Need answers for part B, and C the entries

Need answers for part B, and C the entries

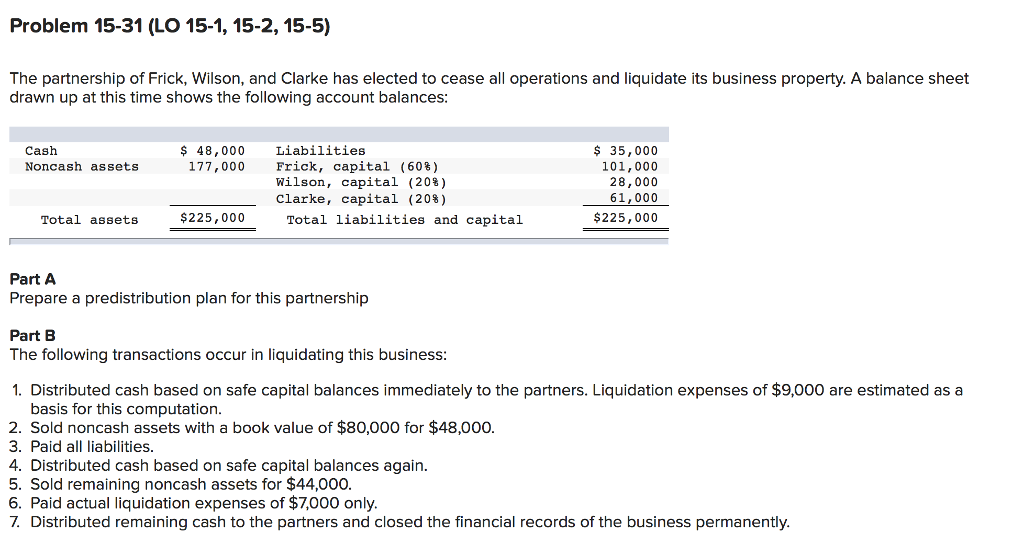

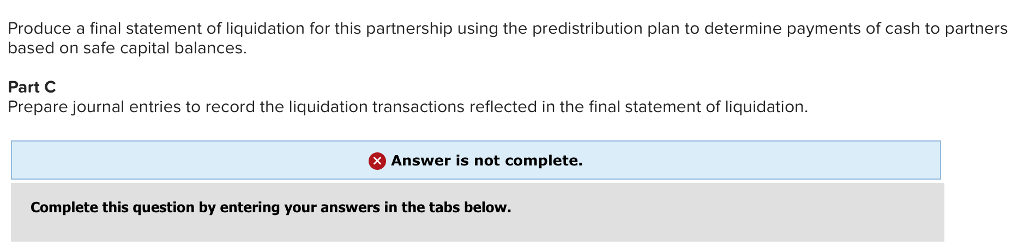

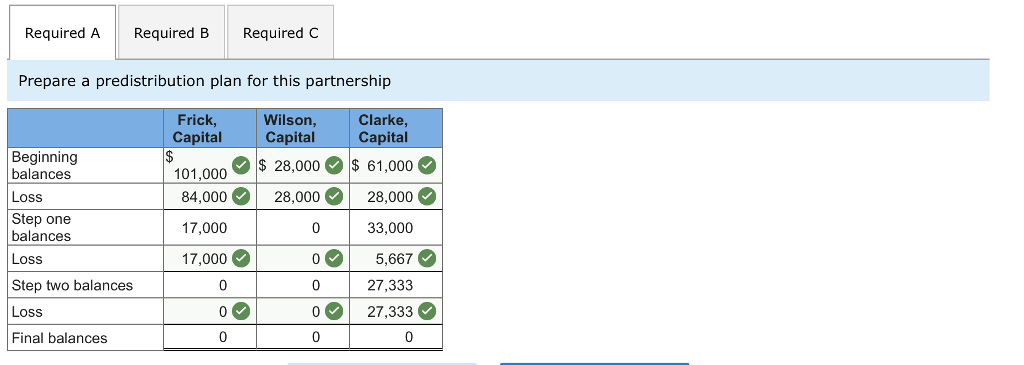

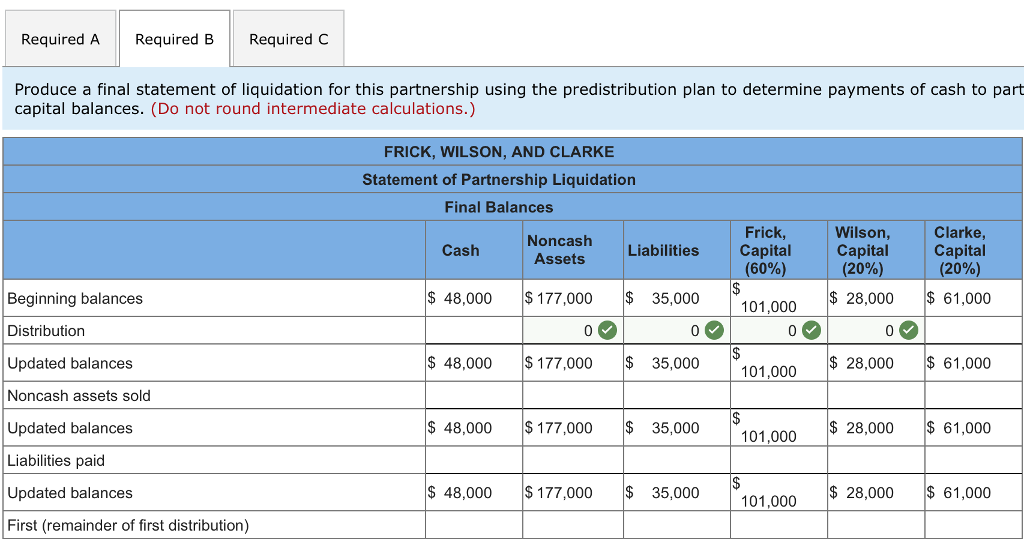

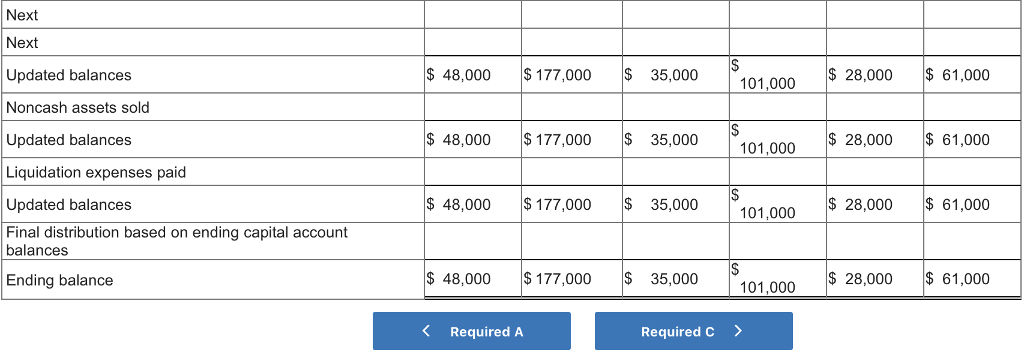

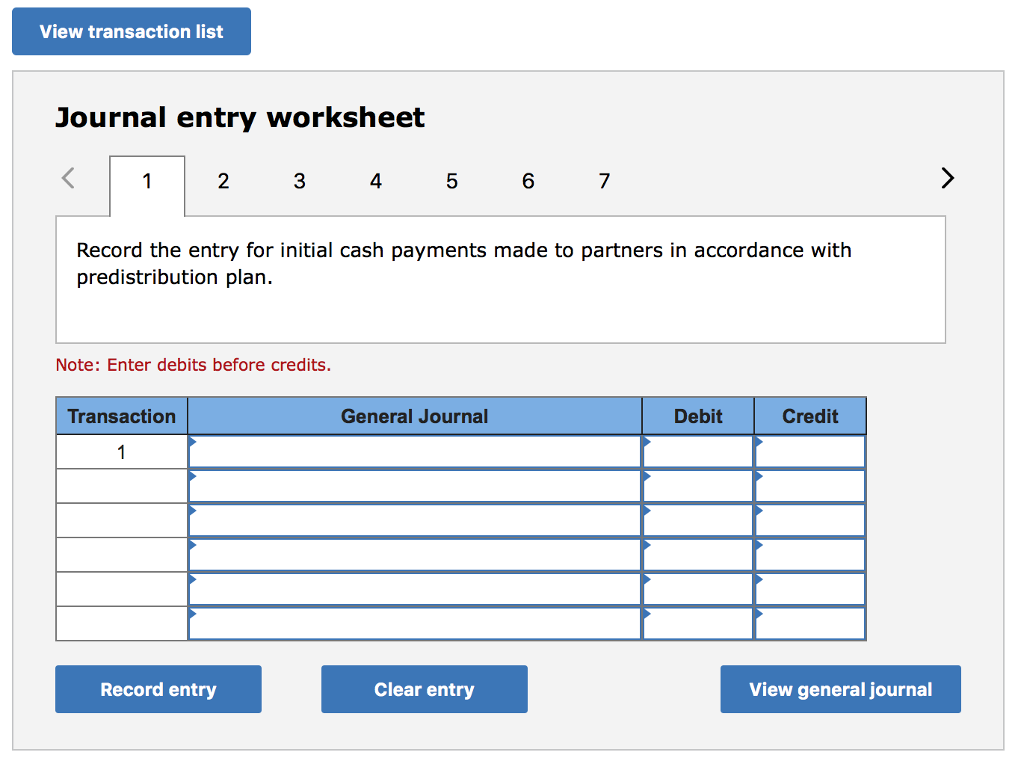

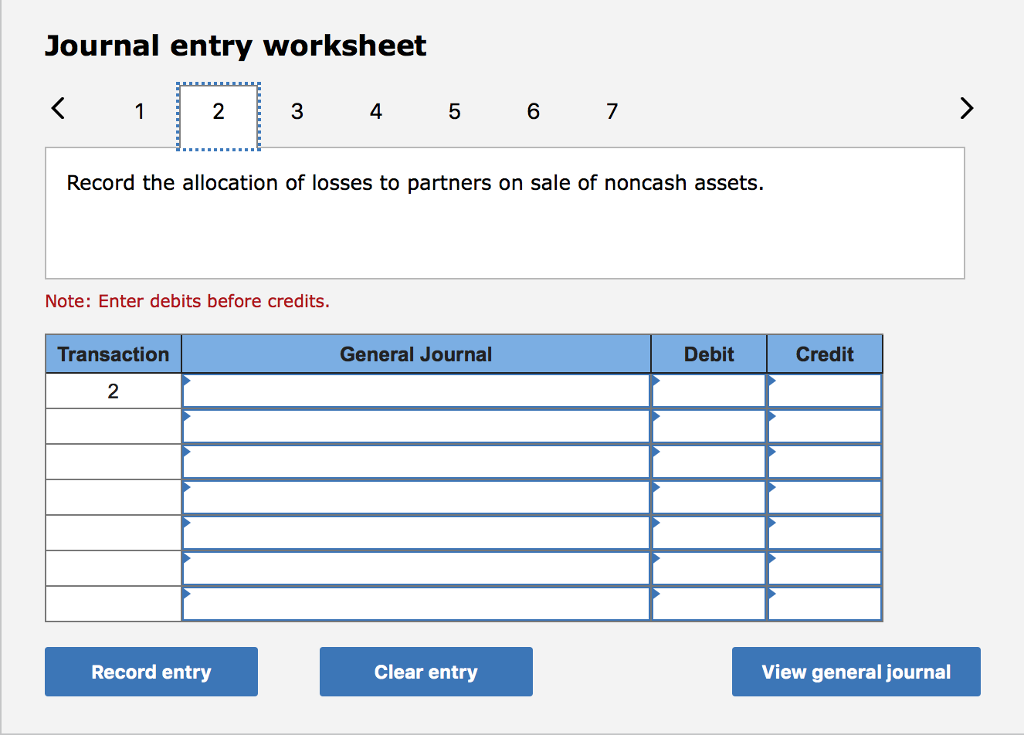

