Answered step by step

Verified Expert Solution

Question

1 Approved Answer

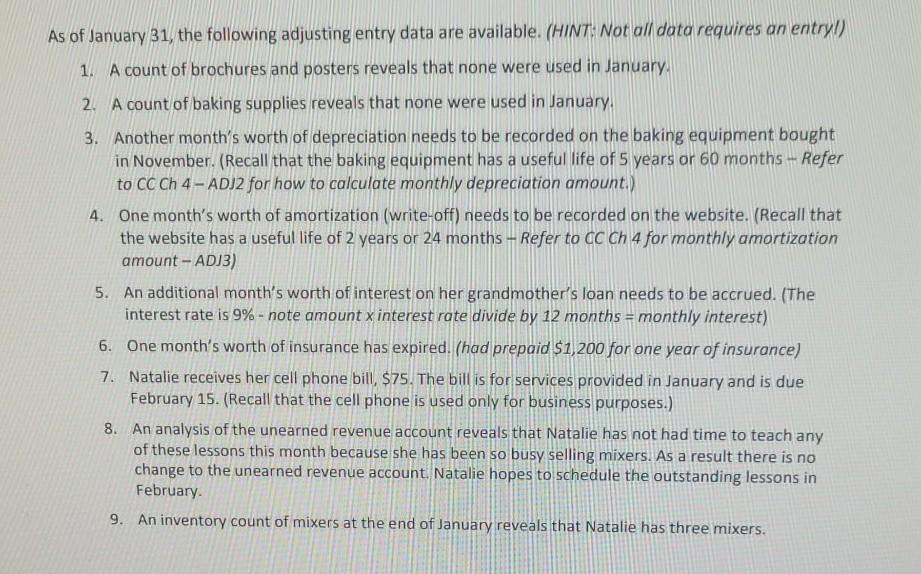

need adjusted general journal As of January 31, the following adjusting entry data are available. (HINT: Not all doto requires on entryl) 1. A count

