Answered step by step

Verified Expert Solution

Question

1 Approved Answer

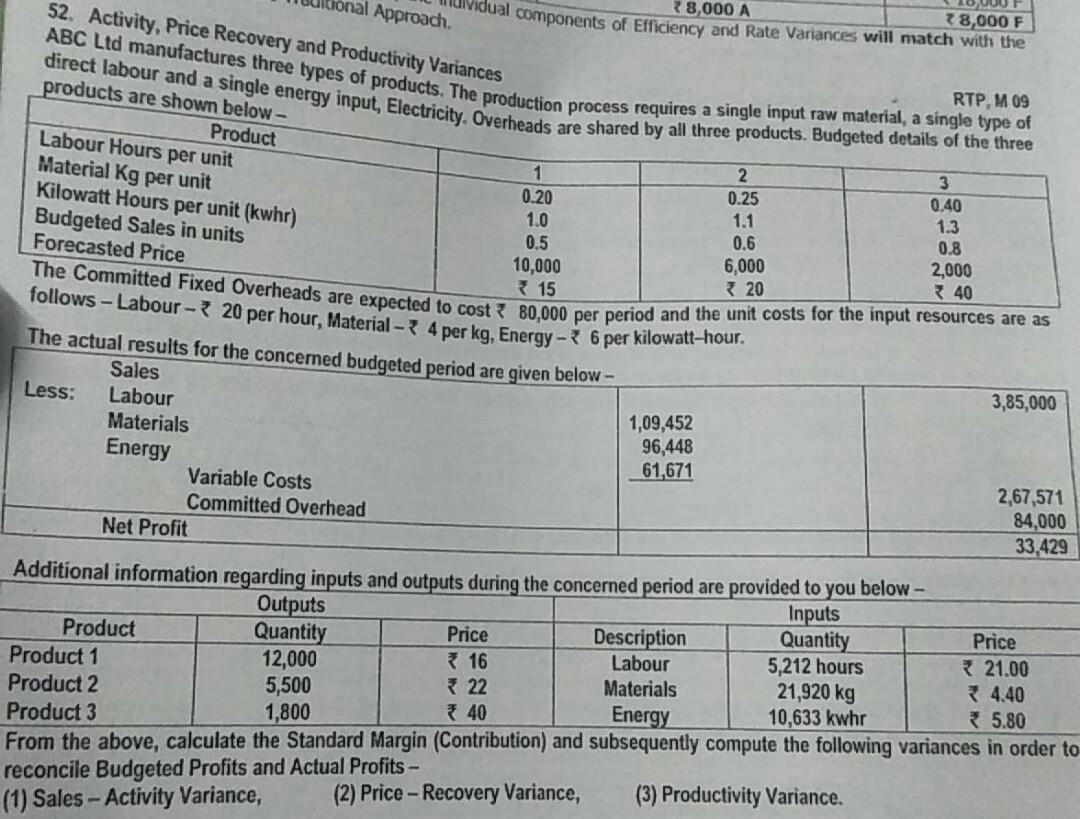

need all 52. Variances Approach 78,000 A dual components of Efficiency and Rate Variances will match with the 28,000 F direct labour and a single