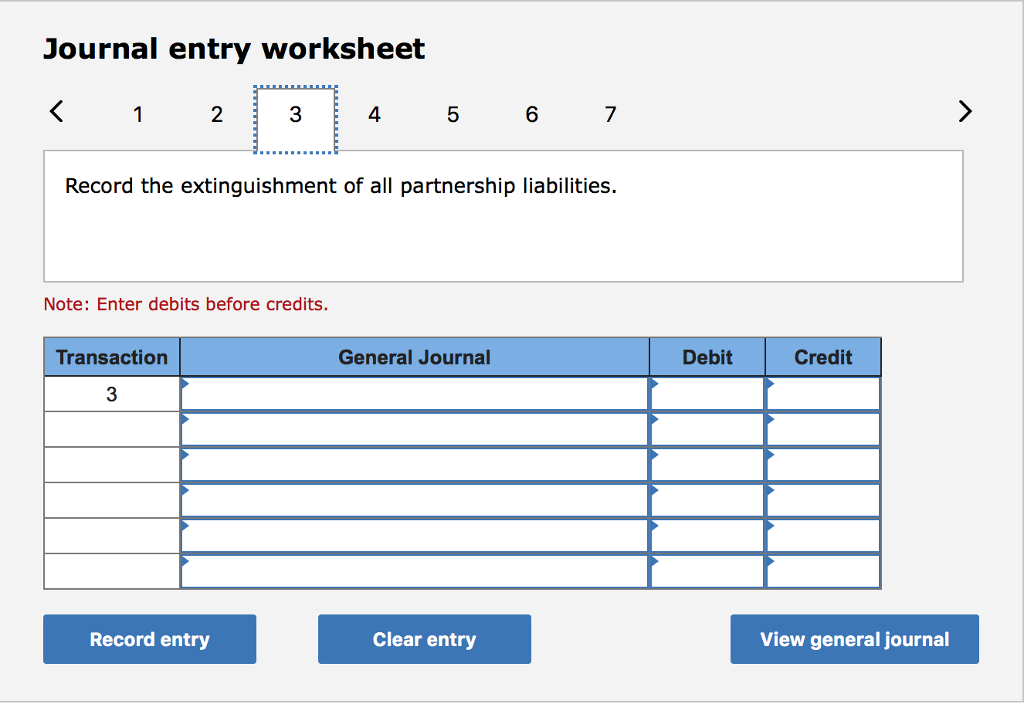

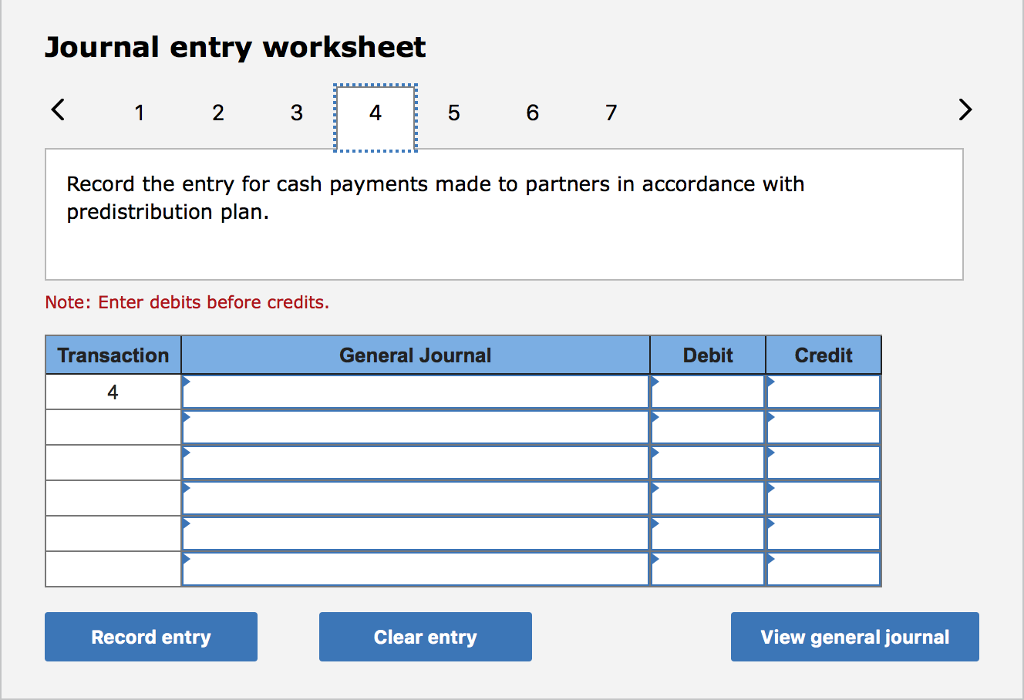

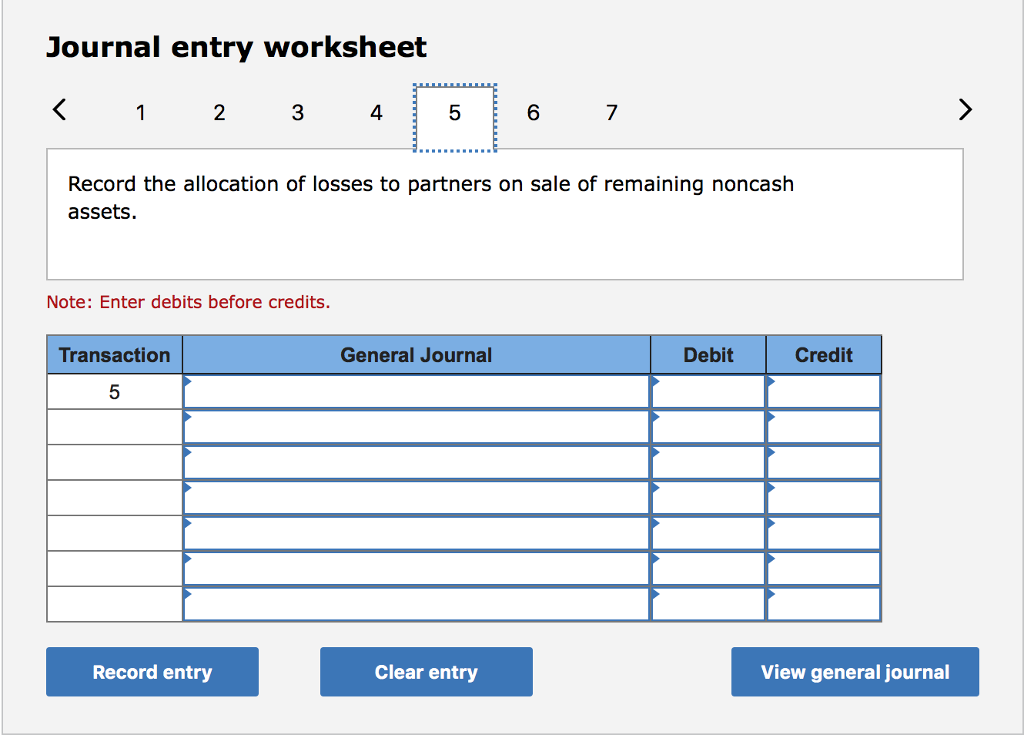

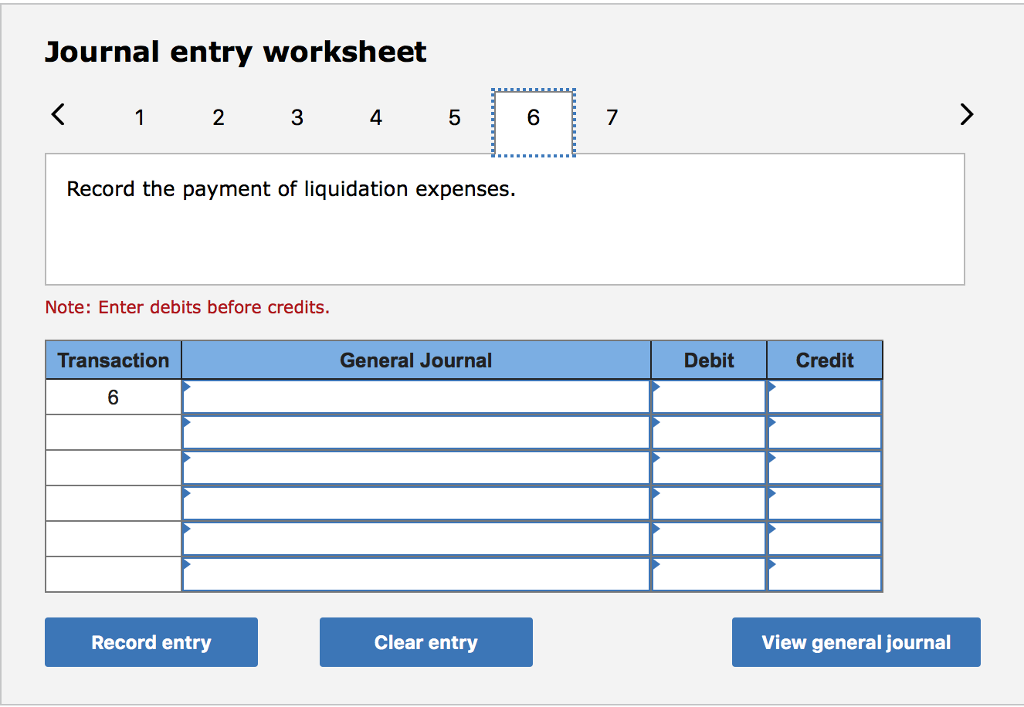

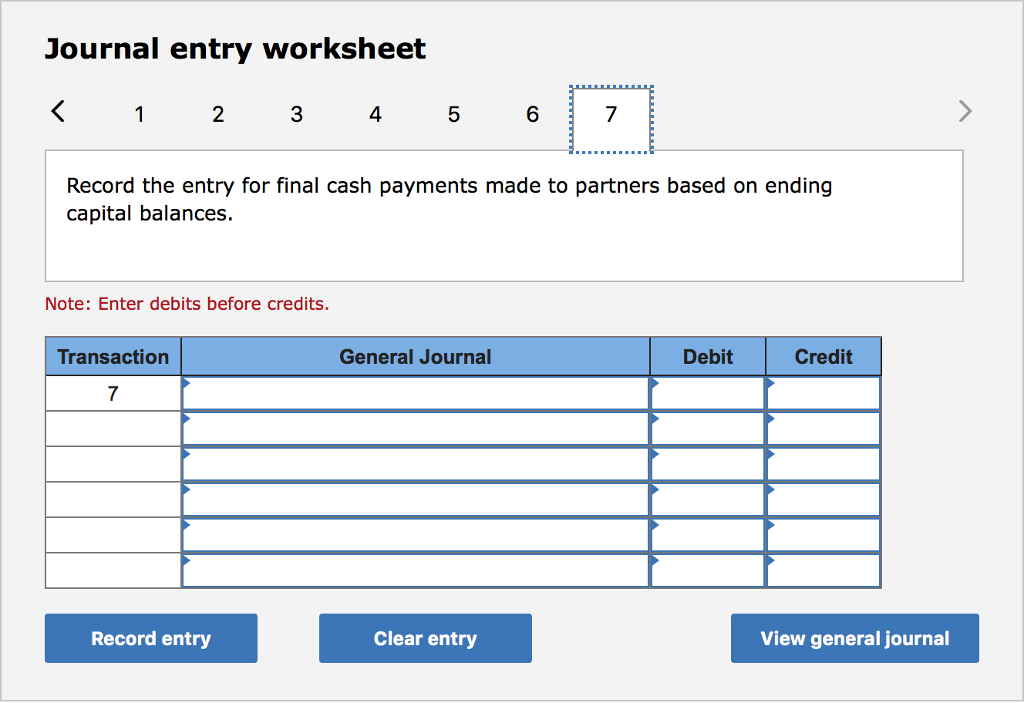

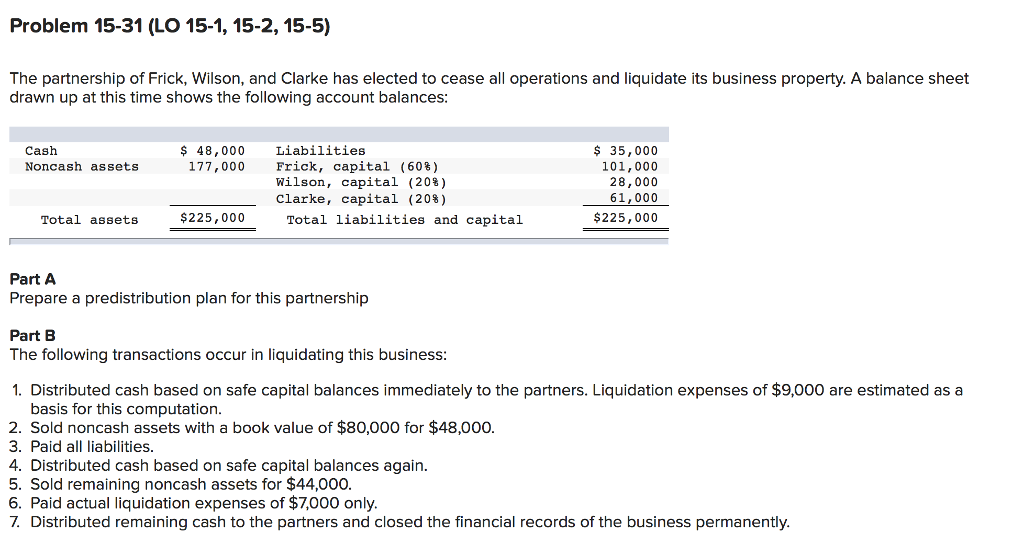

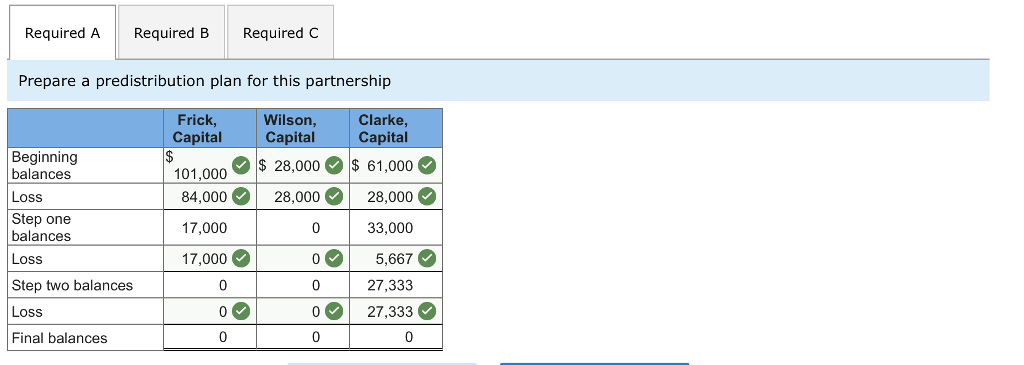

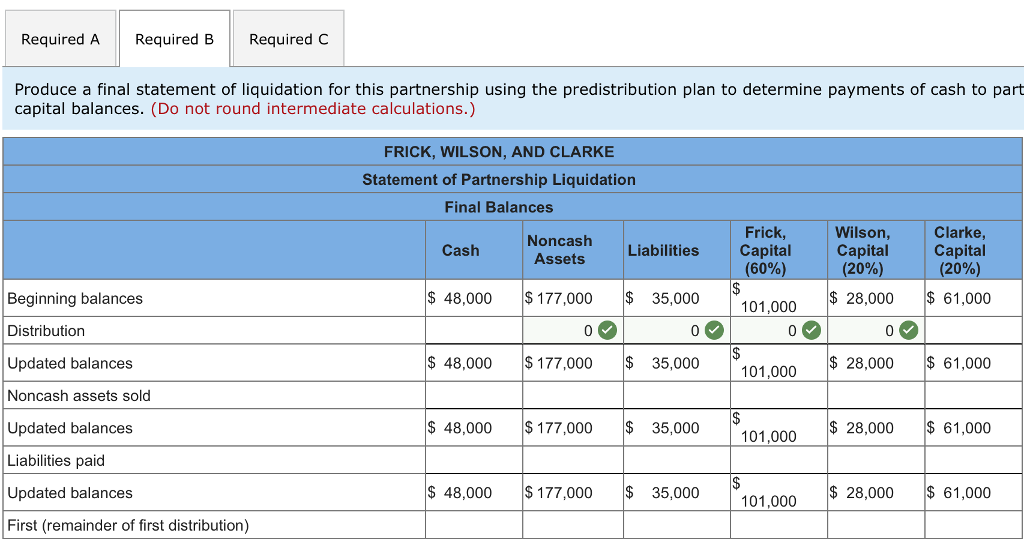