need adjusted general journal

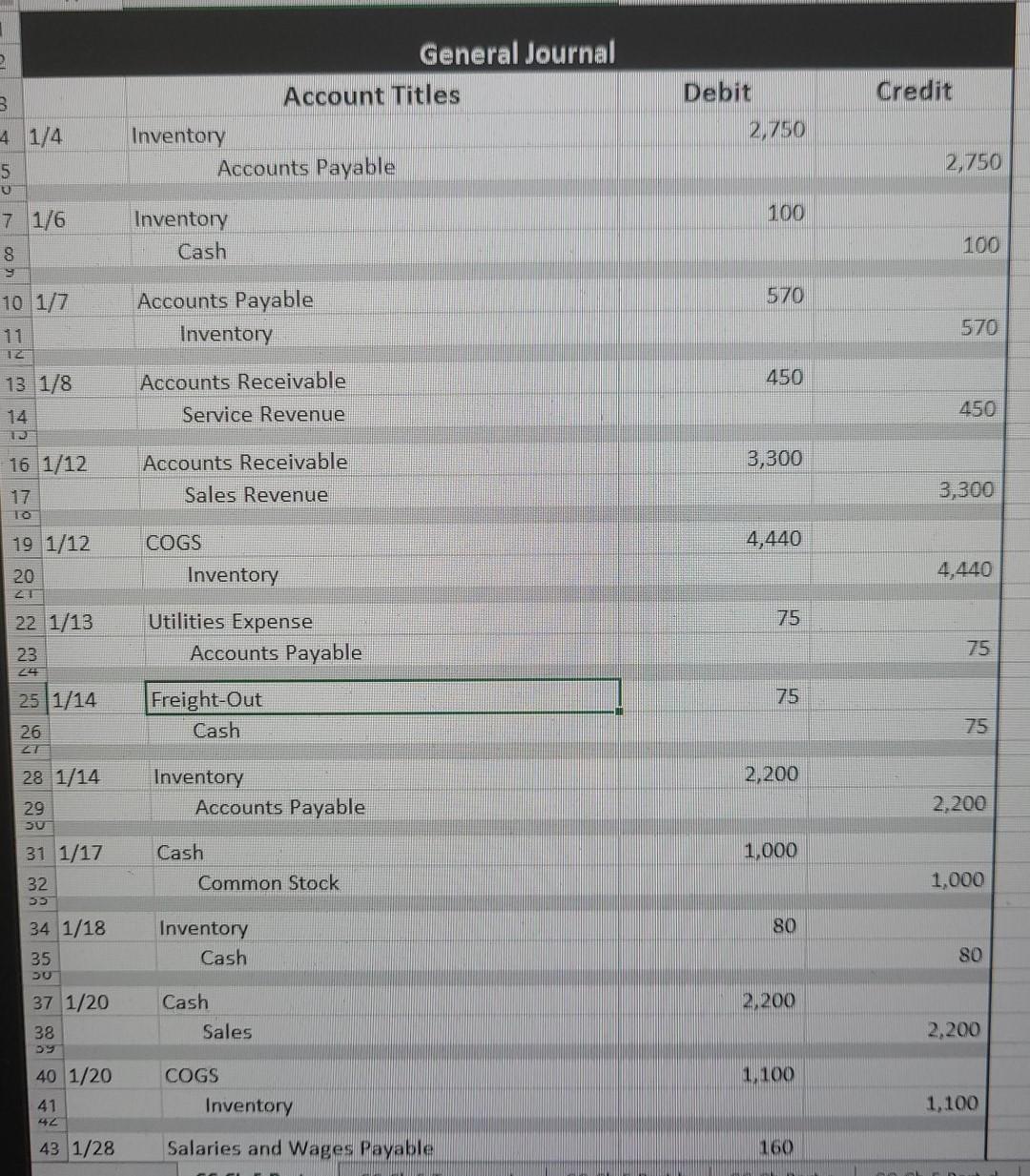

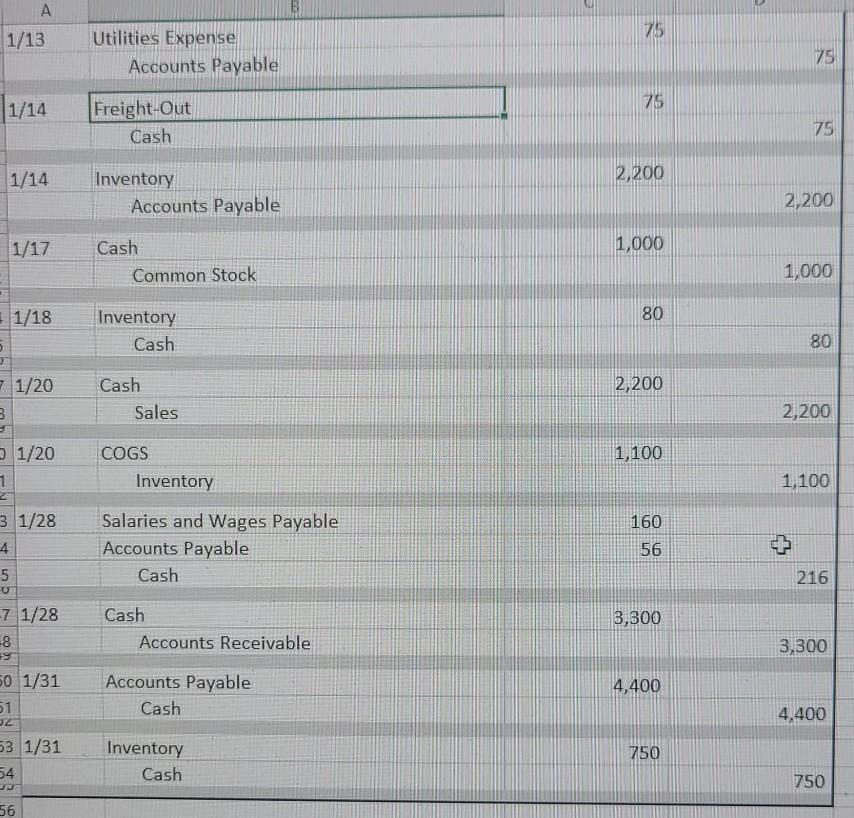

As of January 31, the following adjusting entry data are available. (HINT: Not all doto requires on entryl) 1. A count of brochures and posters reveals that none were used in January 2. A count of baking supplies reveals that none were used in January 3. Another month's worth of depreciation needs to be recorded on the baking equipment bought in November. (Recall that the baking equipment has a useful life of 5 years or 60 months - Refer to CC Ch 4 - ADJ2 for how to calculate monthly depreciation amount.) 4. One month's worth of amortization (write-off) needs to be recorded on the website. (Recall that the website has a useful life of 2 years or 24 months Refer to CC Ch 4 for monthly amortization amount - ADJ3) 5. An additional month's worth of interest on her grandmother's loan needs to be accrued. (The interest rate is 9%- note amount x interest rate divide by 12 months = monthly interest) 6. One month's worth of insurance has expired. (had prepaid $1,200 for one year of insurance) 7. Natalie receives her cell phone bill, $75. The bill is for services provided in January and is due February 15. (Recall that the cell phone is used only for business purposes.) 8. An analysis of the unearned revenue account reveals that Natalie has not had time to teach any of these lessons this month because she has been so busy selling mixers. As a result there is no change to the unearned revenue account. Natalie hopes to schedule the outstanding lessons in February. 9. An inventory count of mixers at the end of January reveals that Natalie has three mixers. 1 Credit General Journal Account Titles Inventory Accounts Payable Debit 2,750 4 1/4 5 2,750 7 1/6 100 Inventory Cash 100 8 9 10 1/7 570 Accounts Payable Inventory 570 13 1/8 450 Accounts Receivable Service Revenue 14 450 16 1/12 3,300 Accounts Receivable Sales Revenue 3,300 17 TO 4,440 19 1/12 20 21 22 1/13 COGS Inventory 4,440 75 Utilities Expense Accounts Payable 75 23 24 25 1/14 75 Freight-Out Cash 26 75 2,200 28 1/14 29 Inventory Accounts Payable 2,200 SU 31 1/17 1,000 Cash Common Stock 1,000 32 S 80 Inventory Cash 80 34 1/18 35 DU 37 1/20 38 2,200 Cash Sales 2,200 Dy 1.100 40 1/20 41 COGS Inventory 1,100 42 43 1/28 Salaries and Wages Payable 160 A 75 1/13 Utilities Expense Accounts Payable 75 1/14 75 Freight-Out Cash 75 1/14 2,200 Inventory Accounts Payable 2,200 1/17 1,000 Cash Common Stock 1,000 1/18 80 Inventory Cash 80 5 3 2,200 7 1/20 3 Cash Sales 2,200 1,100 0 1/20 1 COGS Inventory 1,100 3 1/28 4. 