Answered step by step

Verified Expert Solution

Question

1 Approved Answer

National Gears has a machining facility specializing in jobs for the two - wheeler components market. The job - costing system follows two direct -

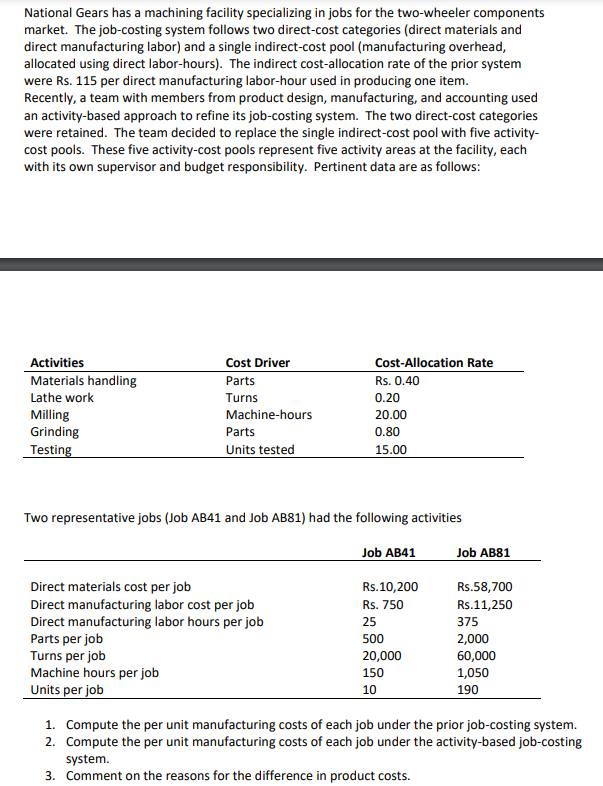

National Gears has a machining facility specializing in jobs for the twowheeler components

market. The jobcosting system follows two directcost categories direct materials and

direct manufacturing labor and a single indirectcost pool manufacturing overhead,

allocated using direct laborhours The indirect costallocation rate of the prior system

were Rs per direct manufacturing laborhour used in producing one item.

Recently, a team with members from product design, manufacturing, and accounting used

an activitybased approach to refine its jobcosting system. The two directcost categories

were retained. The team decided to replace the single indirectcost pool with five activity

cost pools. These five activitycost pools represent five activity areas at the facility, each

with its own supervisor and budget responsibility. Pertinent data are as follows:

Two representative jobs Job AB and Job AB had the following activities

Compute the per unit manufacturing costs of each job under the prior jobcosting system.

Compute the per unit manufacturing costs of each job under the activitybased jobcosting

system.

Comment on the reasons for the difference in product costs. Do the above calculations in excel, attach excel screenshots and explain the steps and formulas, give explanation for rd question too

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started