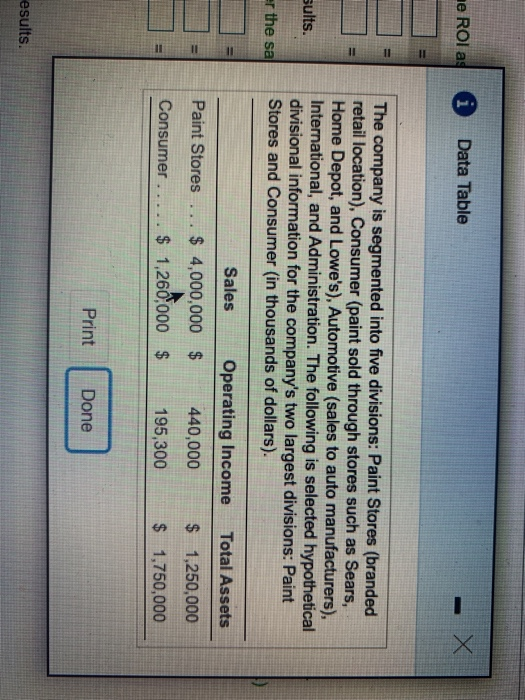

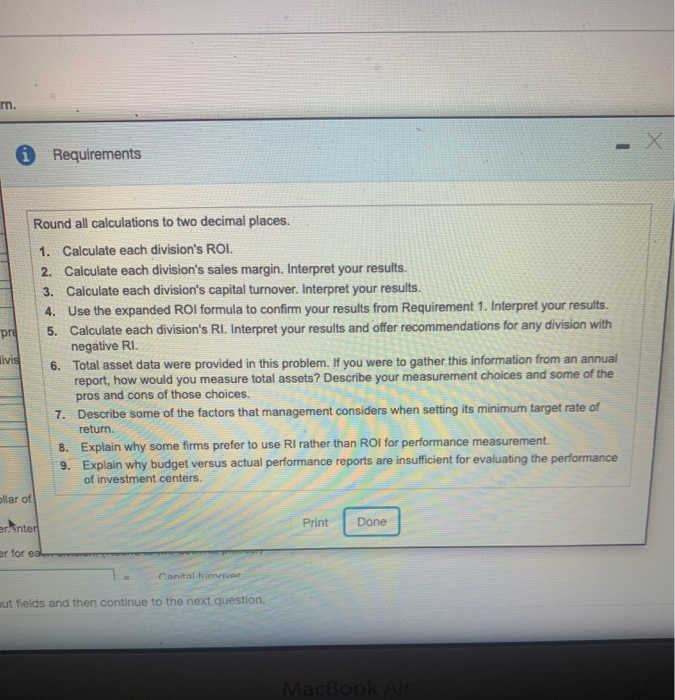

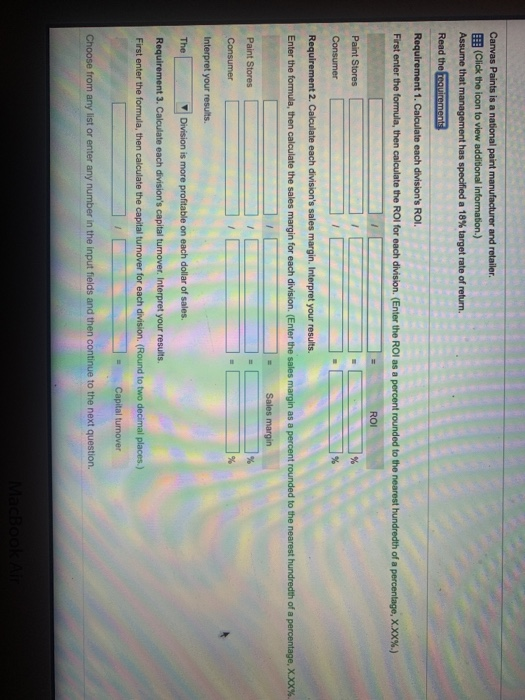

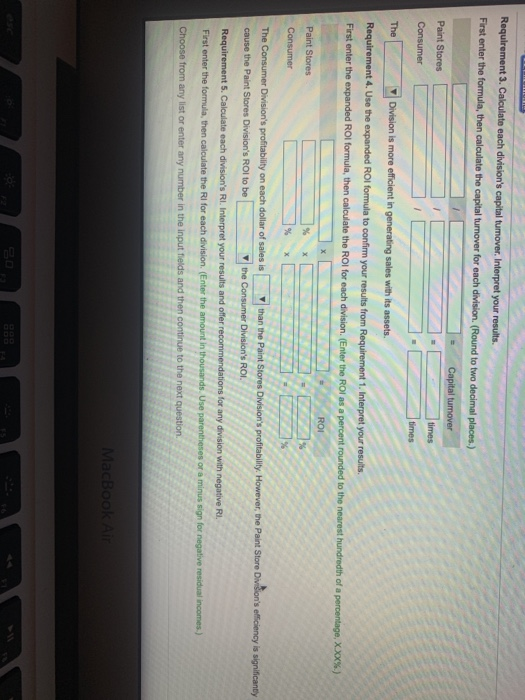

ne ROI ai Data Table The company is segmented into five divisions: Paint Stores (branded retail location), Consumer (paint sold through stores such as Sears, Home Depot, and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). sults. er the sal Sales Operating Income 440,000 Paint Stores ... $ 4,000,000 Consumer ..... $ 1,260,000 $ $ Total Assets $ 1,250,000 $ 1,750,000 195,300 Print Done esults. Requirements Round all calculations to two decimal places. 1. Calculate each division's ROI. 2. Calculate each division's sales margin. Interpret your results. 3. Calculate each division's capital turnover. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate each division's RI. Interpret your results and offer recommendations for any division with negative RI. livis 6. Total asset data were provided in this problem. If you were to gather this information from an annual report, how would you measure total assets? Describe your measurement choices and some of the pros and cons of those choices. 7. Describe some of the factors that management considers when setting its minimum target rate of return. Explain why some firms prefer to use Rl rather than ROI for performance measurement. Explain why budget versus actual performance reports are insufficient for evaluating the performance of investment centers. Har of erinter Print Done et for edhe Cantal tiver ut fields and then continue to the next question. Canvas Paints is a national paint manufacturer and retailer. (Click the icon to view additional information.) Assume that management has specified a 18% target rate of retu Read the requirements Requirement 1. Calculate each division's ROI. First enter the formula, then calculate the ROI for each division. (Enter the ROI as a percent rounded to the nearest hundredth of a percentage, X.XX%.) = ROI Paint Stores Consumer Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the nearest hundredth of a percentage, X.XX%. Sales margin Paint Stores Consumer Interpret your results. The Division is more profitable on each dollar of sales. Requirement 3. Calculate each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division (Round to two decimal places) - Capital turnover Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 3. Calculate each division's capital tumover. Interpret your results. First enter the formula, then calculate the capital turnover for each division (Round to two decimal places.) = i Paint Stores Consumer Capital turnover times times = The Division is more efficient in generating sales with its assets. Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. First enter the expanded ROI formula, then calculate the ROI for each division. (Enter the ROI as a percent rounded to the nearest hundredth of a percentage, XXX56.) - ROI Paint Stores Consumer The Consumer Division's profitability on each dollar of sales is than the Paint Stores Division's profitability. However, the Paint Store Division's efficiency is significantly cause the Paint Stores Division's ROI to be the Consumer Division's ROI. Requirements. Calculate each division's R. Interpret your results and offer recommendations for any division with negative RI. First enter the formula, then calculate the RI for each division (Enter the amount in thousands Use parentheses or a minus sign for negative residual incomes.) Choose from any list or enter any number in the input fields and then continue to the next question 30 A n s ational pain and acturer and retailer Click the icon to view and formation) Assume that management has specified a torgetorum. Requirements. Cleachd Riderpret your First order the formed the call the for each of and other recommendations for any in the the amount in ou U press or s informativo Were your rendered for anyone Requirement s data were provided problem you were together women om anal report how you w e re you rement chances and some and cons of www balance in the income in the Occionised over the ye Management to decide whetherney wish e s of the pulled from the balance showever, Rousing that will at t Requirement 7. Describe some of the actions that management considers when weg g elorum Choose from wys or any number in the input fields and then continue to the next gestion Read the Estomers choices Most companies use the balance since the income used in the Rollins med over the year Management must decide whether they wish to use the grous book value of the book of The book value is often used because ti p uled from the balance sheet. However, R ing that we wer v er Reglement 7. Debe some of the actors that management considers when ing s umberger Requirement. E n hy some prefer to her an Rol for performance measurement Rides a better job of cerers are responsible for Choose from any store any number in the routes and then continue to the next