Question

TAX RESEARCH MEMORANDUM: HAWAIIAN MEMORIES INC. Prepare a memorandum to the tax manager outlining the information you found in your research. Follow the examples of

TAX RESEARCH MEMORANDUM: HAWAIIAN MEMORIES INC.

-

Prepare a memorandum to the tax manager outlining the information you found in your research.

-

Follow the examples of file memoranda using the formatted Word document included. Format the memo to include:

o Restatement of Facts (paraphrase) o Identify at least three main issues based on these facts o Provide a conclusion for each issue o Include the analysis that led you to the conclusion for each issue. This analysis should refer to the primary authority that best addresses the issue. o Primary authority would include items such as the Internal Revenue Code, Regulations, Court Cases, etc. These also should be paraphrased to highlight your understanding of the primary authority and how it relates specifically to the issue. IRS Publications and Tax Topics are NOT considered primary authority for this assignment.

Please provide AT LEAST 3 ISSUES and give an in depth analysis and conclusion of each.

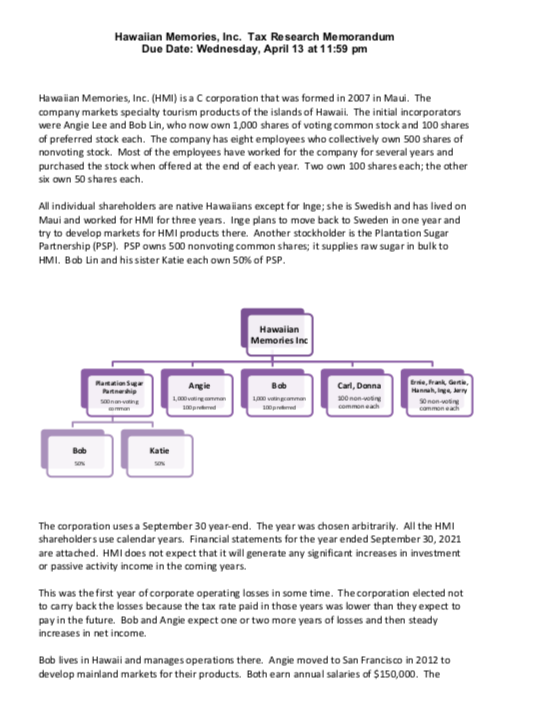

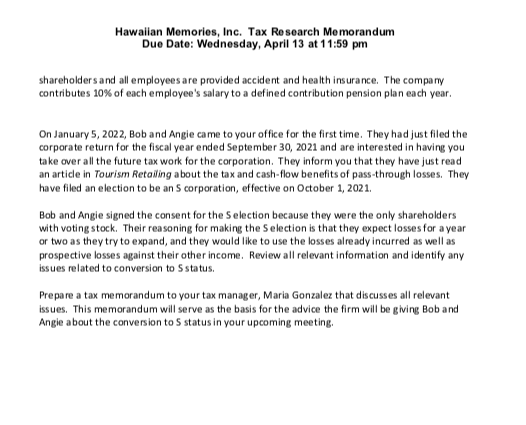

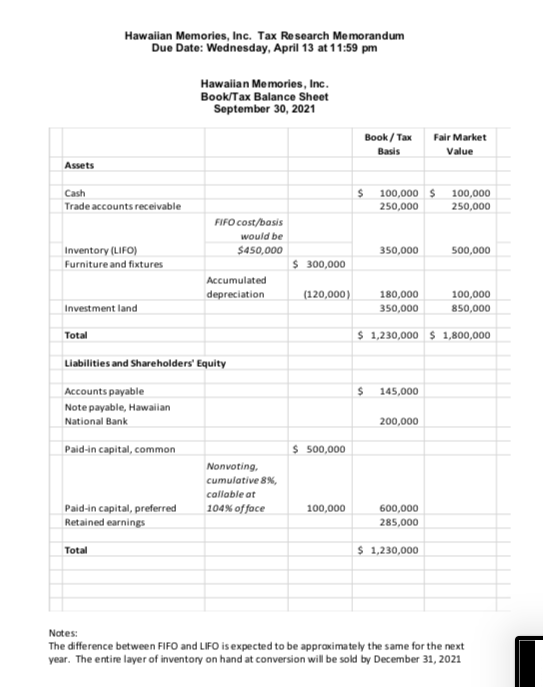

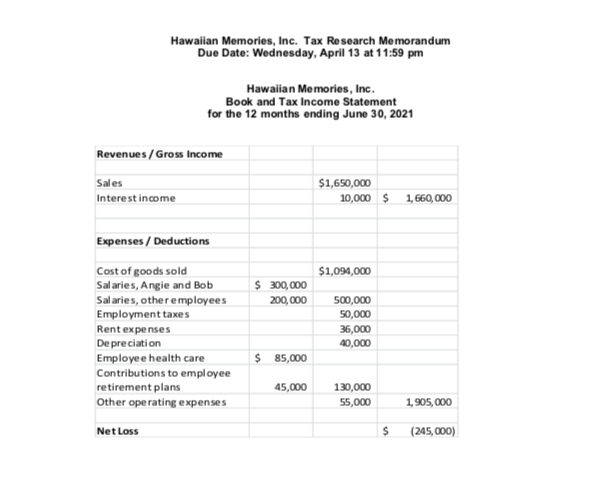

Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Hawaiian Memories, Inc. (HMI) is a C corporation that was formed in 2007 in Maui. The company markets specialty tourism products of the islands of Hawaii. The initial incorporators were Angie Lee and Bob Lin, who now own 1,000 shares of voting common stock and 100 shares of preferred stock each. The company has eight employees who collectively own 500 shares of nonvoting stock. Most of the employees have worked for the company for several years and purchased the stock when offered at the end of each year. Two own 100 shares each; the other six own 50 shares each All individual shareholders are native Hawaiians except for Inge; she is Swedish and has lived on Maui and worked for HMI for three years. Inge plans to move back to Sweden in one year and try to develop markets for HMI products there. Another stockholder is the Plantation Sugar Partnership (PSP). PSP owns 500 nonvoting common shares; it supplies raw sugar in bulk to HMI. Bob Lin and his sister Katie each own 50% of PSP. Hawaiian Memories Inc Marios Partneri Bab Carl, Donna no como Bre, franke, Henna, So non mone pred pred The corporation uses a September 30 year-end. The year was chosen arbitrarily. All the HMI shareholders use calendar years. Financial statements for the year ended September 30, 2021 are attached. HMI does not expect that it will generate any significant increases in investment or passive activity income in the coming years. This was the first year of corporate operating losses in some time. The corporation elected not to carry back the losses because the tax rate paid in those years was lower than they expect to pay in the future. Bob and Angie expect one or two more years of losses and then steady increases in net income. Bob lives in Hawaii and manages operations there. Angie moved to San Francisco in 2012 to develop mainland markets for their products. Both earn annual salaries of $150,000. The Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm shareholders and all employees are provided accident and health insurance. The company contributes 10% of each employee's salary to a defined contribution pension plan each year. On January 5, 2022, Bob and Angie came to your office for the first time. They had just filed the corporate return for the fiscal year ended September 30, 2021 and are interested in having you take over all the future tax work for the corporation. They inform you that they