5 Salaries and Wages Payable Accounts Payable Cash 160 56 216 7 1/28 3,300 Cash Accounts Receivable 8 3,300 Accounts Payable Cash 4,400 4,400 50 1/31 51 32 53 1/31 54 750 Inventory Cash 750 56 As of January 31, the following adjusting entry data are available. (HINT: Not all doto requires on entryl) 1. A count of brochures and posters reveals that none were used in January 2. A count of baking supplies reveals that none were used in January 3. Another month's worth of depreciation needs to be recorded on the baking equipment bought in November. (Recall that the baking equipment has a useful life of 5 years or 60 months - Refer to CC Ch 4 - ADJ2 for how to calculate monthly depreciation amount.) 4. One month's worth of amortization (write-off) needs to be recorded on the website. (Recall that the website has a useful life of 2 years or 24 months Refer to CC Ch 4 for monthly amortization amount - ADJ3) 5. An additional month's worth of interest on her grandmother's loan needs to be accrued. (The interest rate is 9%- note amount x interest rate divide by 12 months = monthly interest) 6. One month's worth of insurance has expired. (had prepaid $1,200 for one year of insurance) 7. Natalie receives her cell phone bill, $75. The bill is for services provided in January and is due February 15. (Recall that the cell phone is used only for business purposes.) 8. An analysis of the unearned revenue account reveals that Natalie has not had time to teach any of these lessons this month because she has been so busy selling mixers. As a result there is no change to the unearned revenue account. Natalie hopes to schedule the outstanding lessons in February. 9. An inventory count of mixers at the end of January reveals that Natalie has three mixers. 1 Credit General Journal Account Titles Inventory Accounts Payable Debit 2,750 4 1/4 5 2,750 7 1/6 100 Inventory Cash 100 8 9 10 1/7 570 Accounts Payable Inventory 570 13 1/8 450 Accounts Receivable Service Revenue 14 450 16 1/12 3,300 Accounts Receivable Sales Revenue 3,300 17 TO 4,440 19 1/12 20 21 22 1/13 COGS Inventory 4,440 75 Utilities Expense Accounts Payable 75 23 24 25 1/14 75 Freight-Out Cash 26 75 2,200 28 1/14 29 Inventory Accounts Payable 2,200 SU 31 1/17 1,000 Cash Common Stock 1,000 32 S 80 Inventory Cash 80 34 1/18 35 DU 37 1/20 38 2,200 Cash Sales 2,200 Dy 1.100 40 1/20 41 COGS Inventory 1,100 42 43 1/28 Salaries and Wages Payable 160 A 75 1/13 Utilities Expense Accounts Payable 75 1/14 75 Freight-Out Cash 75 1/14 2,200 Inventory Accounts Payable 2,200 1/17 1,000 Cash Common Stock 1,000 1/18 80 Inventory Cash 80 5 3 2,200 7 1/20 3 Cash Sales 2,200 1,100 0 1/20 1 COGS Inventory 1,100 3 1/28 4. 5 Salaries and Wages Payable Accounts Payable Cash 160 56 216 7 1/28 3,300 Cash Accounts Receivable 8 3,300 Accounts Payable Cash 4,400 4,400 50 1/31 51 32 53 1/31 54 750 Inventory Cash 750 56Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started