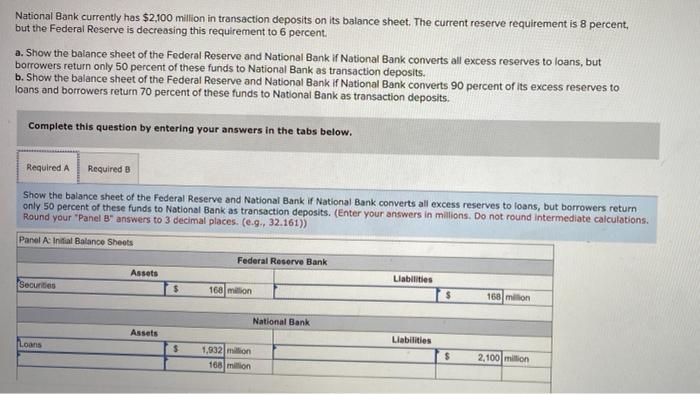

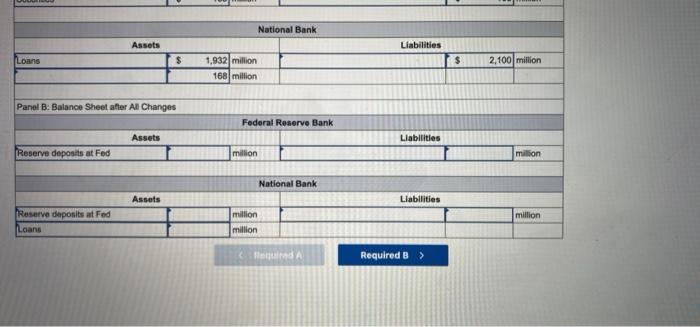

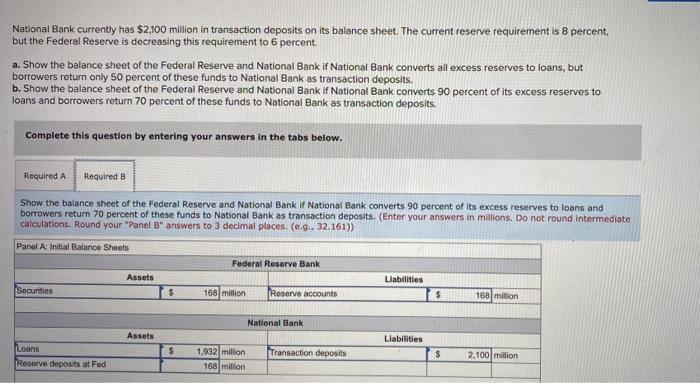

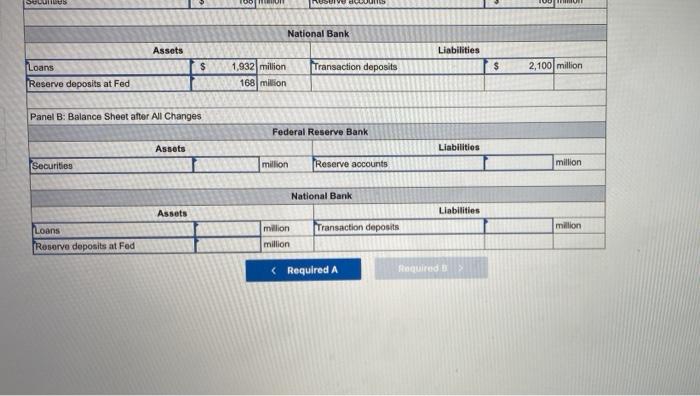

National Bank currently has $2,100 million in transaction deposits on its balance sheet. The current reserve requirement is 8 percent but the Federal Reserve is decreasing this requirement to 6 percent. a. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts all excess reserves to loans, but borrowers return only 50 percent of these funds to National Bank as transaction deposits b. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts 90 percent of its excess reserves to loans and borrowers return 70 percent of these funds to National Bank as transaction deposits Complete this question by entering your answers in the tabs below. Required A Required B Show the balance sheet of the Federal Reserve and National Bank if National Bank converts all excess reserves to loans, but borrowers return only 50 percent of these funds to National Bank as transaction deposits. (Enter your answers in millions. Do not round Intermediate calculations. Round your "Panel 8" answers to 3 decimal places. (e.g., 32.161)) Panel Initial Balance Sheets Federal Reserve Bank Assets Liabilities Secund $ 168 million 168 million National Bank Assets Liabilities Loans $ 1,832 million 168 million $ 2,100 million National Bank Assets Liabilities Loans $ $ 2,100 million 1,932 million 168 million Panel B: Balance Sheet after All Changes Federal Reserve Bank Assets Liabilities Reserve deposits at Fed million million National Bank Assets Liabilities million million Reserve deposits at Fed Loans million Home A Required B National Bank currently has $2,100 million in transaction deposits on its balance sheet. The current reserve requirement is 8 percent, but the Federal Reserve is decreasing this requirement to 6 percent. a. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts all excess reserves to loans, but borrowers return only 50 percent of these funds to National Bank as transaction deposits b. Show the balance sheet of the Federal Reserve and National Bank If National Bank converts 90 percent of its excess reserves to loans and borrowers return 70 percent of these funds to National Bank as transaction deposits. Complete this question by entering your answers in the tabs below. Required A Required B Show the balance sheet of the Federal Reserve and National Bank If National Bank converts 90 percent of its excess reserves to loans and borrowers return 70 percent of these funds to National Bank as transaction deposits. (Enter your answers in millions. Do not round intermediate calculations. Round your "Panel B' answers to 3 decimal places. (e.g., 32.161)) Panel A: Initial Balance Sheets Federal Reserve Bank Assets Liabilities Securities $ 168 million Reserve accounts $ 168 million National Bank Assets Liabilities $ Transaction deposits Loans Reserve deposits at Fed $ 2.100 million 1,932 million 168 million SOLULUS UN v dobou National Bank Assets Liabilities $ Transaction deposits $ 2,100 million Loans Reserve deposits at Fed 1,932 milion 168 million Panel B: Balance Sheet after All Changes Federal Reserve Bank Assets Liabilities Securities million Reserve accounts million National Bank Assets Liabilities million Transaction deposits million Loans Reserve deposits at Fed million