need all answered

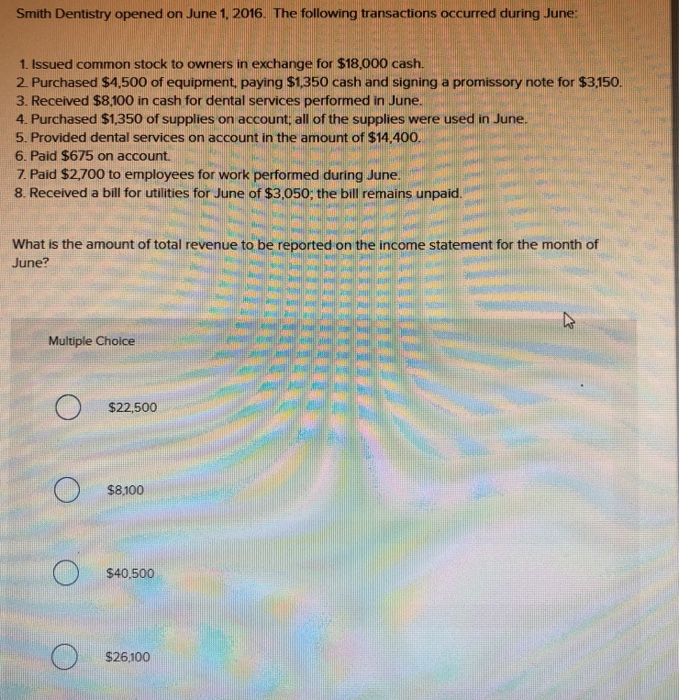

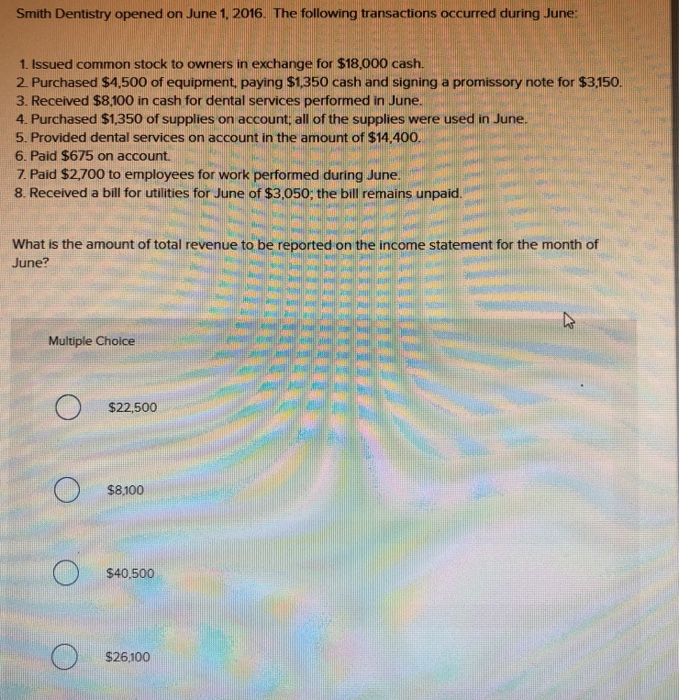

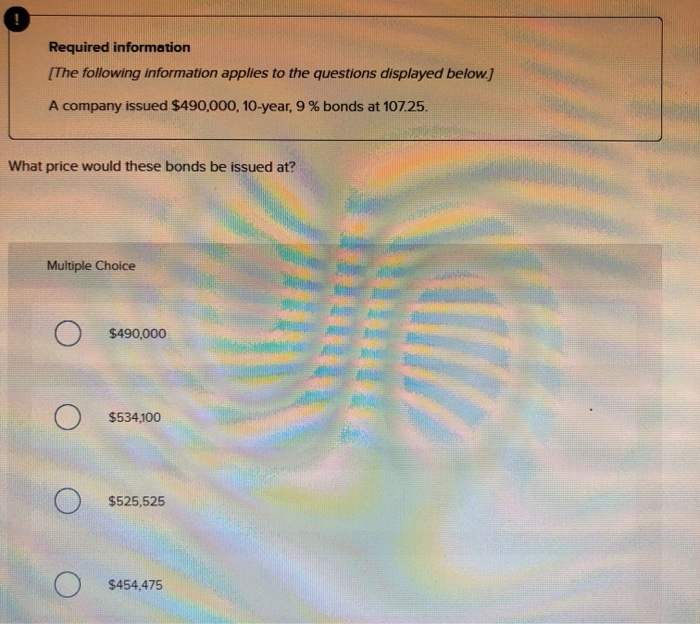

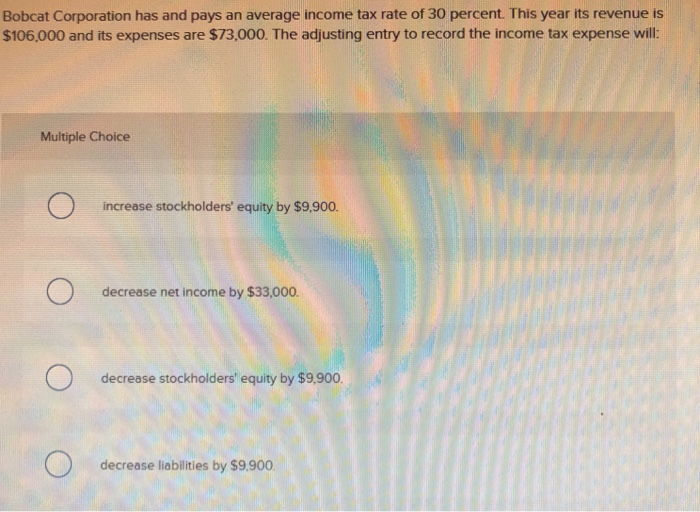

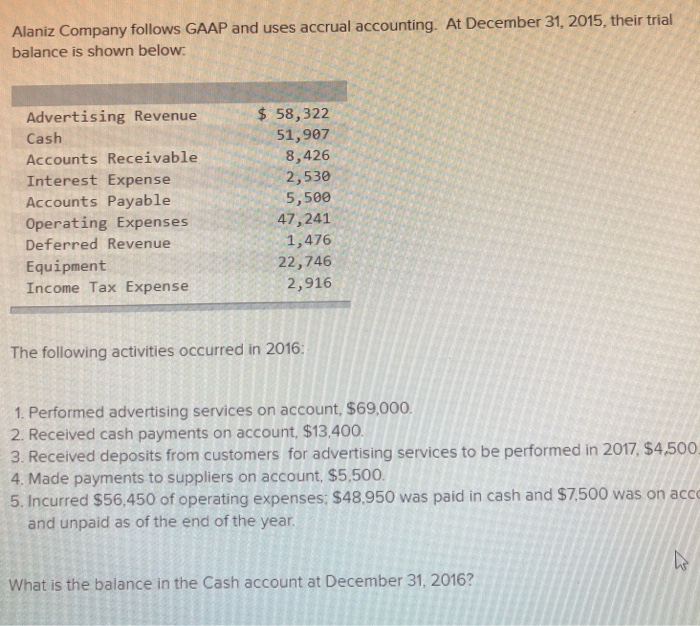

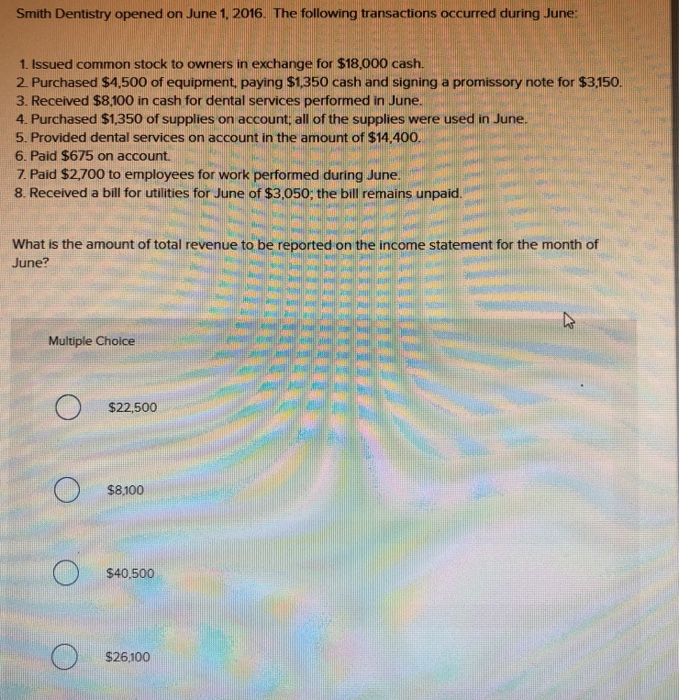

Smith Dentistry opened on June 1, 2016. The following transactions occurred during June 1. Issued common stock to owners in exchange for $18,000 cash. 2. Purchased $4,500 of equipment, paying $1,350 cash and signing a promissory note for $3,150. 3. Received $8,100 in cash for dental services performed in June. 4. Purchased $1,350 of supplies on account, all of the supplies were used in June. 5. Provided dental services on account in the amount of $14,400. 6. Paid $675 on account 7. Paid $2,700 to employees for work performed during June. 8. Received a bill for utilities for June of $3,050, the bill remains unpaid. What is the amount of total revenue to be reported on the income statement for the month of June? Multiple Choice $22,500 O $8,100 O $40,500 o $26,100 Required information [The following information applies to the questions displayed below.) A company issued $490,000, 10-year, 9% bonds at 107.25. What price would these bonds be issued at? Multiple Choice o $490,000 o $534100 o $525,525 o 5454.475 S454,475 Chris Company purchased a new piece of equipment for its research lab on January 1, 2015 for $43,200. The equipment is expected to have a useful life of four years after which it will have an expected