have just read an article in Tourism Retailing about the tax and cash-flow benefits of pass-through losses. They have filed an election to be an corporation, effective on October 1, 2021. Bob and Angie signed the consent for the selection because they were the only shareholders with voting stock. Their reasoning for making the Selection is that they expect losses for a year or two as they try to expand, and they would like to use the losses already incurred as well as prospective losses against their other income. Review all relevant information and identify any issues related to conversion to status. Prepare a tax memorandum to your tax manager, Maria Gonzalez that discusses all relevant issues. This memorandum will serve as the basis for the advice the firm will be giving Bob and Angie about the conversion to status in your upcoming meeting, Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Hawaiian Memories, Inc. Book/Tax Balance Sheet September 30, 2021 Book / Tax Basis Fair Market Value Assets $ Cash Trade accounts receivable 100,000 $ 250,000 100,000 250,000 FIFO cost/bosis would be $450,000 350,000 500,000 Inventory (LIFO) Furniture and fixtures $ 300,000 Accumulated depreciation (120,000) 180,000 350,000 100,000 850,000 Investment land Total $ 1,230,000 $ 1,800,000 Liabilities and Shareholders' Equity $ 145,000 Accounts payable Note payable, Hawaiian National Bank Paid-in capital, common 200,000 $ 500,000 Nonvoting, cumulative 8%, callable at 104% of foce Paid-in capital, preferred Retained earnings 100,000 600,000 285,000 Total $ 1,230,000 Notes: The difference between FIFO and LIFO is expected to be approximately the same for the next year. The entire layer of inventory on hand at conversion will be sold by December 31, 2021 Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Memories' balance in Earnings and Profits is $300,000. Current E&P for the year ended September 30, 2021 was $0. Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Hawaiian Memories, Inc. Book and Tax Income Statement for the 12 months ending June 30, 2021 Revenues / Gross Income Sales Interest income $1,650,000 10,000 $ 1,660,000 $1,094,000 $ 300,000 200,000 Expenses / Deductions Cost of goods sold Salaries, Angie and Bob Salaries, other employees Employment taxes Rent expenses Depreciation Employee health care Contributions to employee retirement plans Other operating expenses 500,000 50,000 36,000 40,000 $ 85,000 45,000 130,000 55,000 1,905,000 (245,000) Net Loss $ Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Hawaiian Memories, Inc. (HMI) is a C corporation that was formed in 2007 in Maui. The company markets specialty tourism products of the islands of Hawaii. The initial incorporators were Angie Lee and Bob Lin, who now own 1,000 shares of voting common stock and 100 shares of preferred stock each. The company has eight employees who collectively own 500 shares of nonvoting stock. Most of the employees have worked for the company for several years and purchased the stock when offered at the end of each year. Two own 100 shares each; the other six own 50 shares each All individual shareholders are native Hawaiians except for Inge; she is Swedish and has lived on Maui and worked for HMI for three years. Inge plans to move back to Sweden in one year and try to develop markets for HMI products there. Another stockholder is the Plantation Sugar Partnership (PSP). PSP owns 500 nonvoting common shares; it supplies raw sugar in bulk to HMI. Bob Lin and his sister Katie each own 50% of PSP. Hawaiian Memories Inc Marios Partneri Bab Carl, Donna no como Bre, franke, Henna, So non mone pred pred The corporation uses a September 30 year-end. The year was chosen arbitrarily. All the HMI shareholders use calendar years. Financial