Question

Natalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not

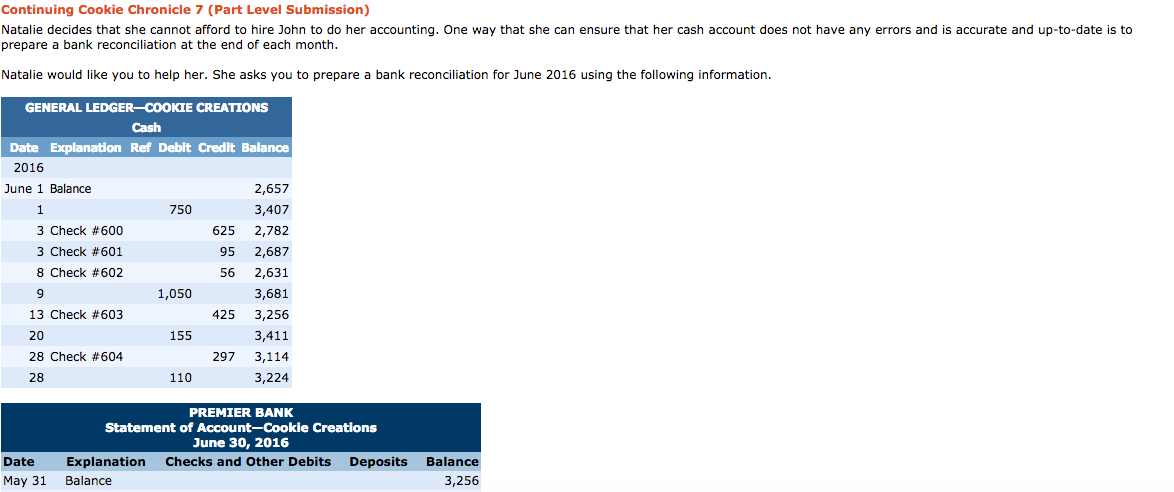

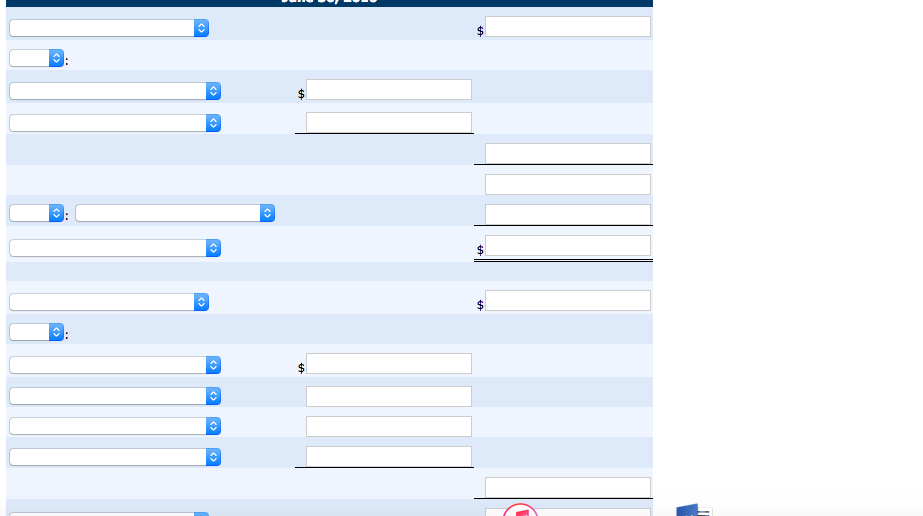

Natalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not have any errors and is accurate and up-to-date is to prepare a bank reconciliation at the end of each month. Natalie would like you to help her. She asks you to prepare a bank reconciliation for June 2016 using the following information.