need all

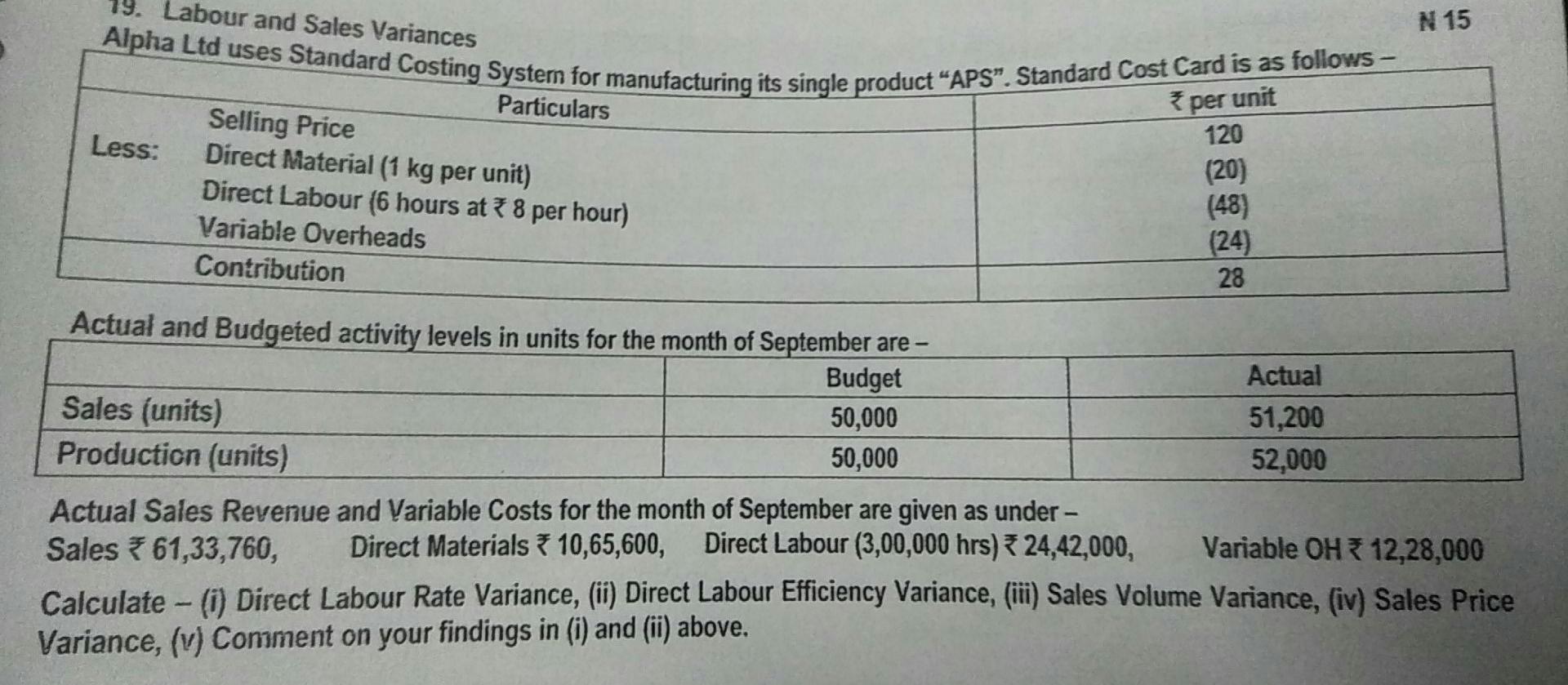

52. Variances Approach 78,000 A dual components of Efficiency and Rate Variances will match with the 28,000 F direct labour and a single energy input, Electricity. Overheads are shared by all three products. Budgeted details of the three ABC Ltd manufactures three types of products. The production process requires a single input raw material, a single type of RTP M 09 1 2. 3 0.20 0.25 0.40 1.0 1.1 1.3 0.5 0.6 0.8 10,000 6,000 2,000 The Committed Fixed Overheads are expected to cost 30,000 per period and the unit costs for the input resources are as 20 7.40 products are shown below- Product Labour Hours per unit Material Kg per unit Kilowatt Hours per unit (kwhr) Budgeted Sales in units Forecasted Price 15 follows - Labour - 20 per hour, Material 4 per kg, Energy - 6 per kilowatt-hour. The actual results for the concerned budgeted period are given below - Sales Less: Labour Materials Energy Variable Costs Committed Overhead Net Profit 3,85,000 1,09,452 96,448 61,671 2,67,571 84,000 33,429 Additional information regarding inputs and outputs during the concerned period are provided to you below - Outputs Inputs Product Quantity Price Description Quantity Price Product 1 12,000 16 Labour 5,212 hours 21.00 Product 2 5,500 22 Materials 21,920 kg * 4.40 Product 3 1,800 * 40 Energy 10,633 kwhr 5.80 From the above, calculate the Standard Margin (Contribution) and subsequently compute the following variances in order to reconcile Budgeted Profits and Actual Profits - (1) Sales - Activity Variance, (2) Price - Recovery Variance, (3) Productivity Variance. 19. Labour and Sales Variances N 15 Alpha Ltd uses Standard Costing System for manufacturing its single product "APS". Standard Cost Card is as follows - per unit Less: Particulars Selling Price Direct Material (1 kg per unit) Direct Labour (6 hours at 8 per hour) Variable Overheads Contribution 120 (20) (48) (24) 28 Actual and Budgeted activity levels in units for the month of September are - Budget Actual Sales (units) 50,000 51,200 Production (units) 50,000 52,000 Actual Sales Revenue and Variable Costs for the month of September are given as under - Sales 61,33,760, Direct Materials 10,65,600, Direct Labour (3,00,000 hrs) 24,42,000, Variable OH 12,28,000 Calculate - (i) Direct Labour Rate Variance, (ii) Direct Labour Efficiency Variance, (iii) Sales Volume Variance, (iv) Sales Price Variance, (v) Comment on your findings in (i) and (ii) aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started