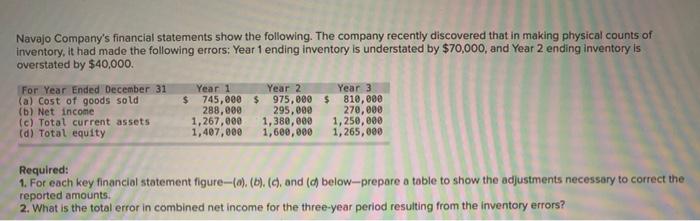

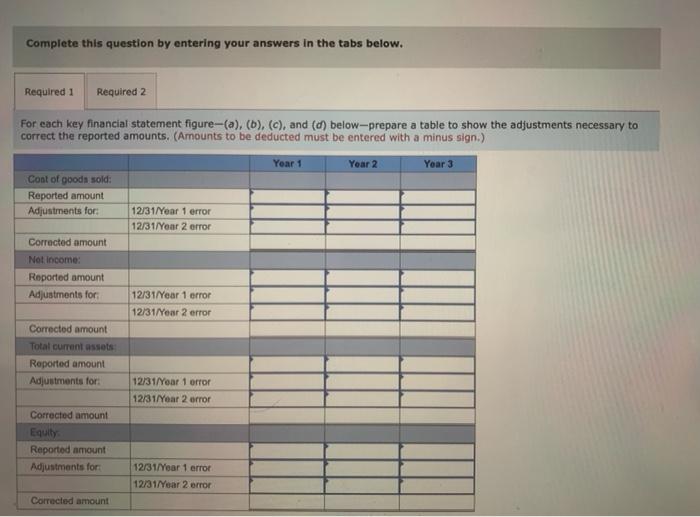

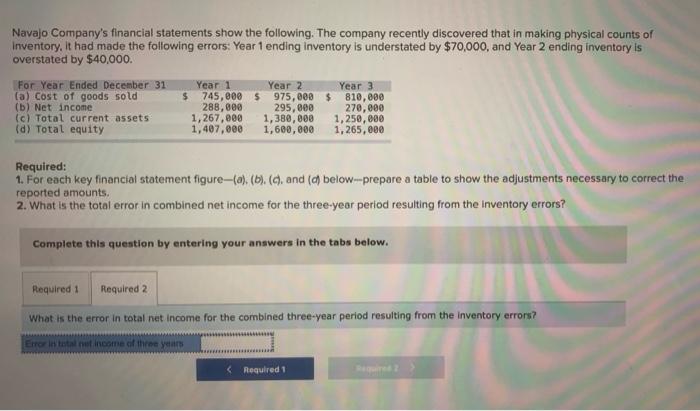

Navajo Company's financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Year 1 ending inventory is understated by $70,000, and Year 2 ending inventory is overstated by $40,000. For Year Ended December 31 Year 1 Year 2 Year 3 (a) Cost of goods sold $ 745,000 $ 975,000 $ 810,000 (6) Net income 288,000 295,000 270,000 (c) Total current assets 1,267,000 1,380,000 1,250,000 (d) Total equity 1,407,000 1,600,000 1,265,000 Required: 1. For each key financial statement figure-o). (b), (c), and (c) below-prepare a table to show the adjustments necessary to correct the reported amounts 2. What is the total error in combined net income for the three-year period resulting from the inventory errors? Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each key financial statement figure-(a), (b), (c), and (d) below-prepare a table to show the adjustments necessary to correct the reported amounts. (Amounts to be deducted must be entered with a minus sign.) Year 1 Year 2 Yoar 3 Cont of goods sold: Reported amount Adjustments for: 12/31/Year 1 error 12/31/Year 2 error Corrected amount Not Income Reported amount Adjustments for 12/31/Year 1 error 12/31/Year 2 error Corrected amount Total current assets Reported amount Adjustments for: 12/31/Year 1 orror 12/31/Year 2 error Corrected amount Equity Reported amount Adjustments for 12/31/Year 1 error 12/31/Year 2 error Corrected amount Navajo Company's financial statements show the following. The company recently discovered that in making physical counts of Inventory. It had made the following errors: Year 1 ending inventory is understated by $70,000, and Year 2 ending inventory is overstated by $40,000 For Year Ended December 31 Year 1 Year 2 Year 3 (a) Cost of goods sold $ 745,000 $ 975,000 $ (b) Net income 288,000 295,000 270,000 (c) Total current assets 1,250,000 (d) Total equity 1,407,000 1,600,000 1,265,000 810,000 1,267,000 1,380,000 Required: 1. For each key financial statement figure(a)(1). (C. and (c) below---prepare a table to show the adjustments necessary to correct the reported amounts. 2. What is the total error in combined net income for the three-year period resulting from the inventory errors? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the error in total net income for the combined three-year period resulting from the inventory errors? Emotale income of three years