Need 3,4,and 5. Thanks!

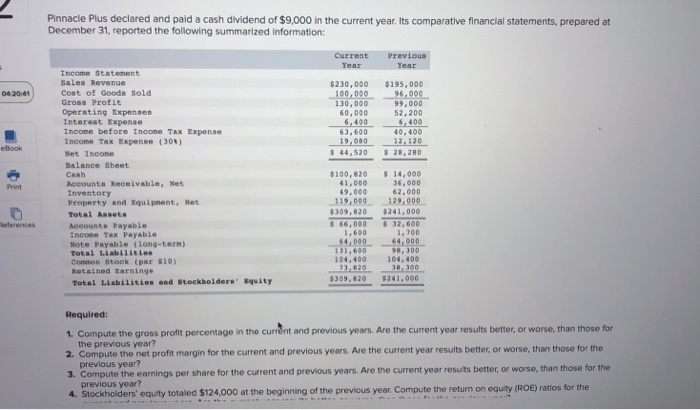

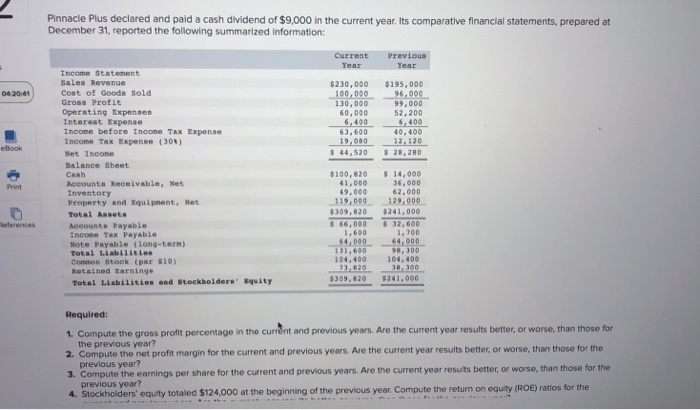

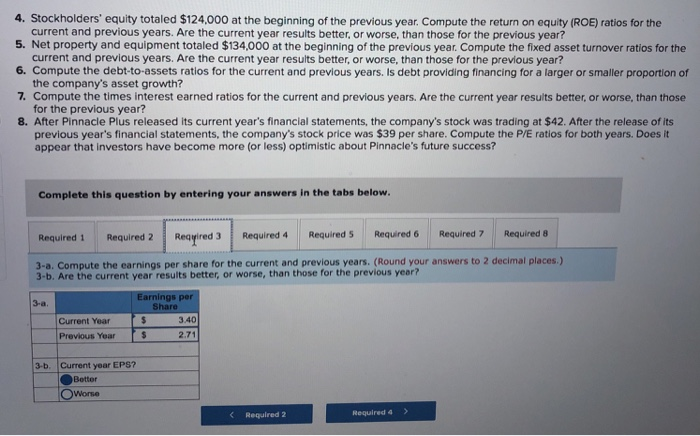

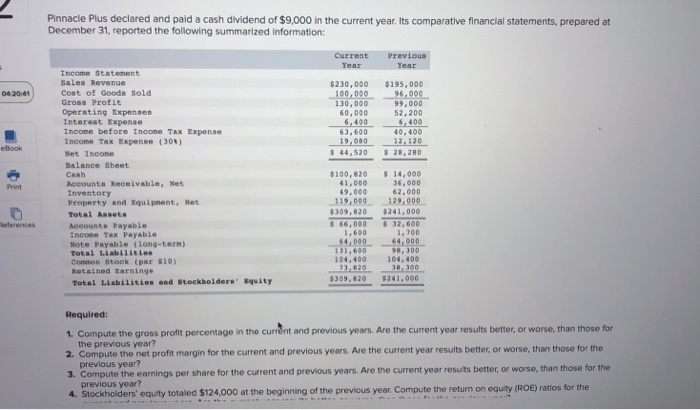

Pinnacle Plus declared and paid a cash dividend of $9,000 in the current year. Its comparative financial statements, prepared at Current revious Year $230,000 130,000 Income Statement sales Revenue Cost of Goods Sold Gross Profit Operating Expensers Interest Expense Income before Income Tax Expense Income Tax Expense (301) Net Ineome Balance Sheet Cash Accounta Receivable, Net 195,000 0420:41 99,000 52,200 6,4006400 60,000 40,400 63,600 19.080 120 44,520 28,280 eBook 100,820 14,000 36,000 62,000 119,000 129,000 309,820 $241,000 1,000 49,000 Print Property and Equipment, Net Total Assets Accounts Payable 66,000 32,600 700 eferences ,600 Incone Tax Payable Note Payable (1ong-term) fotal Liabilities Common Stock (par $10) R tained arnings 1,6009,100 104,400 104,400 309,820 $241,000 Total Liabilities and Stockholders Equity Required: . Compute the gross proft percentage in the current and previous years. Are the current year results better, or worse, than those for the previous year? previous year? previous year? profit margin for the current and previous years. Are the current year results better, or worse, than those for the 2. Compute the net 3. Compute the earnings per share for the current and previous years. Are the current year resuts better, or worse, than those for the 4. Stockholders' equity totaled $124,000 at the beginning of the previous year Compute the return on equity (ROE) 4. Stockholders' equity totaled $124,000 at the beginning of the previous year. Compute the return on equity (ROE) ratios for the 5. Net property and equipment totaled $134,000 at the beginning of the previous year. Compute the fixed asset turnover ratios for the 6. Compute the debt-to-assets ratios for the current and previous years. Is debt providing financing for a larger or smaller proportion of 7. Compute the times interest earned ratios for the current and previous years. Are the current year results better, or worse, than those 8. After Pinnacle Plus released its current year's financial statements, the company's stock was trading at $42. After the release of its current and previous years. Are the current year results better, or worse, than those for the previous year? current and previous years. Are the current year results better, or worse, than those for the previous year? the company's asset growth? for the previous year? previous year's financial statements, the company's stock price was $39 per share. Compute the P/E ratios for both years. Does it appear that investors have become more (or less) optimistic about Pinnacle's future success? Complete this question by entering your answers in the tabs below uired 7 Required 8 Required 1 Required 2 Reayired3 Required 4 Required S Required 6 Req 3-a. Compute the earnings per share for the current and previous years. (Round your answers to 2 decimal places.) 3-b. Are the current year results better, or worse, than those for the previous year ngs 3-a 3.40 2.71 Current Year Previous Year 3-b. Current year EPS? Bottor Worse Required 4> Requlred 2