Answered step by step

Verified Expert Solution

Question

1 Approved Answer

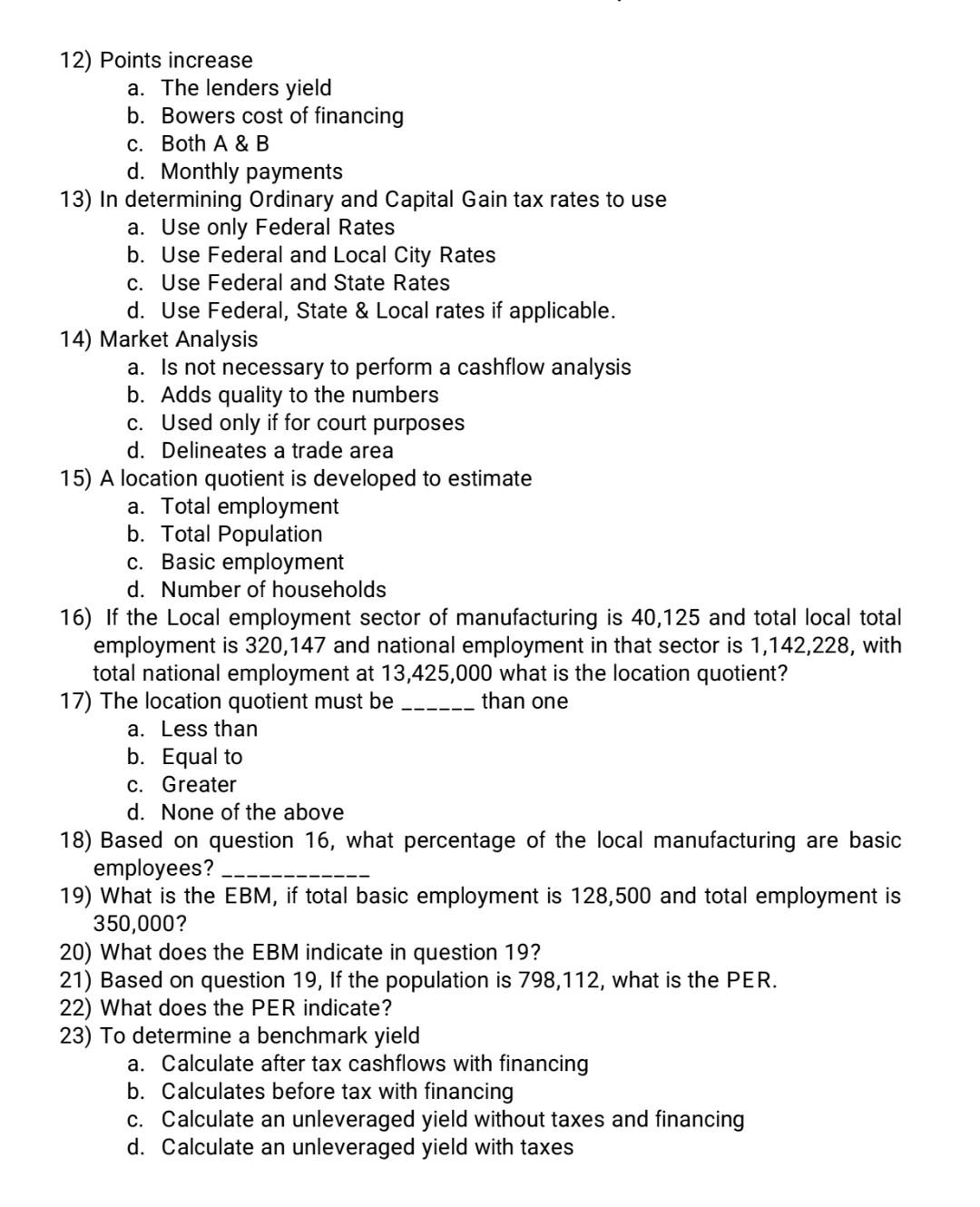

need answers for the questions 12) Points increase a. The lenders yield b. Bowers cost of financing c. Both A & B d. Monthly payments

need answers for the questions

12) Points increase a. The lenders yield b. Bowers cost of financing c. Both A \& B d. Monthly payments 13) In determining Ordinary and Capital Gain tax rates to use a. Use only Federal Rates b. Use Federal and Local City Rates c. Use Federal and State Rates d. Use Federal, State \& Local rates if applicable. 14) Market Analysis a. Is not necessary to perform a cashflow analysis b. Adds quality to the numbers c. Used only if for court purposes d. Delineates a trade area 15) A location quotient is developed to estimate a. Total employment b. Total Population c. Basic employment d. Number of households 16) If the Local employment sector of manufacturing is 40,125 and total local total employment is 320,147 and national employment in that sector is 1,142,228, with total national employment at 13,425,000 what is the location quotient? 17) The location quotient must be than one a. Less than b. Equal to c. Greater d. None of the above 18) Based on question 16, what percentage of the local manufacturing are basic employees? 19) What is the EBM, if total basic employment is 128,500 and total employment is 350,000? 20) What does the EBM indicate in question 19 ? 21) Based on question 19 , If the population is 798,112 , what is the PER. 22) What does the PER indicate? 23) To determine a benchmark yield a. Calculate after tax cashflows with financing b. Calculates before tax with financing c. Calculate an unleveraged yield without taxes and financing d. Calculate an unleveraged yield with taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started