statements for the year ended September 30, 2021 are attached. HMI does not expect that it will generate any significant increases in investment or passive activity income in the coming years. This was the first year of corporate operating losses in some time. The corporation elected not to carry back the losses because the tax rate paid in those years was lower than they expect to pay in the future. Bob and Angie expect one or two more years of losses and then steady increases in net income. Bob lives in Hawaii and manages operations there. Angie moved to San Francisco in 2012 to develop mainland markets for their products. Both earn annual salaries of $150,000. The Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm shareholders and all employees are provided accident and health insurance. The company contributes 10% of each employee's salary to a defined contribution pension plan each year. On January 5, 2022, Bob and Angie came to your office for the first time. They had just filed the corporate return for the fiscal year ended September 30, 2021 and are interested in having you take over all the future tax work for the corporation. They inform you that they have just read an article in Tourism Retailing about the tax and cash-flow benefits of pass-through losses. They have filed an election to be an corporation, effective on October 1, 2021. Bob and Angie signed the consent for the selection because they were the only shareholders with voting stock. Their reasoning for making the Selection is that they expect losses for a year or two as they try to expand, and they would like to use the losses already incurred as well as prospective losses against their other income. Review all relevant information and identify any issues related to conversion to status. Prepare a tax memorandum to your tax manager, Maria Gonzalez that discusses all relevant issues. This memorandum will serve as the basis for the advice the firm will be giving Bob and Angie about the conversion to status in your upcoming meeting, Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Hawaiian Memories, Inc. Book/Tax Balance Sheet September 30, 2021 Book / Tax Basis Fair Market Value Assets $ Cash Trade accounts receivable 100,000 $ 250,000 100,000 250,000 FIFO cost/bosis would be $450,000 350,000 500,000 Inventory (LIFO) Furniture and fixtures $ 300,000 Accumulated depreciation (120,000) 180,000 350,000 100,000 850,000 Investment land Total $ 1,230,000 $ 1,800,000 Liabilities and Shareholders' Equity $ 145,000 Accounts payable Note payable, Hawaiian National Bank Paid-in capital, common 200,000 $ 500,000 Nonvoting, cumulative 8%, callable at 104% of foce Paid-in capital, preferred Retained earnings 100,000 600,000 285,000 Total $ 1,230,000 Notes: The difference between FIFO and LIFO is expected to be approximately the same for the next year. The entire layer of inventory on hand at conversion will be sold by December 31, 2021 Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Memories' balance in Earnings and Profits is $300,000. Current E&P for the year ended September 30, 2021 was $0. Hawaiian Memories, Inc. Tax Research Memorandum Due Date: Wednesday, April 13 at 11:59 pm Hawaiian Memories, Inc. Book and Tax Income Statement for the 12 months ending June 30, 2021 Revenues / Gross Income Sales Interest income $1,650,000 10,000 $ 1,660,000 $1,094,000 $ 300,000 200,000 Expenses / Deductions Cost of goods sold Salaries, Angie and Bob Salaries, other employees Employment taxes Rent expenses Depreciation Employee health care Contributions to employee retirement plans Other operating expenses 500,000 50,000 36,000 40,000 $ 85,000 45,000 130,000 55,000 1,905,000 (245,000) Net Loss $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started