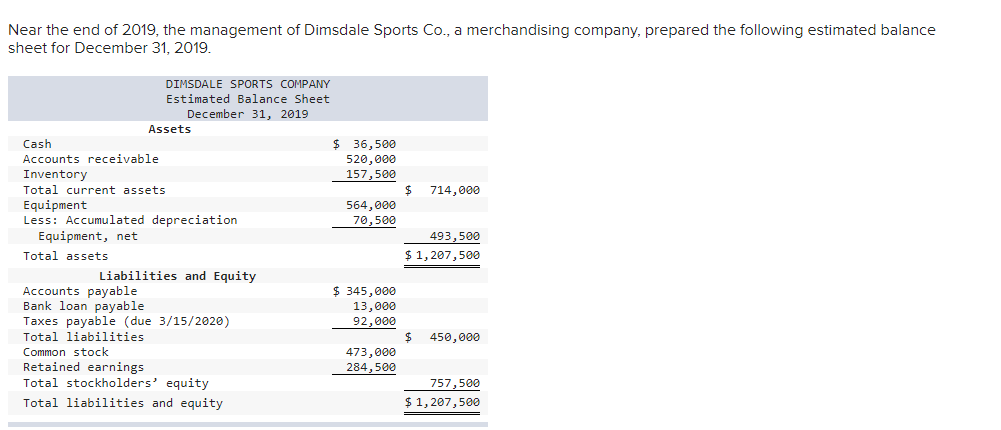

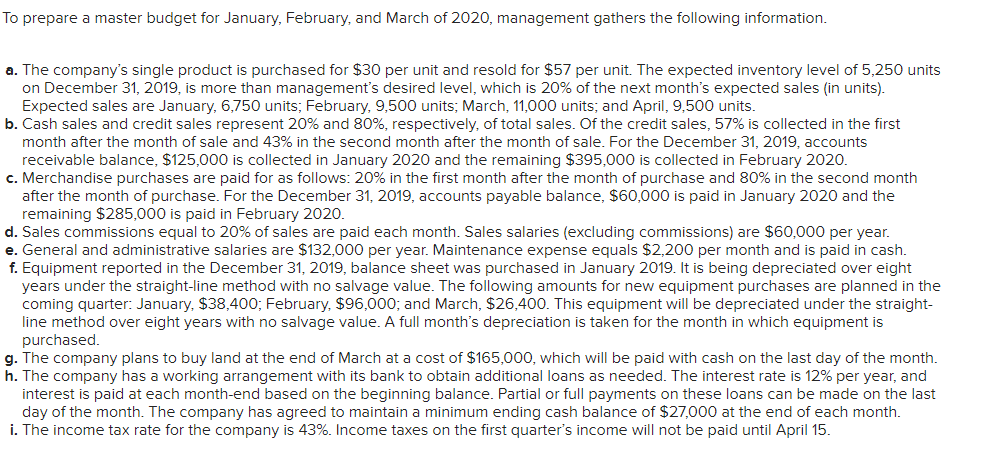

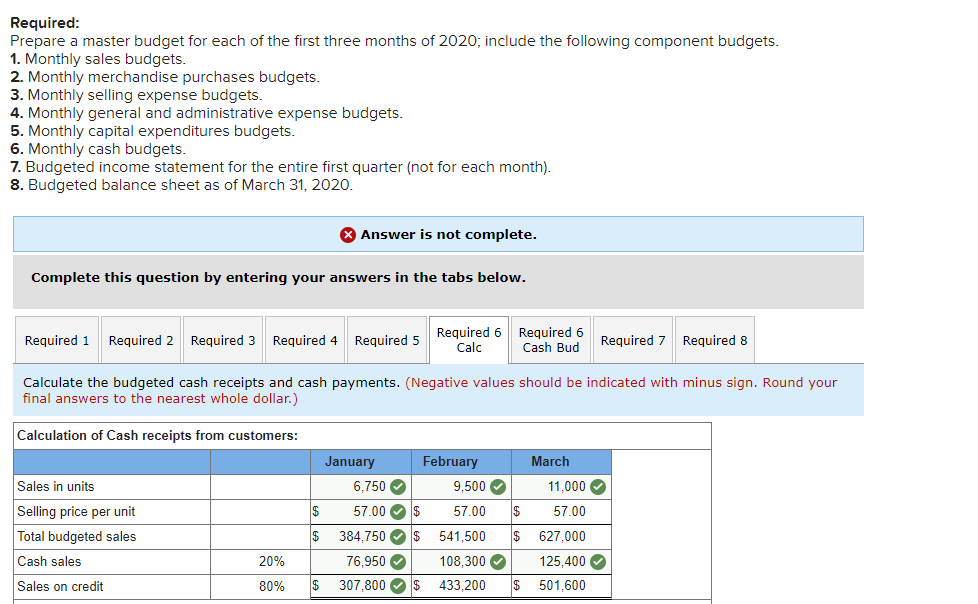

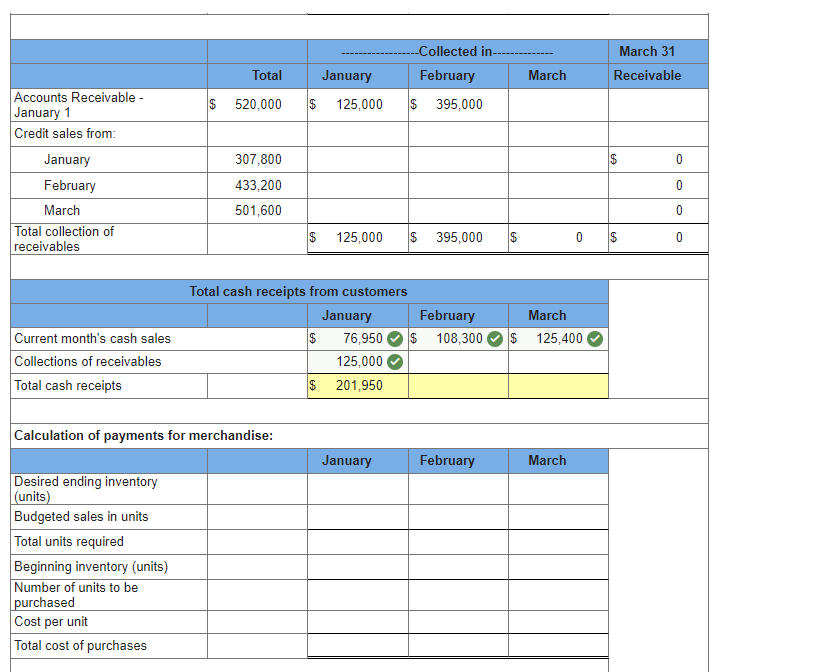

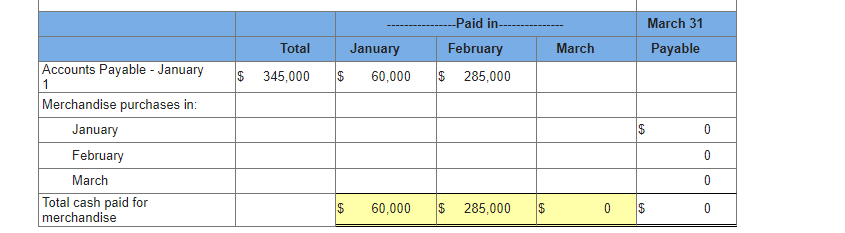

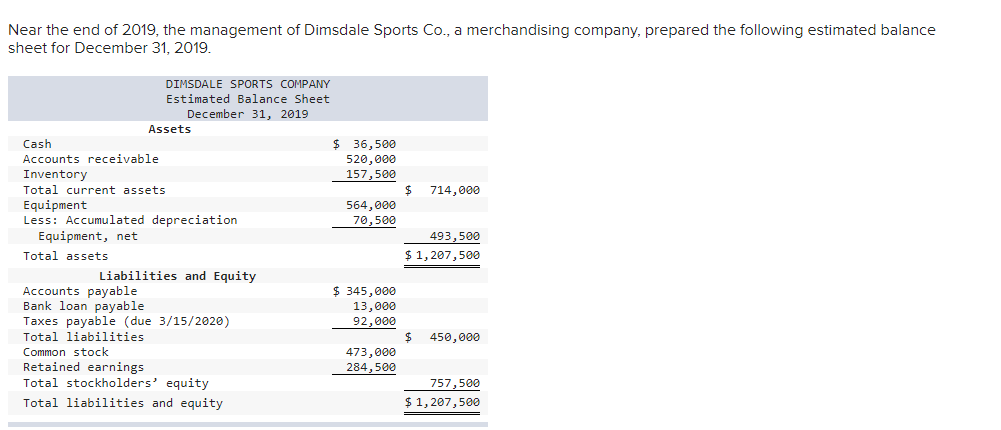

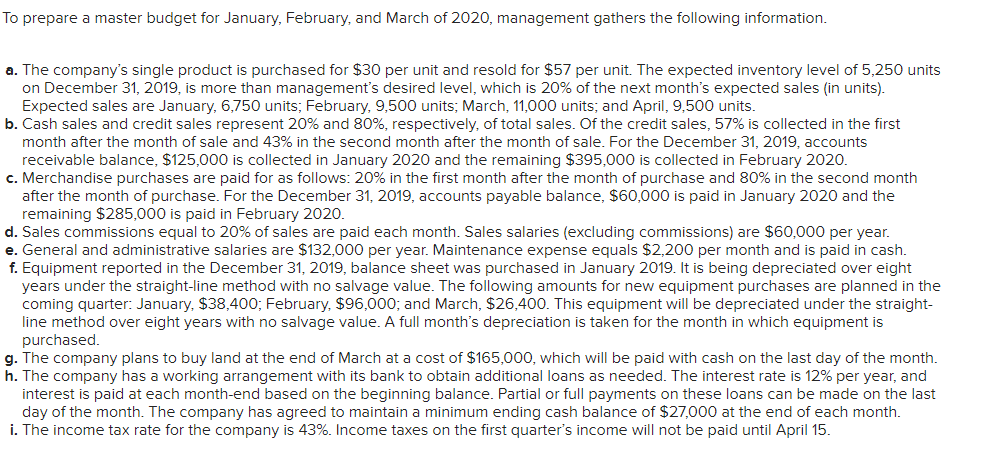

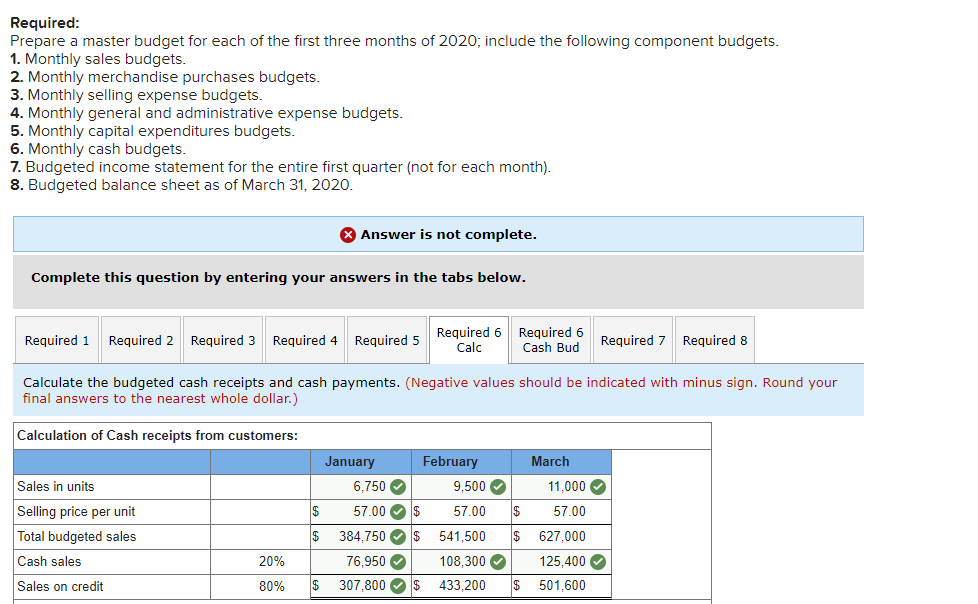

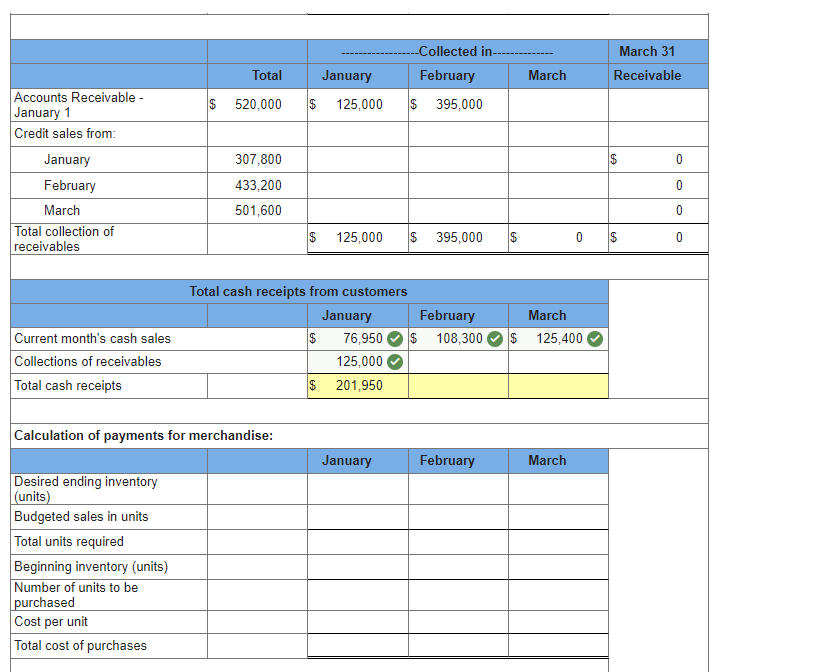

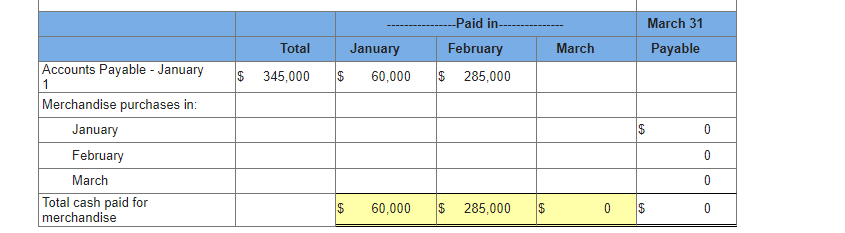

Near the end of 2019, the management of Dimsdale Sports Co., a merchandising company, prepared the following estimated balance sheet for December 31, 2019. 714,000 DIMSDALE SPORTS COMPANY Estimated Balance Sheet December 31, 2019 Assets Cash $ 36,500 Accounts receivable 520,000 Inventory 157,500 Total current assets Equipment 564,000 Less: Accumulated depreciation 70,500 Equipment, net Total assets Liabilities and Equity Accounts payable $ 345,000 Bank loan payable Taxes payable (due 3/15/2020) 92,000 Total liabilities Common stock 473,000 Retained earnings 284,500 Total stockholders' equity Total liabilities and equity 493,500 $ 1,207,500 13,000 450,000 757,500 $ 1,207,500 To