Answered step by step

Verified Expert Solution

Question

1 Approved Answer

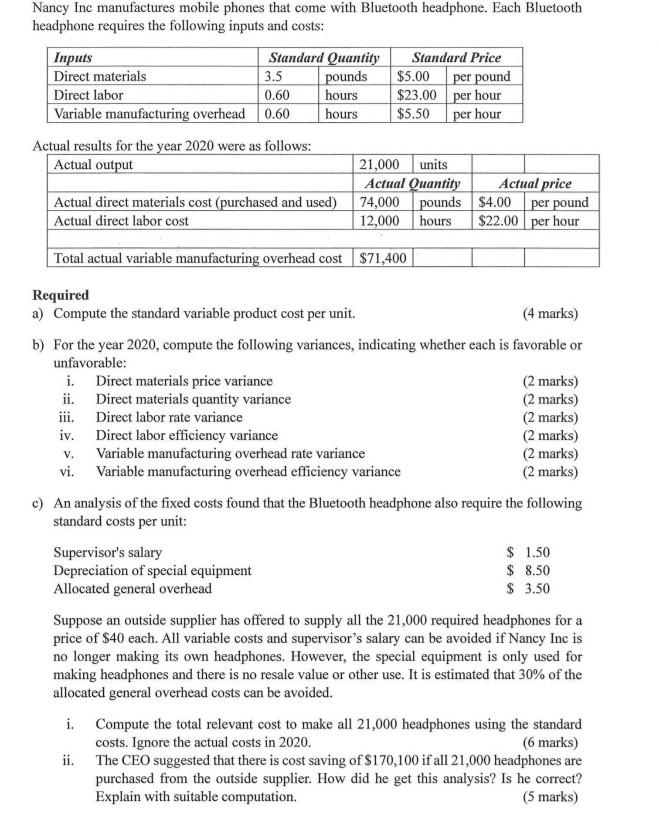

Nancy Inc manufactures mobile phones that come with Bluetooth headphone. Each Bluetooth headphone requires the following inputs and costs: Inputs Standard Quantity Standard Price Direct

Nancy Inc manufactures mobile phones that come with Bluetooth headphone. Each Bluetooth headphone requires the following inputs and costs: Inputs Standard Quantity Standard Price Direct materials 3.5 pounds $5.00 per pound Direct labor 0.60 hours $23.00 per hour Variable manufacturing overhead 0.60 hours $5.50 per hour Actual results for the year 2020 were as follows: Actual output Actual direct materials cost (purchased and used) Actual direct labor cost 21,000 units Actual Quantity Actual price 74,000 pounds $4.00 per pound 12,000 hours $22.00 per hour Total actual variable manufacturing overhead cost $71,400 V. Required a) Compute the standard variable product cost per unit. (4 marks) b) For the year 2020, compute the following variances, indicating whether each is favorable or unfavorable: i. Direct materials price variance (2 marks) ii. Direct materials quantity variance (2 marks) iii. Direct labor rate variance (2 marks) iv. Direct labor efficiency variance (2 marks) Variable manufacturing overhead rate variance (2 marks) vi. Variable manufacturing overhead efficiency variance (2 marks) c) An analysis of the fixed costs found that the Bluetooth headphone also require the following standard costs per unit: Supervisor's salary $ 1.50 Depreciation of special equipment $ 8.50 Allocated general overhead $ 3.50 Suppose an outside supplier has offered to supply all the 21,000 required headphones for a price of $40 each. All variable costs and supervisor's salary can be avoided if Nancy Inc is no longer making its own headphones. However, the special equipment is only used for making headphones and there is no resale value or other use. It is estimated that 30% of the allocated general overhead costs can be avoided. i. Compute the total relevant cost to make all 21,000 headphones using the standard costs. Ignore the actual costs in 2020. (6 marks) ii. The CEO suggested that there is cost saving of $170,100 if all 21,000 headphones are purchased from the outside supplier. How did he get this analysis? Is he correct? Explain with suitable computation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started