Question

NEED ANSWER ASAP PLEASE !!! Linton Company purchased a delivery truck for $33,000 on January 1, 2017. The truck has an expected salvage value of

NEED ANSWER ASAP PLEASE !!!

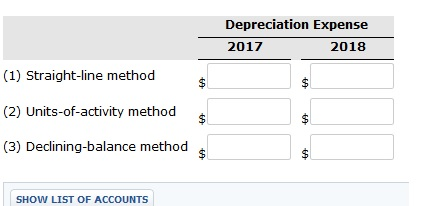

Linton Company purchased a delivery truck for $33,000 on January 1, 2017. The truck has an expected salvage value of $1,300, and is expected to be driven 109,000 miles over its estimated useful life of 9 years. Actual miles driven were 15,400 in 2017 and 12,500 in 2018.

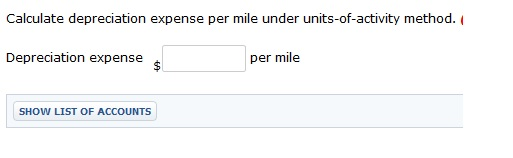

Compute depreciation expense for 2017 and 2018 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation rate to 0 decimal places, e.g. 15%. Round final answers to 0 decimal places, e.g. 2,125.)

Assume that Linton uses the straight-line method. Prepare the journal entry to record 2017 depreciation.

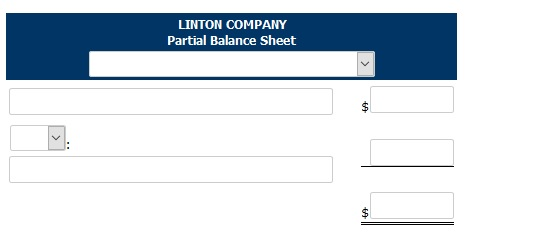

Assume that Linton uses the straight-line method. Show how the truck would be reported in the December 31, 2017, balance sheet. (Round answers to 0 decimal places, e.g. 2,125.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started