| GENERAL LEDGERCOOKIE CREATIONS | |||||

| Cash | |||||

| Date | Explanation | Ref | Debit | Credit | Balance |

| 2016 | |||||

| June 1 | Balance | 2,657 | |||

| 1 | 750 | 3,407 | |||

| 3 | Check #600 | 625 | 2,782 | ||

| 3 | Check #601 | 95 | 2,687 | ||

| 8 | Check #602 | 56 | 2,631 | ||

| 9 | 1,050 | 3,681 | |||

| 13 | Check #603 | 425 | 3,256 | ||

| 20 | 155 | 3,411 | |||

| 28 | Check #604 | 297 | 3,114 | ||

| 28 | 110 | 3,224 | |||

| PREMIER BANK Statement of AccountCookie Creations June 30, 2016 | |||||||||

| Date | Explanation | Checks and Other Debits | Deposits | Balance | |||||

| May 31 | Balance | 3,256 | |||||||

| June 1 | Deposit | 750 | 4,006 | ||||||

| 6 | Check #600 | 625 | 3,381 | ||||||

| 6 | Check #601 | 95 | 3,286 | ||||||

| 8 | Check #602 | 56 | 3,230 | ||||||

| 9 | Deposit | 1,050 | 4,280 | ||||||

| 10 | NSF check | 100 | 4,180 | ||||||

| 10 | NSFfee | 35 | 4,145 | ||||||

| 14 | Check #603 | 452 | 3,693 | ||||||

| 20 | Deposit | 125 | 3,818 | ||||||

| 23 | EFTTelus | 85 | 3,733 | ||||||

| 28 | Check #599 | 361 | 3,372 | ||||||

| 30 | Bank charges | 13 | 3,359 | ||||||

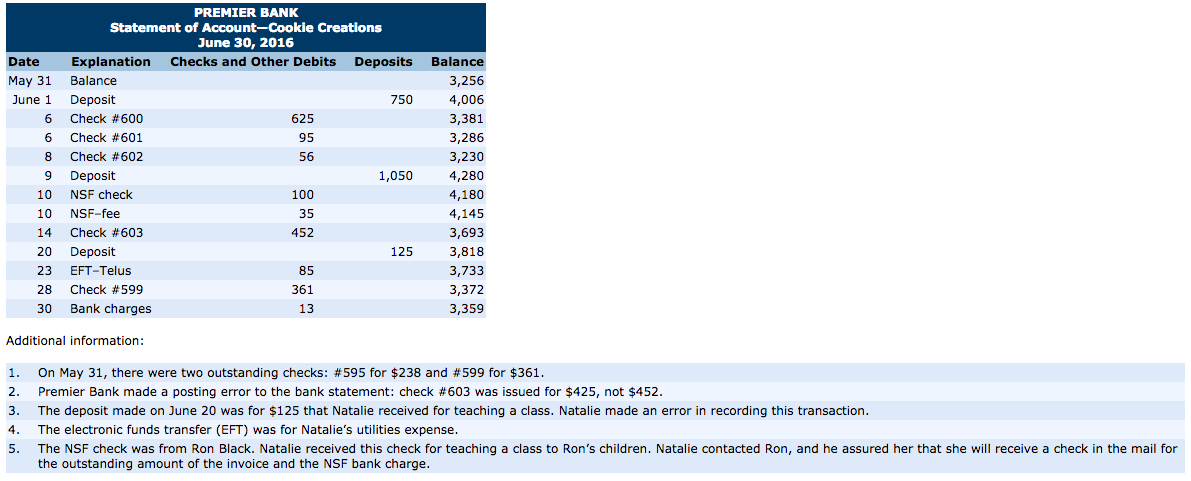

Additional information:

| 1. | On May 31, there were two outstanding checks: #595 for $238 and #599 for $361. | |

| 2. | Premier Bank made a posting error to the bank statement: check #603 was issued for $425, not $452. | |

| 3. | The deposit made on June 20 was for $125 that Natalie received for teaching a class. Natalie made an error in recording this transaction. | |

| 4. | The electronic funds transfer (EFT) was for Natalies utilities expense. | |

| 5. | The NSF check was from Ron Black. Natalie received this check for teaching a class to Rons children. Natalie contacted Ron, and he assured her that she will receive a check in the mail for the outstanding amount of the invoice and the NSF bank charge. |

The NSF fee will be charged to the customer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started