Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answer for this one. x 91 Search Textbook Solutions CH X Practise | AIWAS x New Tab 1-fleet01-xythos.s3.ap-southeast-2.amazonaws.com/5bfdd02798410/1195191?response-cache-control=private%2C%20max-age%3D216008 Week 10 Steve and his cousin

need answer for this one.

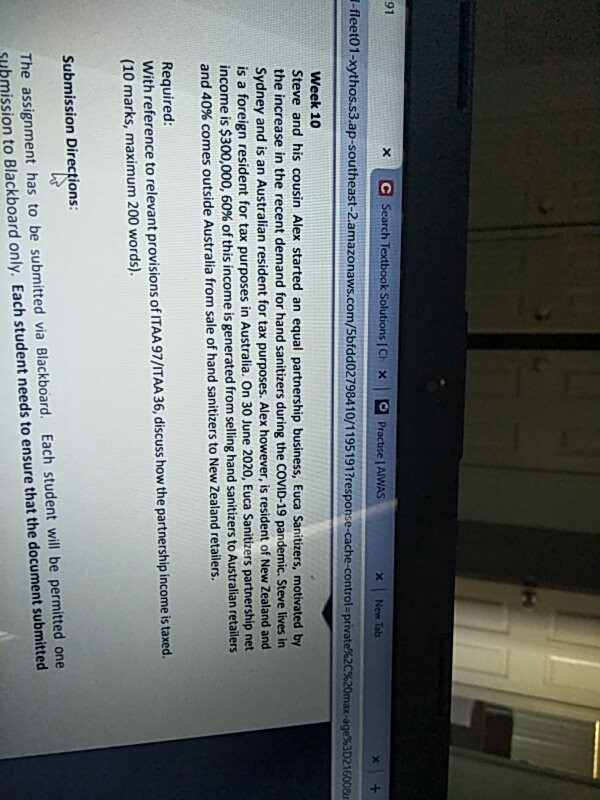

x 91 Search Textbook Solutions CH X Practise | AIWAS x New Tab 1-fleet01-xythos.s3.ap-southeast-2.amazonaws.com/5bfdd02798410/1195191?response-cache-control=private%2C%20max-age%3D216008 Week 10 Steve and his cousin Alex started an equal partnership business, Euca Sanitizers, motivated by the increase in the recent demand for hand sanitizers during the COVID-19 pandemic. Steve lives in Sydney and is an Australian resident for tax purposes. Alex however, is resident of New Zealand and is a foreign resident for tax purposes in Australia. On 30 June 2020, Euca Sanitizers partnership net income is $300,000, 60% of this income is generated from selling hand sanitizers to Australian retailers and 40% comes outside Australia from sale of hand sanitizers to New Zealand retailers. Required: With reference to relevant provisions of ITAA 97/ITAA 36, discuss how the partnership income is taxed. (10 marks, maximum 200 words). Submission Directions: The assignment has to be submitted via Blackboard. Each student will be permitted one nission to Blackboard only. Each student needs to ensure that the document submitted x 91 Search Textbook Solutions CH X Practise | AIWAS x New Tab 1-fleet01-xythos.s3.ap-southeast-2.amazonaws.com/5bfdd02798410/1195191?response-cache-control=private%2C%20max-age%3D216008 Week 10 Steve and his cousin Alex started an equal partnership business, Euca Sanitizers, motivated by the increase in the recent demand for hand sanitizers during the COVID-19 pandemic. Steve lives in Sydney and is an Australian resident for tax purposes. Alex however, is resident of New Zealand and is a foreign resident for tax purposes in Australia. On 30 June 2020, Euca Sanitizers partnership net income is $300,000, 60% of this income is generated from selling hand sanitizers to Australian retailers and 40% comes outside Australia from sale of hand sanitizers to New Zealand retailers. Required: With reference to relevant provisions of ITAA 97/ITAA 36, discuss how the partnership income is taxed. (10 marks, maximum 200 words). Submission Directions: The assignment has to be submitted via Blackboard. Each student will be permitted one nission to Blackboard only. Each student needs to ensure that the document submittedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started