Need answers for Questions 1,2, and 8. Would really appreciae it.

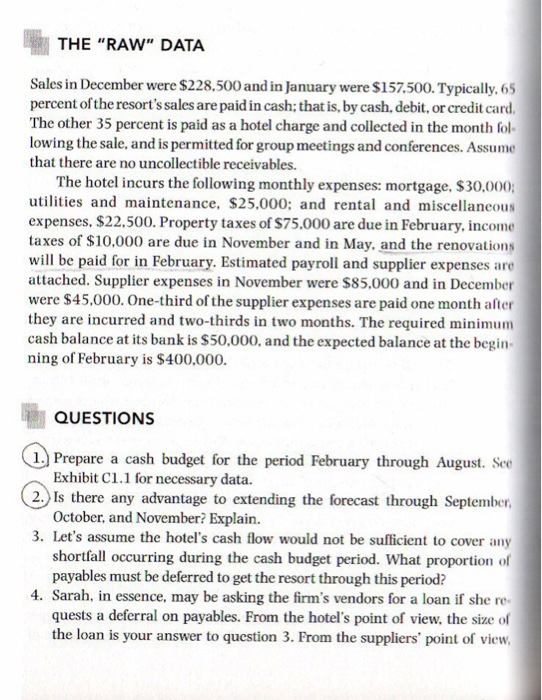

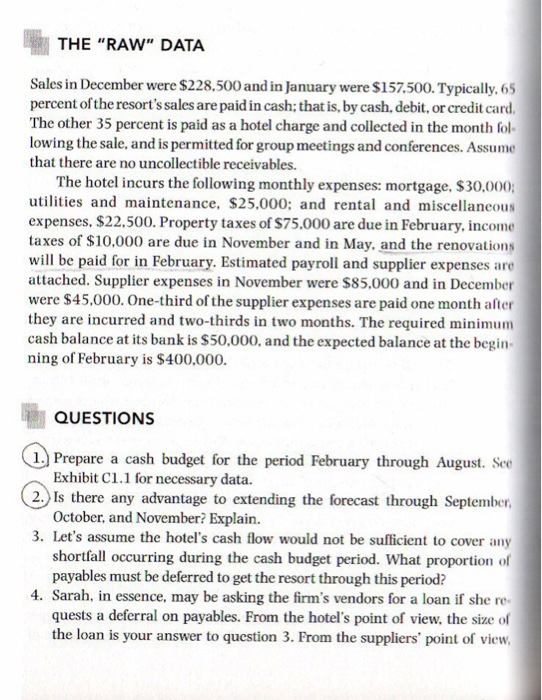

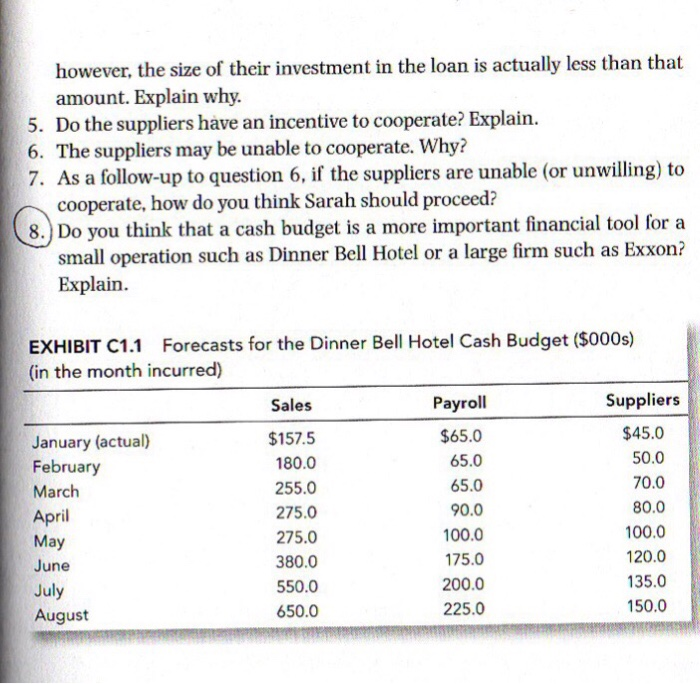

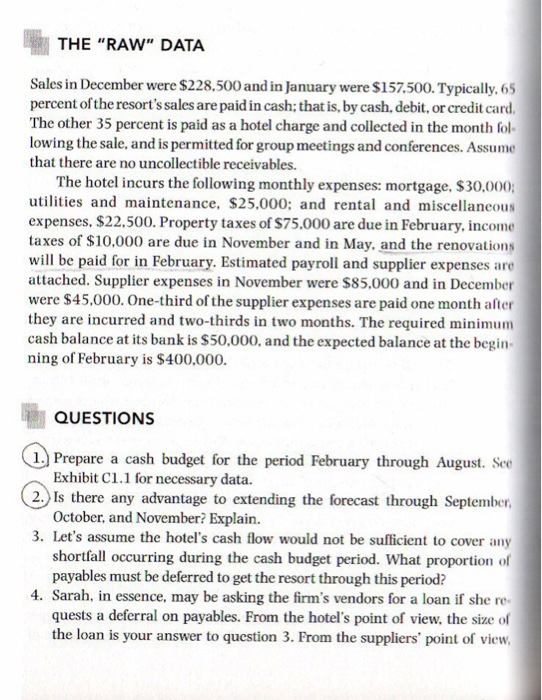

THE "RAW" DATA Sales in December were $228.500 and in January were $157.500. Typically. 65 percent ofthe resort's sales are paid in cash; that is, by cash, debit, or credit card. The other 35 percent is paid as a hotel charge and collected in the month fol lowing the sale, and is permitted for group meetings and conferences. Assume that there are no uncollectible receivables. The hotel incurs the following monthly expenses: mortgage, $30,000; utilities and maintenance, $25,000: and rental and miscellaneous expenses, $22.500. Property taxes of $75.000 are due in February, income taxes of $10,000 are due in November and in May, and the renovations will be paid for in February. Estimated payroll and supplier expenses are attached. Supplier expenses in November were $85,000 and in December were $45,000. One-third of the supplier expenses are paid one month after they are incurred and two-thirds in two months. The required minimum cash balance at its bank is $50.000, and the expected balance at the begin- ning of February is $400,000. QUESTIONS 1Prepare a cash budget for the period February through August. See 2s there any advantage to extending the forecast through September, 3. Let's assume the hotel's cash flow would not be suflicient to cover any Exhibit C1.1 for necessary data. October, and November? Explain. shortfall occurring during the cash budget period. What proportion of payables must be deferred to get the resort through this period? 4. Sarah, in essence, may be asking the firm's vendors for a loan if she re quests a deferral on payables. From the hotel's point of view, the size of the loan is your answer to question 3. From the suppliers' point of view however, the size of their investment in the loan is actually less than that amount. Explain why. 5. Do the suppliers have an incentive to cooperate? Explain. 6. The suppliers may be unable to cooperate. Why? 7. As a follow-up to question 6, if the suppliers are unable (or unwilling) to cooperate, how do you think Sarah should proceed? 8.) Do you think that a cash budget is a more important financial tool for a small operation such as Dinner Bell Hotel or a large firm such as Exxon? Explain EXHIBIT C1.1 Forecasts for the Dinner Bell Hotel Cash Budget ($000s) in the month incurred) January (actual) February March April May June July August Sales $157.5 180.0 255.0 275.0 275.0 380.0 550.0 650.0 Payroll $65.0 65.0 65.0 90.0 100.0 175.0 200.0 225.0 Suppliers $45.0 50.0 70.0 80.0 100.0 120.0 135.0 150.0