prepare a master budget for January, February, and March of 2020, management gathers the following information. a. The company's single product is purchased for $30 per unit and resold for $57 per unit. The expected inventory level of 5,250 units on December 31, 2019, is more than management's desired level, which is 20% of the next month's expected sales (in units). Expected sales are January, 6,750 units; February, 9,500 units; March, 11,000 units; and April, 9,500 units. b. Cash sales and credit sales represent 20% and 80%, respectively, of total sales. Of the credit sales, 57% is collected in the first month after the month of sale and 43% in the second month after the month of sale. For the December 31, 2019, accounts receivable balance, $125,000 is collected in January 2020 and the remaining $395,000 is collected in February 2020. c. Merchandise purchases are paid for as follows: 20% in the first month after the month of purchase and 80% in the second month after the month of purchase. For the December 31, 2019, accounts payable balance, $60,000 is paid in January 2020 and the remaining $285,000 is paid in February 2020. d. Sales commissions equal to 20% of sales are paid each month. Sales salaries (excluding commissions) are $60,000 per year. e. General and administrative salaries are $132,000 per year. Maintenance expense equals $2,200 per month and is paid in cash. f. Equipment reported in the December 31, 2019, balance sheet was purchased in January 2019. It is being depreciated over eight years under the straight-line method with no salvage value. The following amounts for new equipment purchases are planned in the coming quarter: January, $38,400; February, $96,000; and March, $26,400. This equipment will be depreciated under the straight- line method over eight years with no salvage value. A full month's depreciation is taken for the month in which equipment is purchased. g. The company plans to buy land at the end of March at a cost of $165,000, which will be paid with cash on the last day of the month. h. The company has a working arrangement with its bank to obtain additional loans as needed. The interest rate is 12% per year, and interest is paid at each