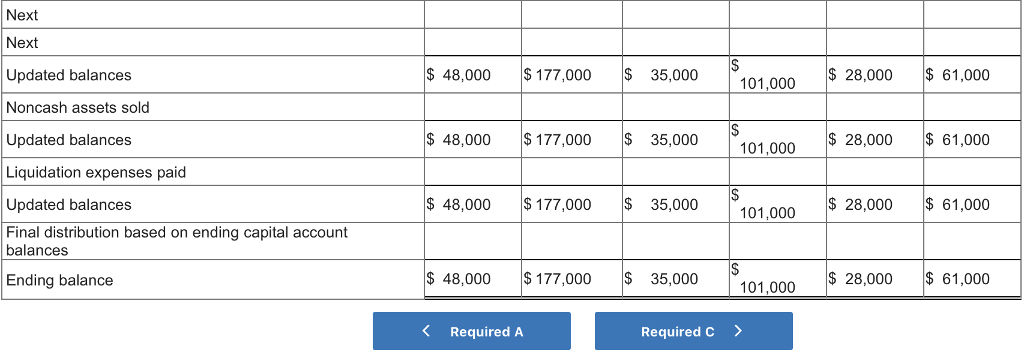

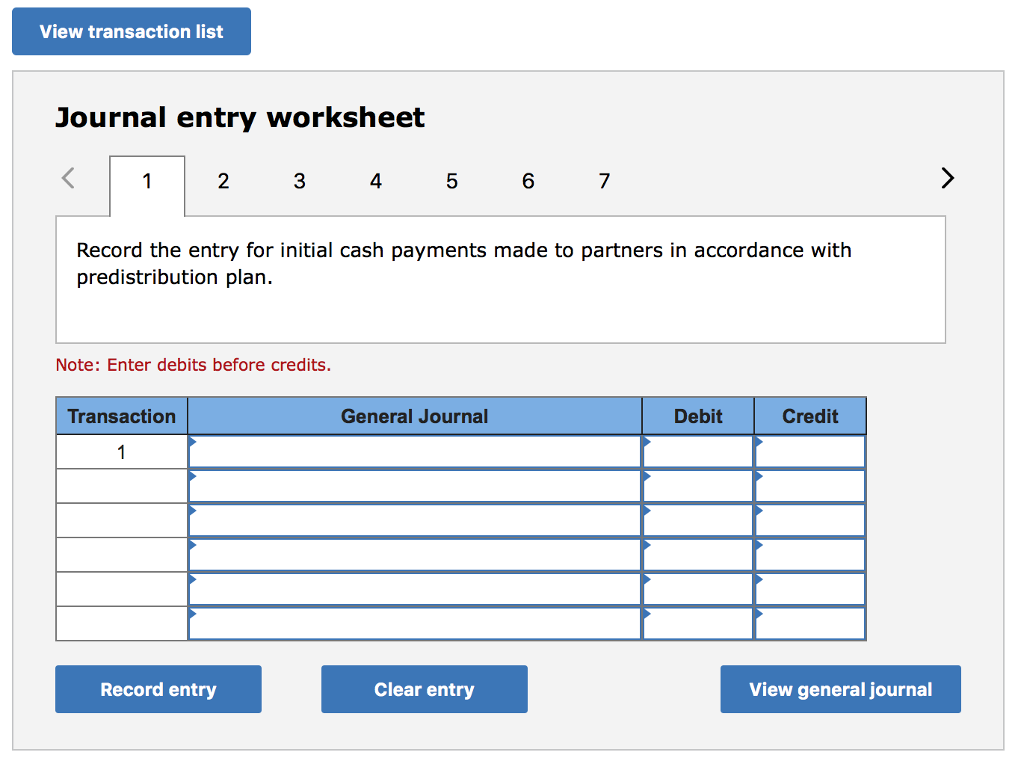

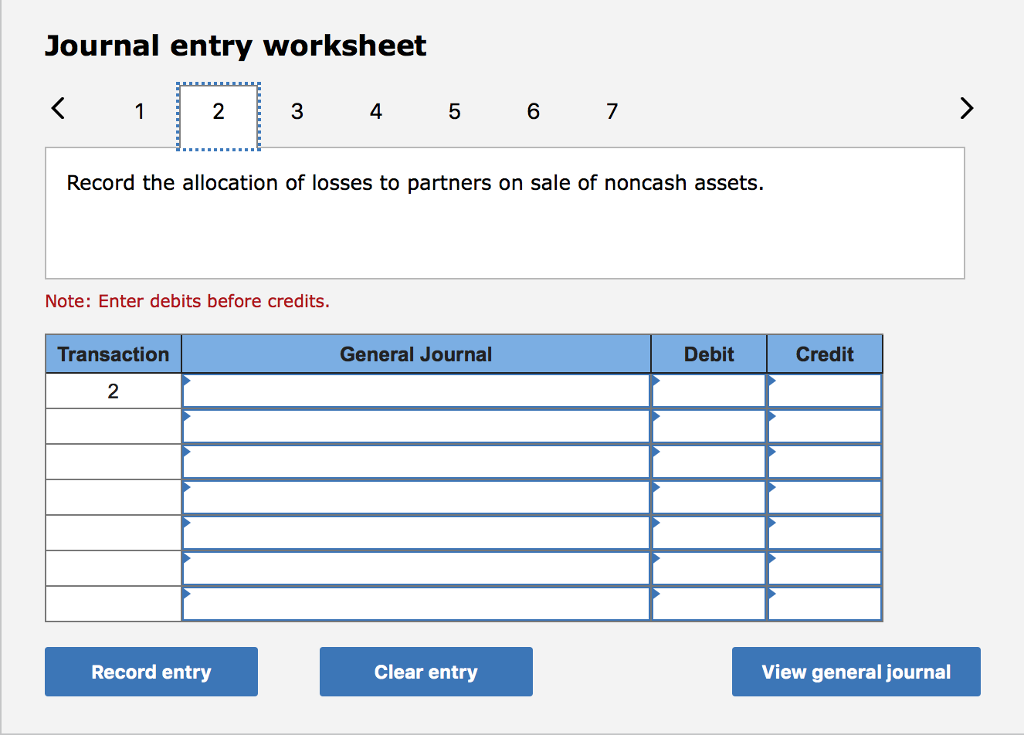

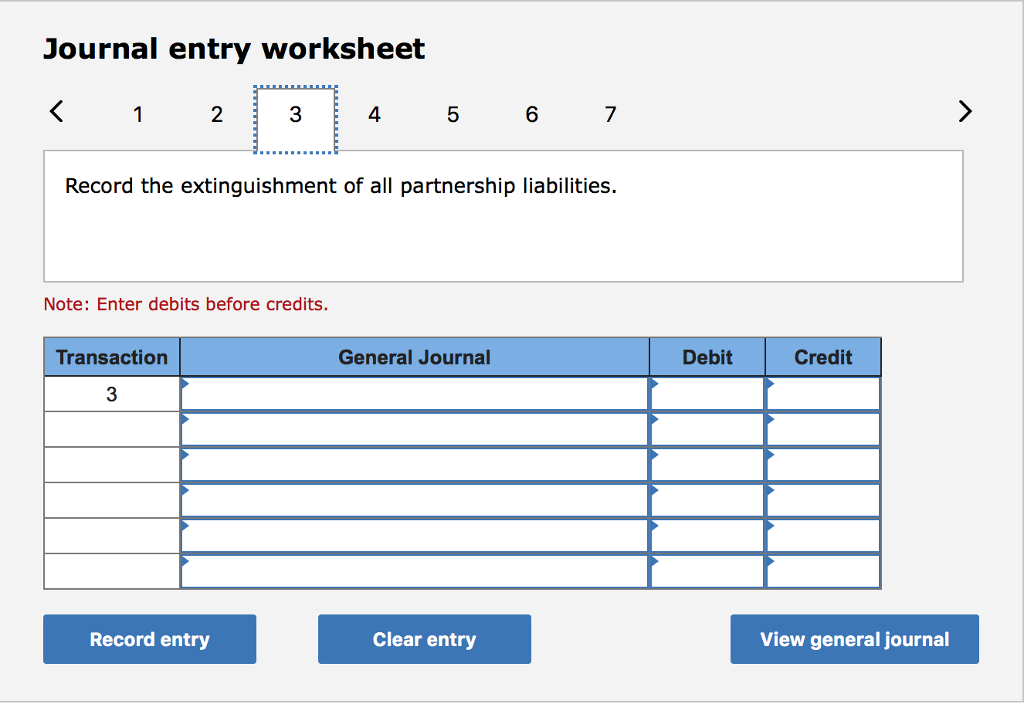

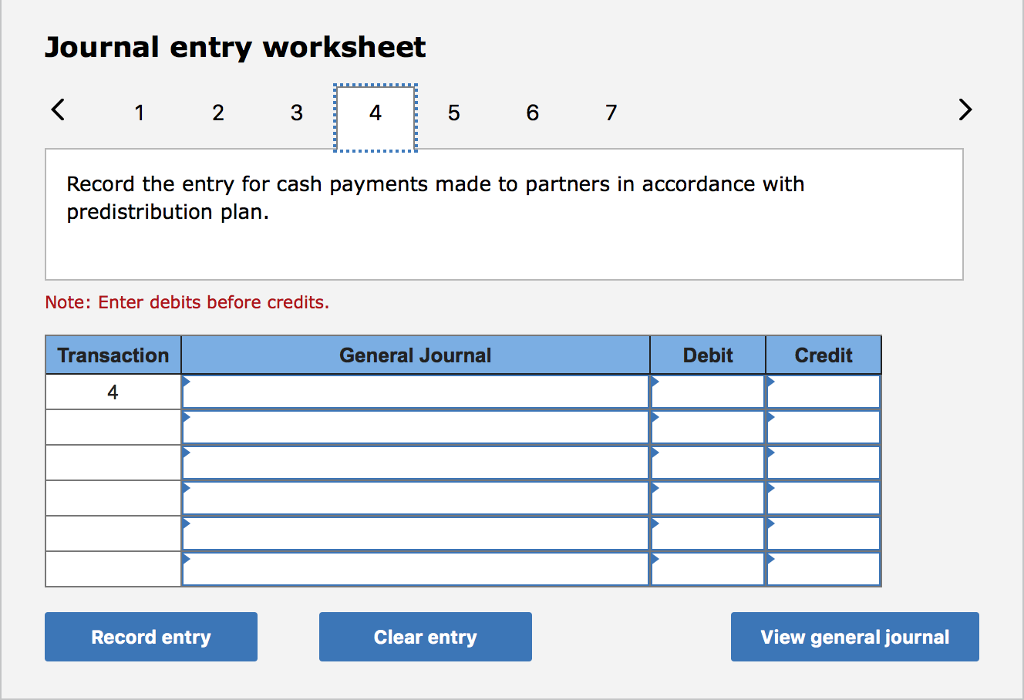

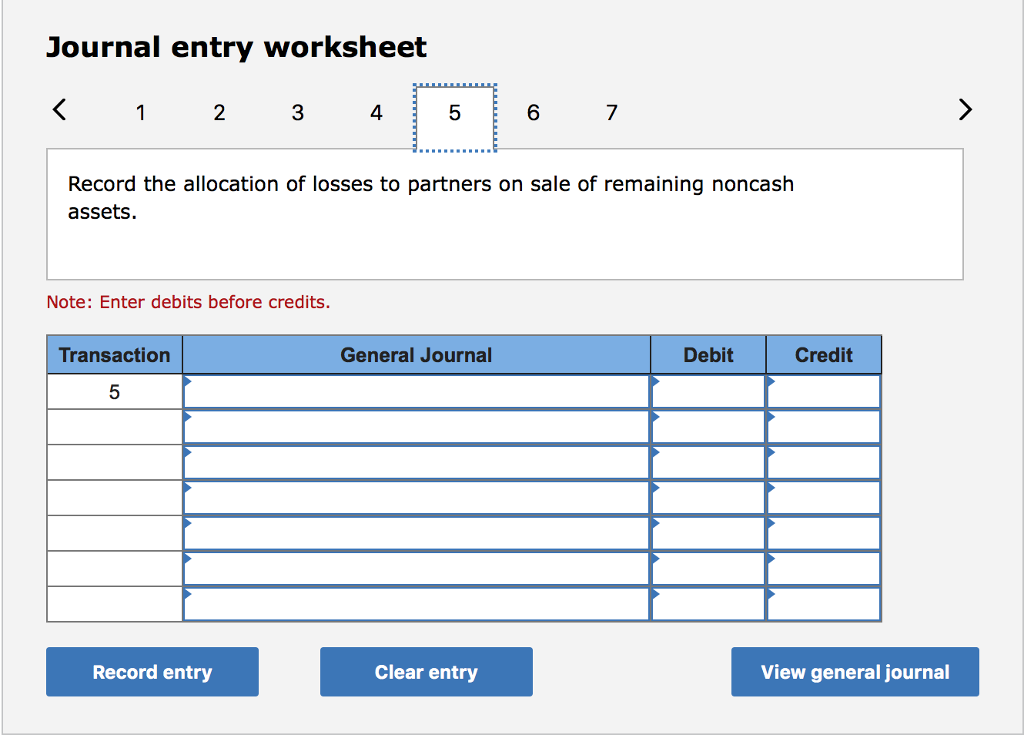

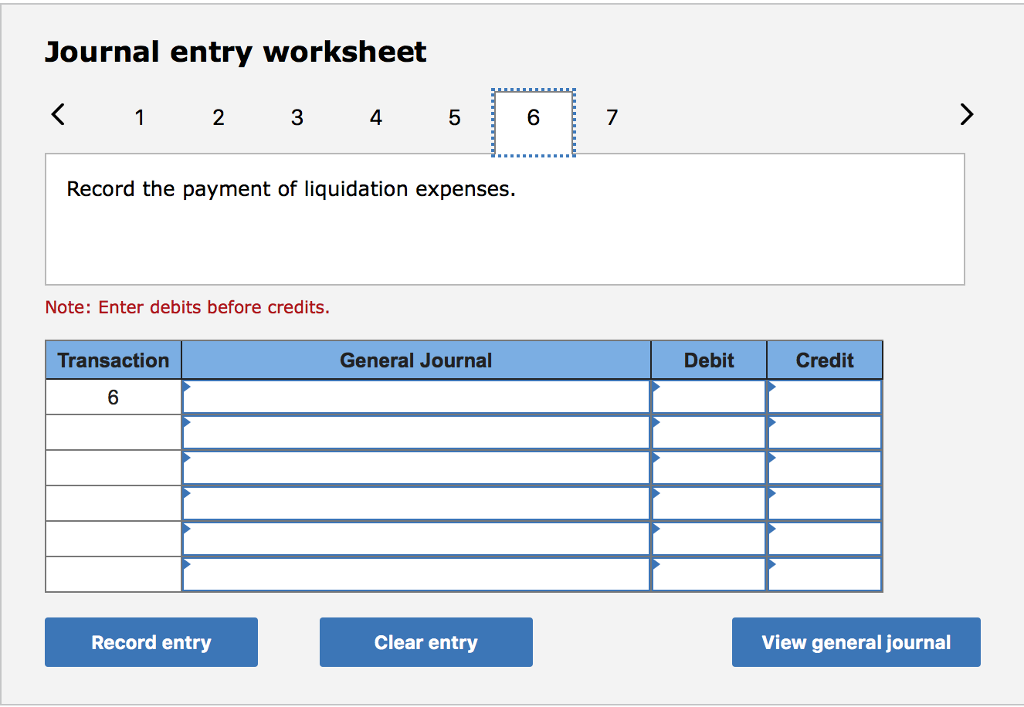

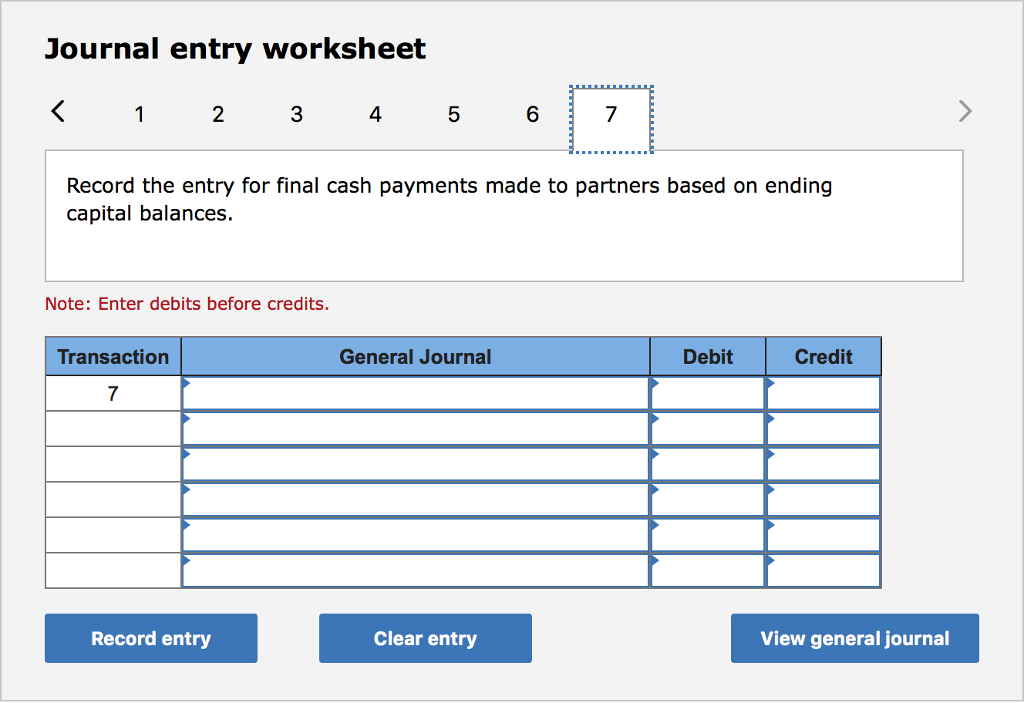