residual value of $5,700. The company uses the straight-line method and decides to sell the equipment on January 1, 2017 after using the equipment for 2 years. Calcualte the gain or loss Chris Company will recognize if the research equipment is sold for $31,400. Multiple Choice gain of $4,850 o oo gain of $6,950 loss of $6,950. O loss of $4,850 Bobcat Corporation has and pays an average income tax rate of 30 percent. This year its revenue is $106,000 and its expenses are $73,000. The adjusting entry to record the income tax expense will: Multiple Choice O increase stockholders' equity by $9,900. O O decrease net income by $33,000. decrease stockholders' equity by $9,900. O decrease liabilities by $9.900. Alaniz Company follows GAAP and uses accrual accounting. At December 31, 2015, their trial balance is shown below: Advertising Revenue Cash Accounts Receivable Interest Expense Accounts Payable Operating Expenses Deferred Revenue Equipment Income Tax Expense $ 58,322 51,907 8,426 2,530 5,500 47,241 1,476 22,746 2,916 The following activities occurred in 2016: 1. Performed advertising services on account, $69,000. 2. Received cash payments on account. $13,400. 3. Received deposits from customers for advertising services to be performed in 2017, $4,500 4. Made payments to suppliers on account, $5,500. 5. Incurred $56,450 of operating expenses: $48,950 was paid in cash and $7,500 was on acco and unpaid as of the end of the year. What is the balance in the Cash account at December 31, 2016