Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need actual answer ASAP. course- corporate finance 2. Tanha International Ltd. is considering a new project to manufacture Milk Candy. The cost of the manufacturing

need actual answer ASAP. course- corporate finance

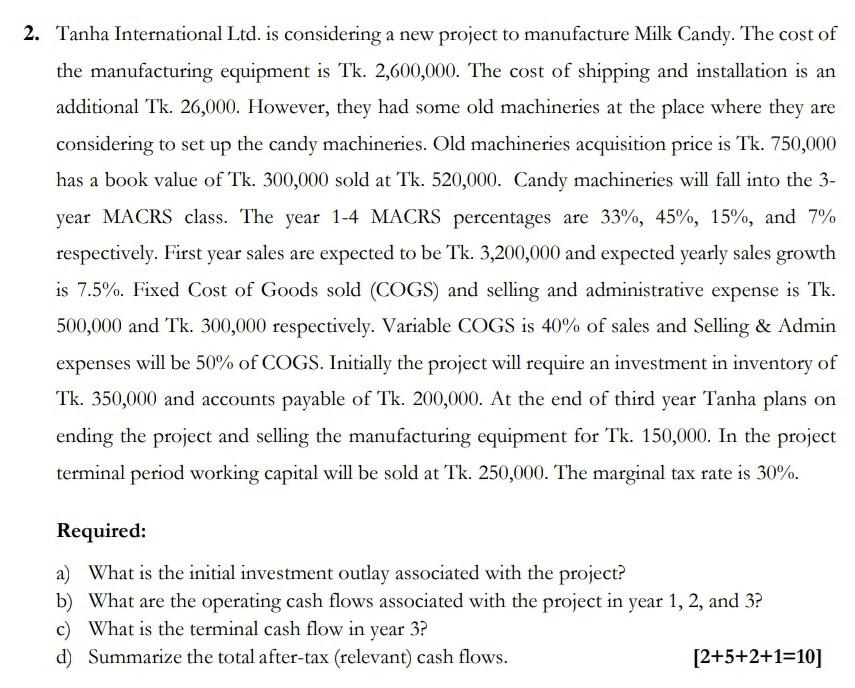

2. Tanha International Ltd. is considering a new project to manufacture Milk Candy. The cost of the manufacturing equipment is Tk. 2,600,000. The cost of shipping and installation is an additional Tk. 26,000. However, they had some old machineries at the place where they are considering to set up the candy machineries. Old machineries acquisition price is Tk. 750,000 has a book value of Tk. 300,000 sold at Tk. 520,000. Candy machineries will fall into the 3- year MACRS class. The year 1-4 MACRS percentages are 33%, 45%, 15%, and 7% respectively. First year sales are expected to be Tk. 3,200,000 and expected yearly sales growth is 7.5%. Fixed Cost of Goods sold (COGS) and selling and administrative expense is Tk. 500,000 and Tk. 300,000 respectively. Variable COGS is 40% of sales and Selling & Admin expenses will be 50% of COGS. Initially the project will require an investment in inventory of Tk. 350,000 and accounts payable of Tk. 200,000. At the end of third year Tanha plans on ending the project and selling the manufacturing equipment for Tk. 150,000. In the project terminal period working capital will be sold at Tk. 250,000. The marginal tax rate is 30%. Required: a) What is the initial investment outlay associated with the project? b) What are the operating cash flows associated with the project in year 1, 2, and 3? c) What is the terminal cash flow in year 3? d) Summarize the total after-tax (relevant) cash flows. [2+5+2+1=10]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started