Question

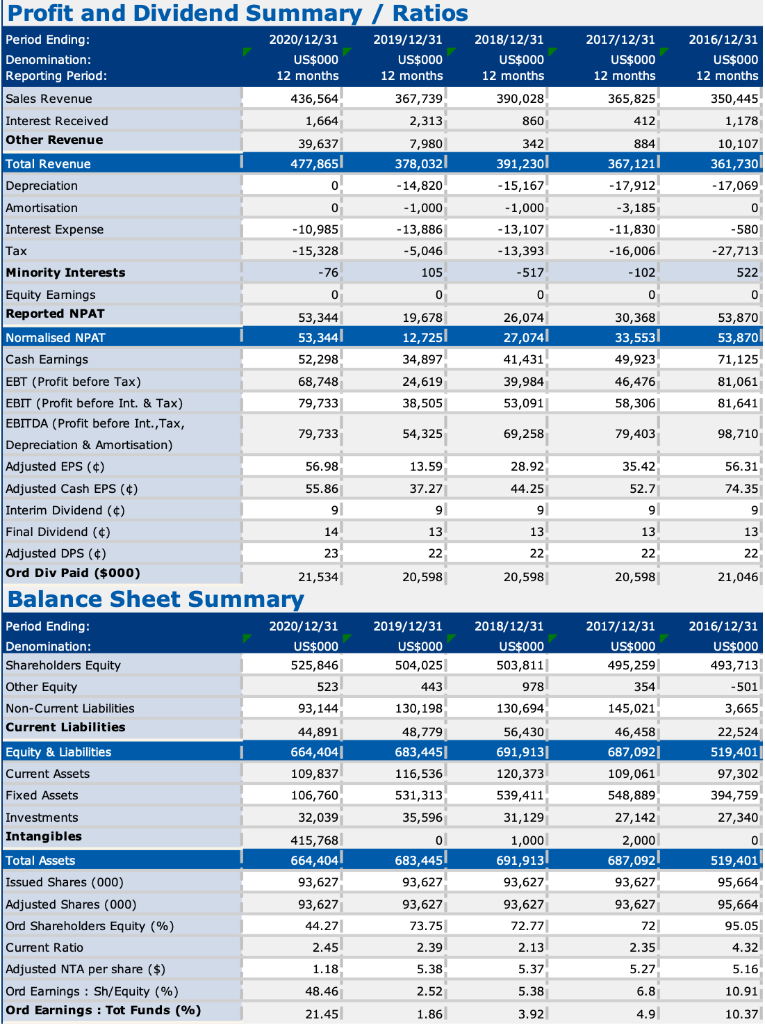

Nathan & Katsumoto Incorporation (NK) is a company listed in a stock exchange. The relative financial information about the company updated in February 2021 is

Nathan & Katsumoto Incorporation (NK) is a company listed in a stock exchange. The relative financial information about the company updated in February 2021 is provided in the Excel file - NK.

Please use the information available from NK Excel file to analyse the companys financial history and future value by answering the following questions:

1. Using the companys 2020 end-period book asset value and 2016 end period book asset value to estimate the average growth rate in the period (A2020 = A2016 (1+g)^4). Based on the assumption that the company will continue to grow in the next four years with the speed of the four previous year period, and no growth afterwards, please estimate (through the discounted cash flow method) the current market equity value and share price at the beginning of year 2021. [Use the annual cash flow of the last year (2020) as the current level of cash flow, and use 15% as the cost of capital (WACC) to calculate the company value at the beginning of 2021]. Assume that the liability of the company at the beginning of 2021 is virtually the same as at the end of 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started