Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need all answered rowed from the Bank of Alberta Payments to the vendors and the bank are being planned Sport Ltd purchases materials and services

need all answered

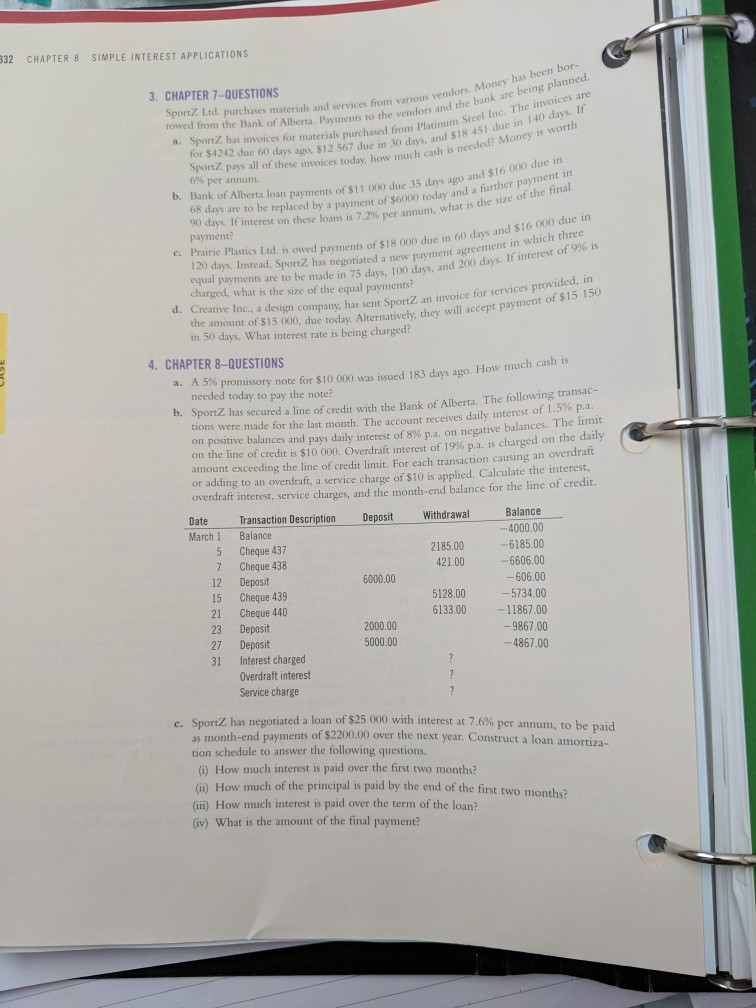

rowed from the Bank of Alberta Payments to the vendors and the bank are being planned Sport Ltd purchases materials and services from various vendors. Money has been bor a. Sport has invoices for materials purchased from Platinum Steel Inc. The invoices are for $4242 due 60 days ago, S12 567 due in 30 days, and 518:451 due in 140 days. If SportZ pays all of these invoices today, how much cash is needed? Money is worth b. Bank of Alberta loan payments of $11 000 due 35 days ago and 516 X due in 68 days are to be replaced by a payment of $6000 today and a further payment in 90 days. If interest on these loans is 7.2% per annum, what is the size of the final c. Prairie Plastics Ltd is owed payments of $18.000 due in 60 days and $16 000 due in 120 days. Instead, SportZ has negotiated a new payment agreement in which three equal payments are to be made in 75 days, 100 days, and 200 days. If interest of 996 is d. Creative Inc., a design company has sent SportZ an invoice for services provided, in the amount of $15 000, due today. Alternatively, they will accept payment of $15 150 332 CHAPTER 8 SIMPLE INTEREST APPLICATIONS CHAPTER 7-QUESTIONS 6% per annum payment? charged, what is the size of the equal payments? in 50 days. What interest rate is being charged? 4. CHAPTER 8-QUESTIONS a. A 5% promissory note for $10.000 was issued 183 days ago. How much cash is needed today to pay the note? b. SportZ has secured a line of credit with the Bank of Alberta. The following transac- tions were made for the last month. The account receives daily interest of 1.5% pa on positive balances and pays daily interest of 8% pa, on negative balances. The limit on the line of credit is $10 000. Overdraft interest of 19% p.a. is charged on the daily amount exceeding the line of credit limit. For each transaction causing an overdraft or adding to an overdraft, a service charge of $10 is applied. Calculate the interest, overdraft interest, service charges, and the month-end balance for the line of credit. Date Transaction Description Deposit Withdrawal Balance March Balance -4000.00 Cheque 437 2185.00 -6185.00 Cheque 438 421.00 -6606,00 12 Deposit 6000.00 - 606,00 15 Cheque 439 5128.00 --5734.00 21 Cheque 440 6133.00 -- 11867.00 23 Deposit 2000.00 -9867.00 27 Deposit 5000.00 31 Interest charged Overdraft interest Service charge 5 --4867.00 c. SportZ has negotiated a loan of 825 000 with interest at 7.6% per annum, to be paid as month-end payments of $2200.00 over the next year. Construct a loan amortiza- tion schedule to answer the following questions, 6) How much interest is paid over the first two months? () How much of the principal is paid by the end of the first two months (iii) How much interest is paid over the term of the loan? (iv) What is the amount of the final payment? rowed from the Bank of Alberta Payments to the vendors and the bank are being planned Sport Ltd purchases materials and services from various vendors. Money has been bor a. Sport has invoices for materials purchased from Platinum Steel Inc. The invoices are for $4242 due 60 days ago, S12 567 due in 30 days, and 518:451 due in 140 days. If SportZ pays all of these invoices today, how much cash is needed? Money is worth b. Bank of Alberta loan payments of $11 000 due 35 days ago and 516 X due in 68 days are to be replaced by a payment of $6000 today and a further payment in 90 days. If interest on these loans is 7.2% per annum, what is the size of the final c. Prairie Plastics Ltd is owed payments of $18.000 due in 60 days and $16 000 due in 120 days. Instead, SportZ has negotiated a new payment agreement in which three equal payments are to be made in 75 days, 100 days, and 200 days. If interest of 996 is d. Creative Inc., a design company has sent SportZ an invoice for services provided, in the amount of $15 000, due today. Alternatively, they will accept payment of $15 150 332 CHAPTER 8 SIMPLE INTEREST APPLICATIONS CHAPTER 7-QUESTIONS 6% per annum payment? charged, what is the size of the equal payments? in 50 days. What interest rate is being charged? 4. CHAPTER 8-QUESTIONS a. A 5% promissory note for $10.000 was issued 183 days ago. How much cash is needed today to pay the note? b. SportZ has secured a line of credit with the Bank of Alberta. The following transac- tions were made for the last month. The account receives daily interest of 1.5% pa on positive balances and pays daily interest of 8% pa, on negative balances. The limit on the line of credit is $10 000. Overdraft interest of 19% p.a. is charged on the daily amount exceeding the line of credit limit. For each transaction causing an overdraft or adding to an overdraft, a service charge of $10 is applied. Calculate the interest, overdraft interest, service charges, and the month-end balance for the line of credit. Date Transaction Description Deposit Withdrawal Balance March Balance -4000.00 Cheque 437 2185.00 -6185.00 Cheque 438 421.00 -6606,00 12 Deposit 6000.00 - 606,00 15 Cheque 439 5128.00 --5734.00 21 Cheque 440 6133.00 -- 11867.00 23 Deposit 2000.00 -9867.00 27 Deposit 5000.00 31 Interest charged Overdraft interest Service charge 5 --4867.00 c. SportZ has negotiated a loan of 825 000 with interest at 7.6% per annum, to be paid as month-end payments of $2200.00 over the next year. Construct a loan amortiza- tion schedule to answer the following questions, 6) How much interest is paid over the first two months? () How much of the principal is paid by the end of the first two months (iii) How much interest is paid over the term of the loan? (iv) What is the amount of the final paymentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started