Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need an answer ASAP, thank you Casino.com Corporation is building a $50 million office building in Las Vegas and is financing the construction at a

Need an answer ASAP, thank you

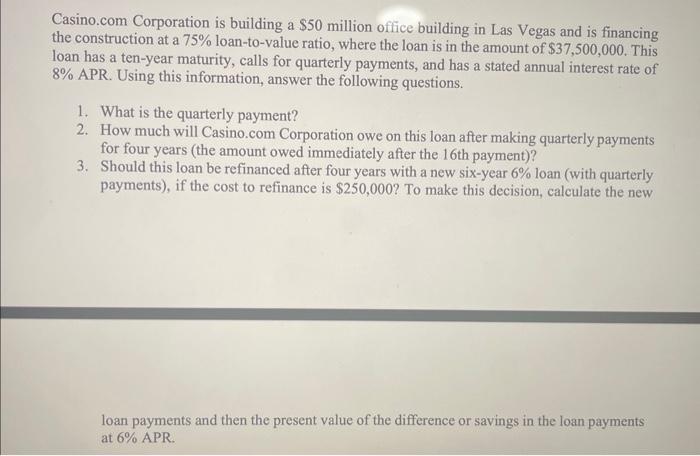

Casino.com Corporation is building a $50 million office building in Las Vegas and is financing the construction at a 75% loan-to-value ratio, where the loan is in the amount of $37,500,000. This loan has a ten-year maturity, calls for quarterly payments, and has a stated annual interest rate of 8% APR. Using this information, answer the following questions. 1. What is the quarterly payment? 2. How much will Casino.com Corporation owe on this loan after making quarterly payments for four years (the amount owed immediately after the 16 th payment)? 3. Should this loan be refinanced after four years with a new six-year 6% loan (with quarterly payments), if the cost to refinance is $250,000 ? To make this decision, calculate the new loan payments and then the present value of the difference or savings in the loan payments at 6% APR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started