales in units and in pesos if the company desires to earn operating income of P60,000. h.Required sales in units and in pesos if the company wants to earn profit of 20% of sales. i. Assuming that the tax rate is 35%, the required sales in units and in pesos if the company projects income after tax of P65,000. j.The profit ratio for the year ended December 31,1988

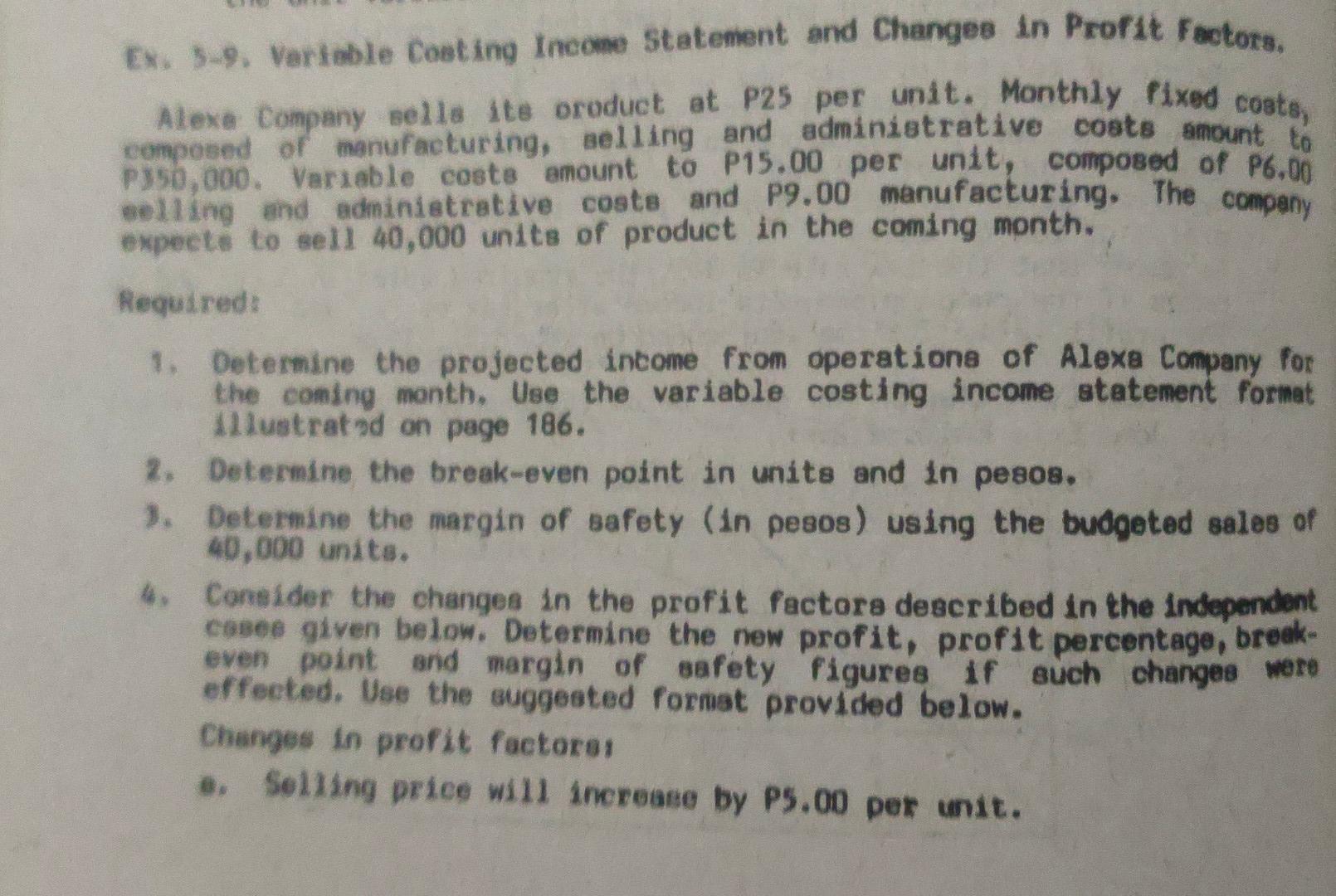

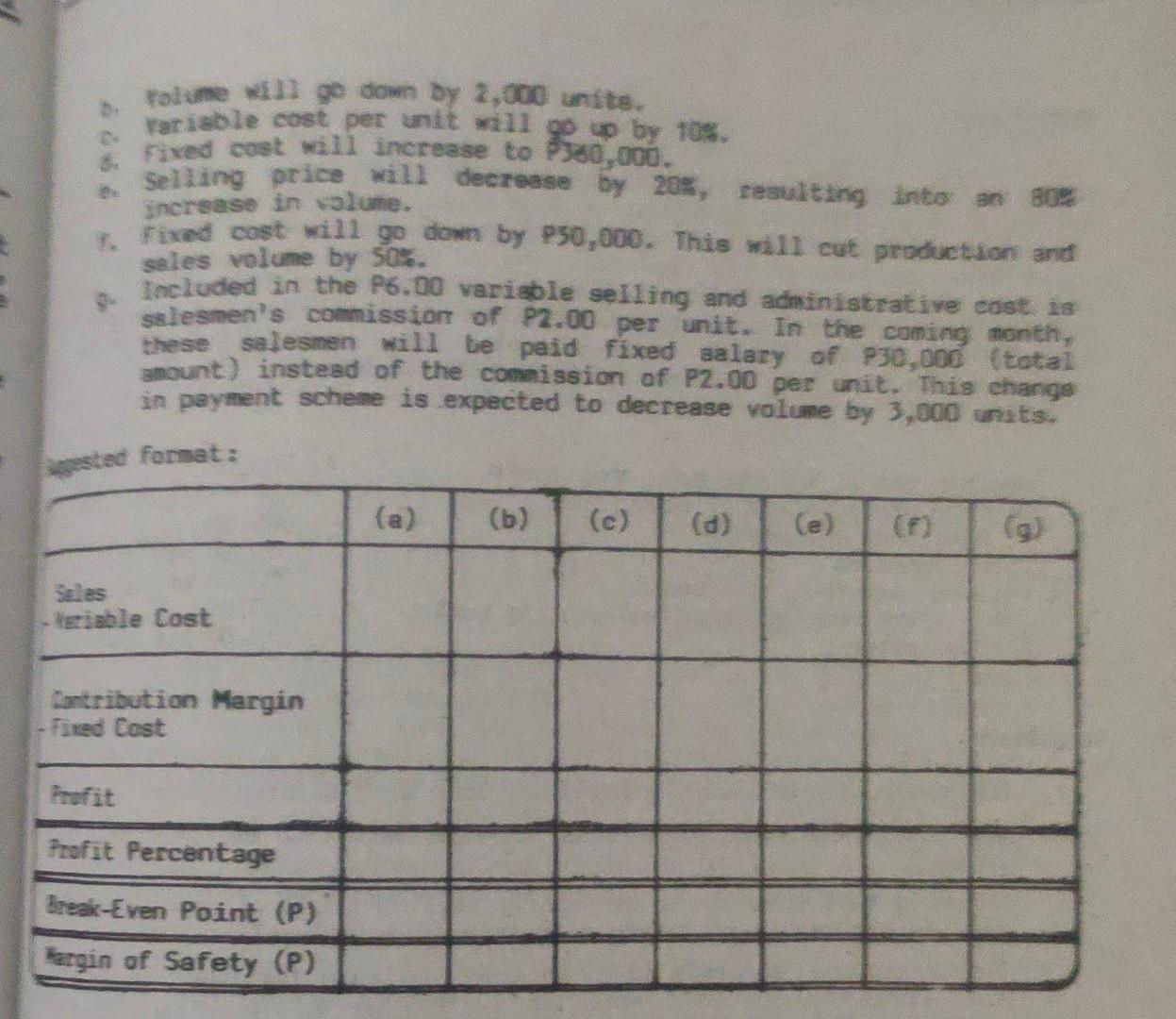

Ex. 5-9. Variable Coeting Incone Statenent and Changes in Profit Factors. Alexe Company sells ite oroduct at P25 per unit. Monthly fixed costs, composed of manufacturing, selling and administrative costs anount to P350,000. Varable costs amount to P15.00 per unit, composed of P6,00 exiling and administrative costs and p9.00 manufacturing. The company Required: 1. Determine the projected income from operations of Alexa Conpany for the coming month. Use the variable costing income statenent format 11 ustratnd on page 186 . 2. Determine the break-even point in units and in pesos. 3. Detemine the margin of Bafety (in pesos) using the budgoted sales of 40,000 units. 4. Consider the changes in the profit factors described in the independent casee given below, Determine the new profit, profit percentage, breekeven point and margin of safety figures if such changes were effeeted. Use the suggested format provided below. Changes in profit factores -. Selling price will increase by P5,00 per unit. 8. Folide will go down by 2,000 unite. a. Farable cost per unit will go ap by tom. 6. Fived cost mall increase to p300,000. b. Seliing price will decrsase by 20%, resulting into an gha: increase in valume. f. Fraed cost will go down by P50,000. This will cut production and seles volune by 50%. 9. Included in the P6.00 variable selling and administrative cost is salesmen's commission of P2.00 per unit. In the coming month, these salesmen will te peid fixed aalary of p30,000 (total amount) instead of the commission of P2.00 per unit. This changs in payment schene is expected to decrease volume by 3,000 units. mosted format: \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & (a) & (b) & (c) & (d) & (e) & (f) & (g) \\ \hline Seles keriable Cast & & & & & & \\ \hline Cantribution Margin - Fired Cost & & & & & & & \\ \hline Profit & & & & & & & \\ \hline Profit Percentage & & & & & & & \\ \hline \hline Break-Even Point (P) & & & & & & & \\ \hline Kargin of Safety (P) & & & & & & \\ \hline \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started