month-end based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. The company has agreed to maintain a minimum ending cash balance of $27,000 at the end of each month. i. The income tax rate for the company is 43%. Income taxes on the first quarter's income will not be paid until April 15. Required: Prepare a master budget for each of the first three months of 2020; include the following component budgets. 1. Monthly sales budgets. 2. Monthly merchandise purchases budgets. 3. Monthly selling expense budgets. 4. Monthly general and administrative expense budgets. 5. Monthly capital expenditures budgets. 6. Monthly cash budgets. 7. Budgeted income statement for the entire first quarter (not for each month). 8. Budgeted balance sheet as of March 31, 2020. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Calc Required 6 Cash Bud Required 7 Required 8 Calculate the budgeted cash receipts and cash payments. (Negative values should be indicated with minus sign. Round your final answers to the nearest whole dollar.) Calculation of Cash receipts from customers: March January 6,750 Februa 9,500 Sales in units 11,000 $ 57.00 $ 57.00 Selling price per unit Total budgeted sales 57.00 $ 384.750 $ $ 541.500 $ 627,000 125,400 Cash sales 76.950 108,300 20% 80% Sales on credit $ 307,800 $ 433,200 $ 501,600 March 31 Total -Collected in- February 395,000 March January $ 125,000 Receivable 520,000 $ 0 Accounts Receivable- January 1 Credit sales from January February March Total collection of receivables 307,800 433,200 501,600 0 0 $ 125,000 $ 395,000 $ 0 $ 0 Total cash receipts from customers January February $ 76,950 $ 108,300 125,000 $ 201,950 March $ 125,400 Current month's cash sales Collections of receivables Total cash receipts Calculation of payments for merchandise: January February March Desired ending inventory (units) Budgeted sales in units Total units required Beginning inventory (units) Number of units to be purchased Cost per unit Total cost of purchases March 31 Payable Total --Paid in- February $ 285,000 January $ 60,000 March 345,000 $ 0 Accounts Payable - January 1 Merchandise purchases in: January February March Total cash paid for merchandise 0 0 60,000 $ 285,000 EA $ 0 $ 0