Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answer for the question 4th Vikki and Tim Treble (ages 50 and 52) have been busy cleaning out Tim's parents' house since his mom

need answer for the question 4th

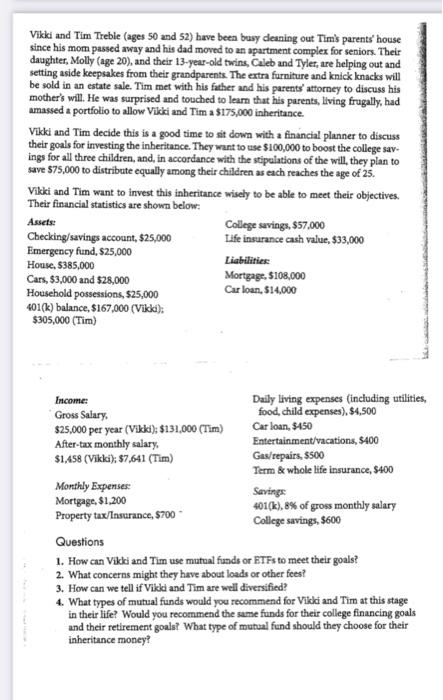

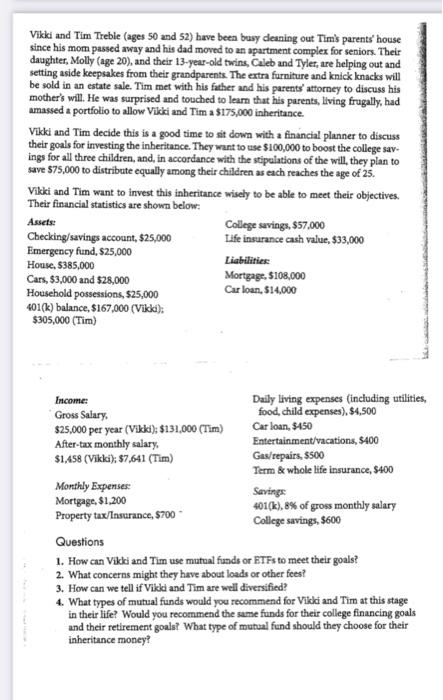

Vikki and Tim Treble (ages 50 and 52) have been busy cleaning out Tim's parents' house since his mom passed away and his dad moved to an apartment complex for seniors. Their daughter, Molly (age 20), and their 13-year-old twins, Caleb and Tyler, are helping out and setting aside keepsakes from their grandparents. The extra furniture and knick knacks will be sold in an estate sale. Tim met with his father and his parents' attorney to discuss his mother's will. He was surprised and touched to learn that his parents, living frugally, had amassed a portfolio to allow Vikki and Tim a $175,000 inheritance. Vikki and Tim decide this is a good time to sit down with a financial planner to discuss their goals for investing the inheritance. They want to use $100,000 to boost the college sav- ings for all three children, and, in accordance with the stipulations of the will, they plan to save $75,000 to distribute equally among their children as each reaches the age of 25. Vikki and Tim want to invest this inheritance wisely to be able to meet their objectives. Their financial statistics are shown below: Assets: College savings, $57,000 Checking/savings account, $25,000 Life insurance cash value, $33,000 Emergency fund, $25,000 House, 5385,000 Liabilities: Cars, $3,000 and $28,000 Mortgage, $108,000 Household possessions, $25,000 Carloan, $14,000 401(k) balance. $167,000 (Vicki): $305,000 (Tim) Income: Daily living expenses (including utilities, Gross Salary food, child expenses), $4,500 $25,000 per year (Vikki): $131,000 (Tim) Car loan, $450 After-tax monthly salary Entertainment/vacations, $400 $1,458 (Vikki): $7,641 (Tim) Gas/repairs, $500 Term & whole life insurance, $400 Monthly Expenses: Savings Mortgage, $1,200 401(k), 8% of gross monthly salary Property tax/Insurance, 8700 College savings, 8600 Questions 1. How can Vikki and Tim use mutual funds or ETFs to meet their goals? 2. What concerns might they have about loads or other fees? 3. How can we tell if Vikki and Tim are well diversified? 4. What types of mutual funds would you recommend for Vikki and Tim at this stage in their life? Would you recommend the same funds for their college financing goals and their retirement goals? What type of mutual fund should they choose for their inheritance money

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started