Problem 15-31 (LO 15-1,15-2,15-5) The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances $ 48,000 Liabilities $ 35,000 101,000 28,000 61,000 $225,000 Cash Noncash assets 177,000 Frick, capital (60) Wilson, capital (208) Clarke, capital (20 %) Total assets $225,000 Total liabilities and capital Part A Prepare a predistribution plan for this partnership Part B The following transactions occur in liquidating this business 1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of $9,000 are estimated as a basis for this computation 2. Sold noncash assets with a book value of $80,000 for $48,000 3. Paid all liabilities 4. Distributed cash based on safe capital balances again. 5. Sold remaining noncash assets for $44,000 6. Paid actual liquidation expenses of $7,000 only 7. Distributed remaining cash to the partners and closed the financial records of the business permanently Problem 15-31 (LO 15-1,15-2,15-5) The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances $ 48,000 Liabilities $ 35,000 101,000 28,000 61,000 $225,000 Cash Noncash assets 177,000 Frick, capital (60) Wilson, capital (208) Clarke, capital (20 %) Total assets $225,000 Total liabilities and capital Part A Prepare a predistribution plan for this partnership Part B The following transactions occur in liquidating this business 1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of $9,000 are estimated as a basis for this computation 2. Sold noncash assets with a book value of $80,000 for $48,000 3. Paid all liabilities 4. Distributed cash based on safe capital balances again. 5. Sold remaining noncash assets for $44,000 6. Paid actual liquidation expenses of $7,000 only 7. Distributed remaining cash to the partners and closed the financial records of the business permanently

Need answers for part B, and C the entries

Need answers for part B, and C the entries