Question

Nash Corporation, a building firm, is entirely financed by equity and has 50 million shares with a current share price of $6 each. Nash has

Nash Corporation, a building firm, is entirely financed by equity and has 50 million shares with a current share price of $6 each. Nash has existing non-cash assets, and $42 million cash. The firm has also submitted a bid for a major new building contract. If the bid is successful (good news) the contract will have a net present value of $52 million to Nash. If it is unsuccessful (bad news) the contract will have zero value. Investors believe it is equally likely that the bid will be successful or unsuccessful. The market is semi-strong form efficient and all the above information is public knowledge. There are no taxes or transactions costs. Assume that the managers of Nash wish to maximise the firms share price.

(a) What is the markets current estimate of the value of Nashs existing non-cash assets? (4 marks) (b) Suppose Nash uses all its cash to repurchase shares before making a public news announcement about the outcome of its bid for the new contract, (i) How many shares will be repurchased? What will the share price be after the repurchase? Why? (ii) After the announcement, what will the share price be if the news is good? What will the share price be if the news is bad? (c) Suppose Nash makes the public news announcement before using all its cash to repurchase shares. (i) If there is good news about the contract, what will be the total value of Nashs equity after the announcement? How many shares will be repurchased and what will the share price be after the repurchase? (ii) If there is bad news about the contract, what will be the total value of Nashs equity after the announcement? How many shares will be repurchased and what will the share price be after the repurchase?

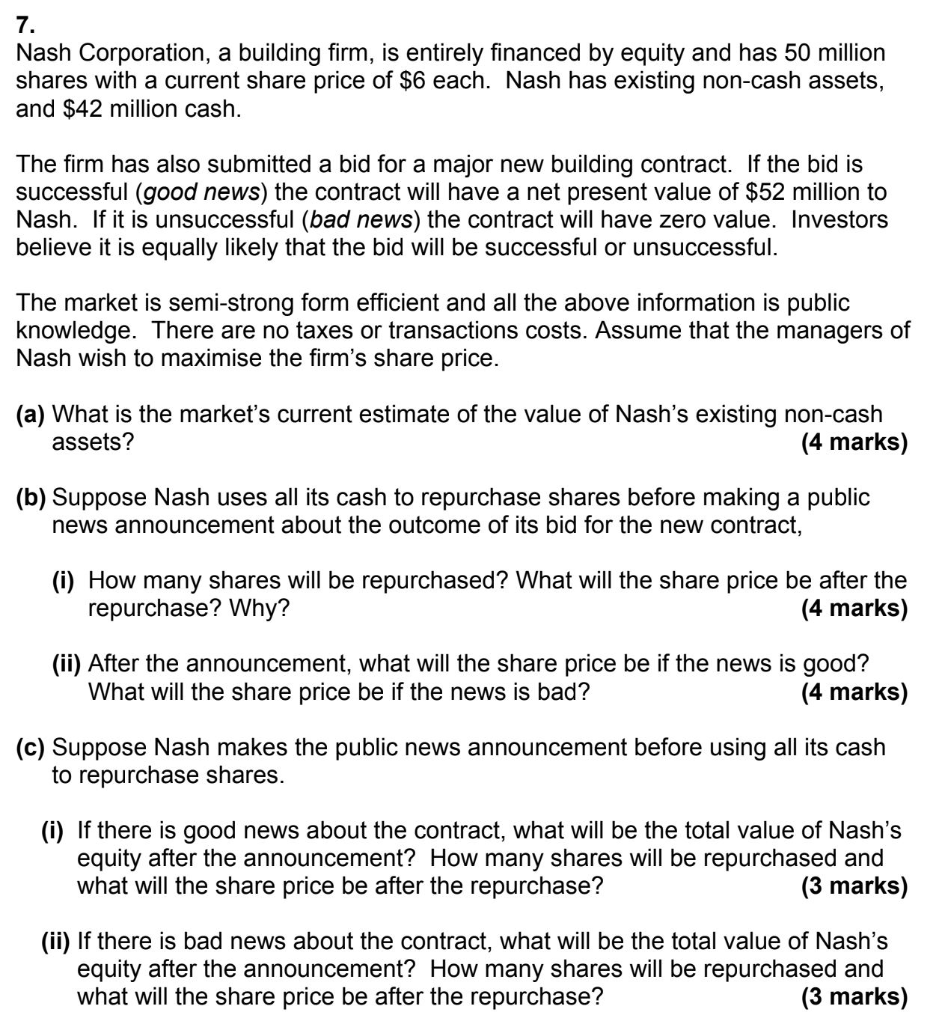

7. Nash Corporation, a building firm, is entirely financed by equity and has 50 million shares with a current share price of $6 each. Nash has existing non-cash assets, and $42 million cash. The firm has also submitted a bid for a major new building contract. If the bid is successful (good news) the contract will have a net present value of $52 million to Nash. If it is unsuccessful (bad news) the contract will have zero value. Investors believe it is equally likely that the bid will be successful or unsuccessful. The market is semi-strong form efficient and all the above information is public knowledge. There are no taxes or transactions costs. Assume that the managers of Nash wish to maximise the firm's share price. (a) What is the market's current estimate of the value of Nash's existing non-cash assets? (4 marks) (b) Suppose Nash uses all its cash to repurchase shares before making a public news announcement about the outcome of its bid for the new contract, (i) How many shares will be repurchased? What will the share price be after the repurchase? Why? (4 marks) (ii) After the announcement, what will the share price be if the news is good? What will the share price be if the news is bad? (4 marks) (C) Suppose Nash makes the public news announcement before using all its cash to repurchase shares. (i) If there is good news about the contract, what will be the total value of Nash's equity after the announcement? How many shares will be repurchased and what will the share price be after the repurchase? (3 marks) (ii) If there is bad news about the contract, what will be the total value of Nash's equity after the announcement? How many shares will be repurchased and what will the share price be after the repurchase? (3 marks) 7. Nash Corporation, a building firm, is entirely financed by equity and has 50 million shares with a current share price of $6 each. Nash has existing non-cash assets, and $42 million cash. The firm has also submitted a bid for a major new building contract. If the bid is successful (good news) the contract will have a net present value of $52 million to Nash. If it is unsuccessful (bad news) the contract will have zero value. Investors believe it is equally likely that the bid will be successful or unsuccessful. The market is semi-strong form efficient and all the above information is public knowledge. There are no taxes or transactions costs. Assume that the managers of Nash wish to maximise the firm's share price. (a) What is the market's current estimate of the value of Nash's existing non-cash assets? (4 marks) (b) Suppose Nash uses all its cash to repurchase shares before making a public news announcement about the outcome of its bid for the new contract, (i) How many shares will be repurchased? What will the share price be after the repurchase? Why? (4 marks) (ii) After the announcement, what will the share price be if the news is good? What will the share price be if the news is bad? (4 marks) (C) Suppose Nash makes the public news announcement before using all its cash to repurchase shares. (i) If there is good news about the contract, what will be the total value of Nash's equity after the announcement? How many shares will be repurchased and what will the share price be after the repurchase? (3 marks) (ii) If there is bad news about the contract, what will be the total value of Nash's equity after the announcement? How many shares will be repurchased and what will the share price be after the repurchase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started