Question

You are interested in forming a portfolio with Stock S and Bond B. Stock S has an expected return of 14% and a standard deviation

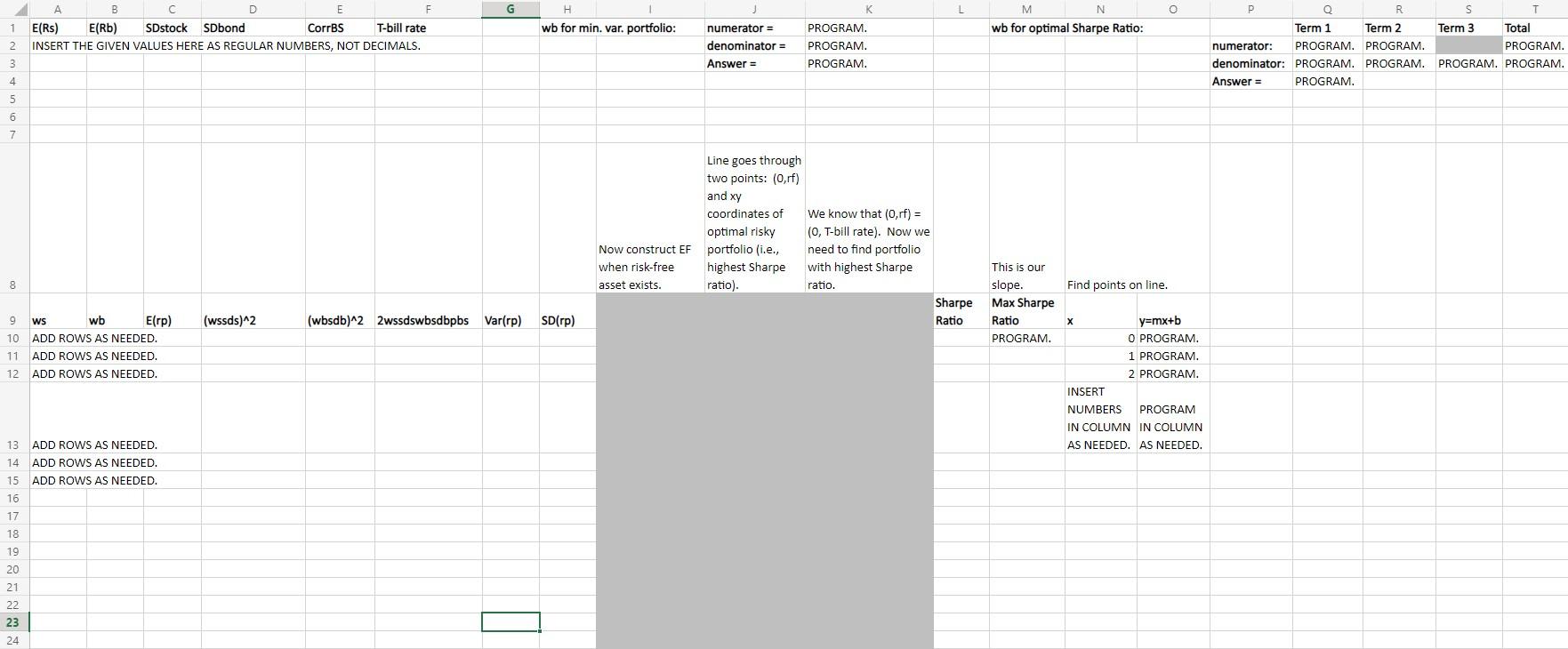

You are interested in forming a portfolio with Stock S and Bond B. Stock S has an expected return of 14% and a standard deviation of returns of 30%. Bond B has an expected return of 8% and a standard deviation of returns of 15%. The correlation coefficient of the returns of S and B is 0.22. The risk-free rate of return is 5%. Using increments of 1 percentage point, fill in the template posted and plot both efficient frontiers (with vs. without the risk-free asset.) When plotting the line for the frontier with the risk-free asset, use a range from 0 to 30 for the X values. Please do not forget the important reminders below. 1. The weight in the bond (Wb) for the minimum-variance portfolio needs to be inserted numerically within the Wb column. 2. The weight in the bond (Wb) for the maximum-Sharpe-Ratio portfolio does not need to be inserted numerically in the Wb column, but you can do so if you would like.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started