Answered step by step

Verified Expert Solution

Question

1 Approved Answer

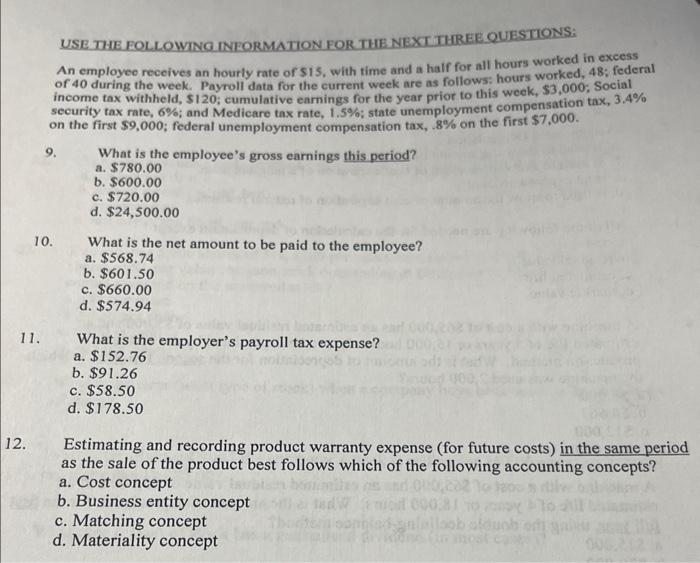

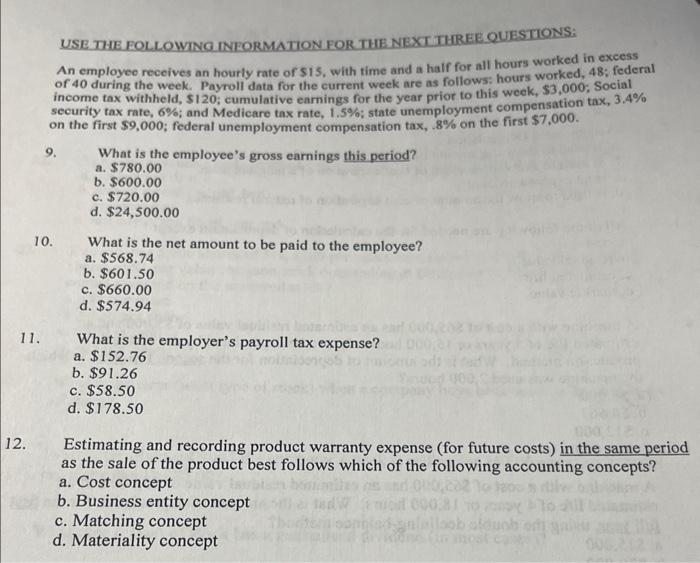

Need answer for 9-12 USE THE FOLLOWING INRORMATION FOR THE NEXT THREE QUESTIONS: An employee receives an hourly rate of s15, with time and a

Need answer for 9-12

USE THE FOLLOWING INRORMATION FOR THE NEXT THREE QUESTIONS: An employee receives an hourly rate of s15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 48 ; federal income tax withheld, $120; cumulative earnings for the year prior to this week, $3,000; Social security tax rate, 6%; and Medicare tax rate, 1.5\%; state unemployment compensation tax, 3.4% on the first $9,000; federal unemployment compensation tax, .8% on the first $7,000. 9. What is the employee's gross earnings this period? a. $780.00 b. $600.00 c. $720.00 d. $24,500.00 10. What is the net amount to be paid to the employee? a. $568.74 b. $601.50 c. $660.00 d. $574.94 11. What is the employer's payroll tax expense? a. $152.76 b. $91.26 c. $58.50 d. $178.50 2. Estimating and recording product warranty expense (for future costs) in the same period as the sale of the product best follows which of the following accounting concepts? a. Cost concept b. Business entity concept c. Matching concept d. Materiality concept

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started