Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nature's Friend Co . is a young eco - friendly paper, personal care, and cleaning product company that newly listed on the TSX Venture Exchange.

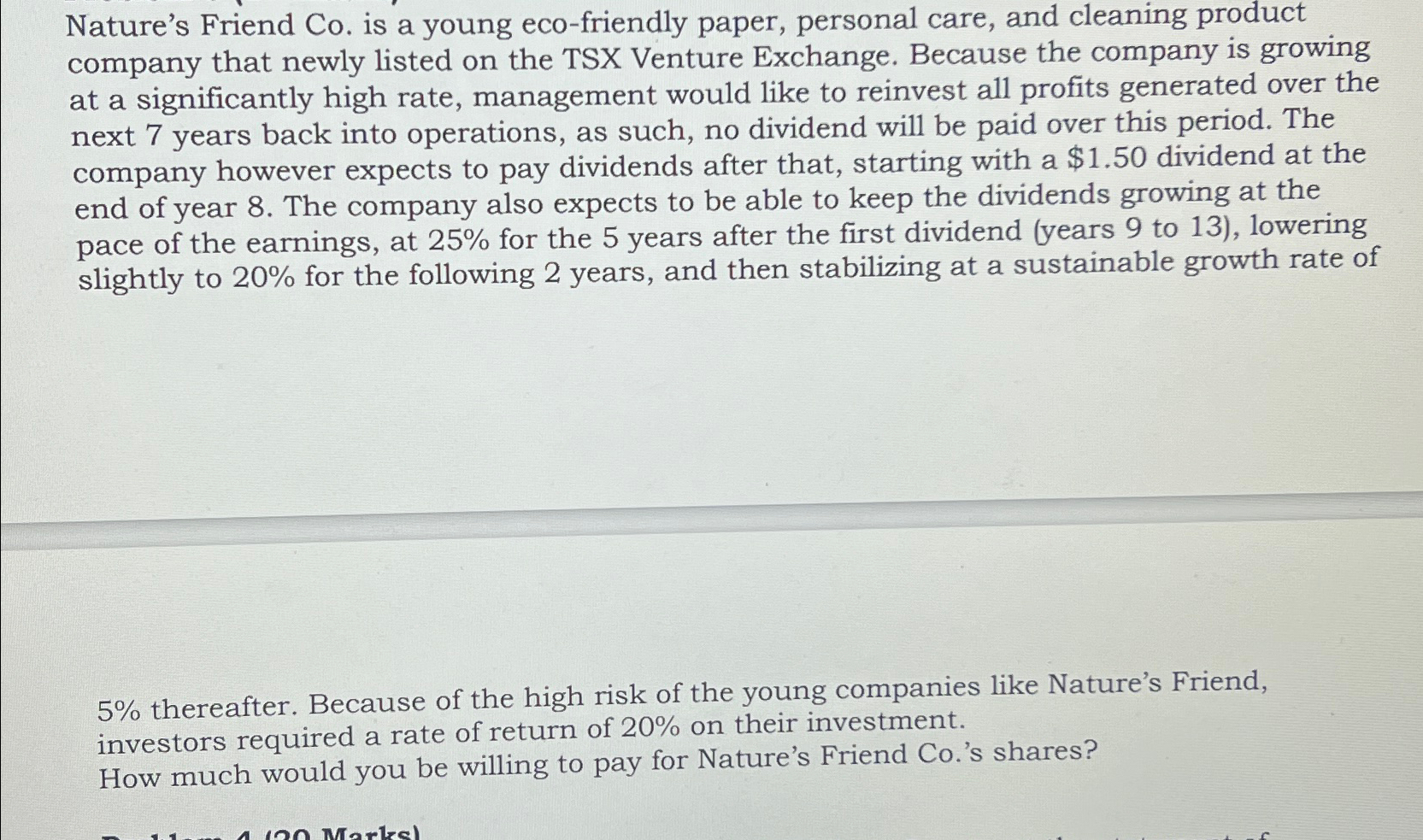

Nature's Friend Co is a young ecofriendly paper, personal care, and cleaning product company that newly listed on the TSX Venture Exchange. Because the company is growing at a significantly high rate, management would like to reinvest all profits generated over the next years back into operations, as such, no dividend will be paid over this period. The company however expects to pay dividends after that, starting with a $ dividend at the end of year The company also expects to be able to keep the dividends growing at the pace of the earnings, at for the years after the first dividend years to lowering slightly to for the following years, and then stabilizing at a sustainable growth rate of

thereafter. Because of the high risk of the young companies like Nature's Friend, investors required a rate of return of on their investment.

How much would you be willing to pay for Nature's Friend Cos shares?

Please provide a written calculation answer. Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started